Your mining profits are under immediate threat as the unprecedented 149T bitcoin mining difficulty level systematically reduces rewards for every terahash you deploy.

You are likely seeing your daily SATs yield dwindle while electricity bills remain stubbornly high, creating a margin squeeze that forces difficult operational decisions. This rising difficulty doesn’t just slow down ROI—it renders older, less efficient hardware fundamentally obsolete in a competitive global landscape.

The solution lies in shifting your strategy from raw hashrate volume to extreme energy efficiency and infrastructure modernization to weather the 149T storm.

Why is the 149T difficulty level a major milestone?

The 149T difficulty level directly forces a contraction in operational efficiency requirements for all participants. In this high-stakes environment, monitoring the bitcoin mining difficulty becomes the single most important daily task for any serious mine manager.

What does this mean for network competition?

The 149T level marks the highest point of network competition in history, signaling a massive influx of next-generation hardware into the global pool. This historic surge in bitcoin mining difficulty indicates that the network is more secure than ever, but it also raises the cost of block discovery.

Think about it: as institutional players deploy thousands of new units, the baseline difficulty rises to exclude anyone who isn’t operating at peak efficiency. Data from Bitbo shows that this adjustment reflects a nearly 6% increase over the previous epoch, forcing rapid hardware turnover.

- Unprecedented 149T difficulty target.

- Record-high network security metrics.

- Increased barrier to entry for small miners.

| Metric | Value | Status |

|---|---|---|

| Network Difficulty | ~149T | All-Time High |

| Adjustment Size | +5.8% | Aggressive |

| Hash Price | $0.042/TH | Compression |

Data points reflect Q1 2026 market benchmarks and average industrial hosting rates.

How does the difficulty adjustment impact your daily yield?

The 149T difficulty level directly forces a shift in operational efficiency requirements for all participants. In this high-stakes environment, monitoring the bitcoin mining difficulty becomes the single most important daily task for any serious mine manager.

How much SATs are you losing per day?

The difficulty adjustment directly reduces the amount of Bitcoin earned per unit of hashing power by increasing the mathematical complexity. As you evaluate your current fleet of bitcoin mining difficulty across all units, you will notice a sharp drop in SATs/TH/Day yields.

The reality is: if your hashrate stays stagnant while difficulty rises, your piece of the reward pie shrinks in real-time. According to Yahoo Finance, this dilution effect is most pronounced for retail-sized operations without bulk pricing power.

- Direct reduction in block reward share.

- Increased variance in mining pool payouts.

- Longer time-to-block discovery.

| Scenario | Yield Impact | Action Required |

|---|---|---|

| Difficulty +5% | -4.8% BTC Reward | Optimize Opex |

| Difficulty +10% | -9.2% BTC Reward | Upgrade ASIC |

| Static Hashrate | Decreasing Revenue | Modernize Fleet |

Data points reflect Q1 2026 market benchmarks and average industrial hosting rates.

Is your current ASIC hardware still profitable today?

The 149T difficulty level directly forces a contraction in operational efficiency requirements for all participants. In this high-stakes environment, monitoring the bitcoin mining difficulty becomes the single most important daily task for any serious mine manager.

What is the new efficiency threshold?

Profitability now depends almost entirely on your Joules per Terahash (J/T) rating rather than raw hashrate output. With the current bitcoin mining difficulty, hardware that operates above 25 J/T is increasingly finding itself underwater in regions with average power costs.

Here is the deal: running an S19 Pro at $0.07/kWh now yields almost zero net margin after maintenance expenses. You must pivot toward next-generation units that offer superior efficiency to maintain a positive cash flow.

- Legacy hardware J/T: 35+ (Unprofitable).

- Mid-range J/T: 21-29 (Marginal).

- Next-gen J/T: <18 (Highly Profitable).

| Model | Efficiency | Margin Status |

|---|---|---|

| Antminer S19 | 34 J/TH | High Risk |

| Antminer S19 XP | 21.5 J/TH | Stable |

| Antminer S21 | 17.5 J/TH | Leading |

Data points reflect Q1 2026 market benchmarks and average industrial hosting rates.

What role does power efficiency play in high difficulty?

The 149T difficulty level directly forces a shift in operational efficiency requirements for all participants. In this high-stakes environment, monitoring the bitcoin mining difficulty becomes the single most important daily task for any serious mine manager.

Why is J/TH the most important metric?

Power efficiency is the only variable within your control that can neutralize the negative effects of a rising bitcoin mining difficulty. Investing in ultra-efficient units like the Bitmain Antminer S21e Hyd allows you to generate more hashrate per kilowatt-hour.

You should know: electricity is typically 60-80% of your operational expense in this high-difficulty environment. By lowering the energy required per hash, you effectively lower your ‘production cost’ for every Bitcoin mined.

- Lower heat generation per TH.

- Reduced load on electrical infrastructure.

- Higher tolerance for BTC price volatility.

| Efficiency Rank | Energy Cost/BTC | Viability |

|---|---|---|

| Tier 1 (<18 J/T) | Lowest | Excellent |

| Tier 2 (18-24 J/T) | Moderate | Good |

| Tier 3 (>25 J/T) | High | Critical |

Data points reflect Q1 2026 market benchmarks and average industrial hosting rates.

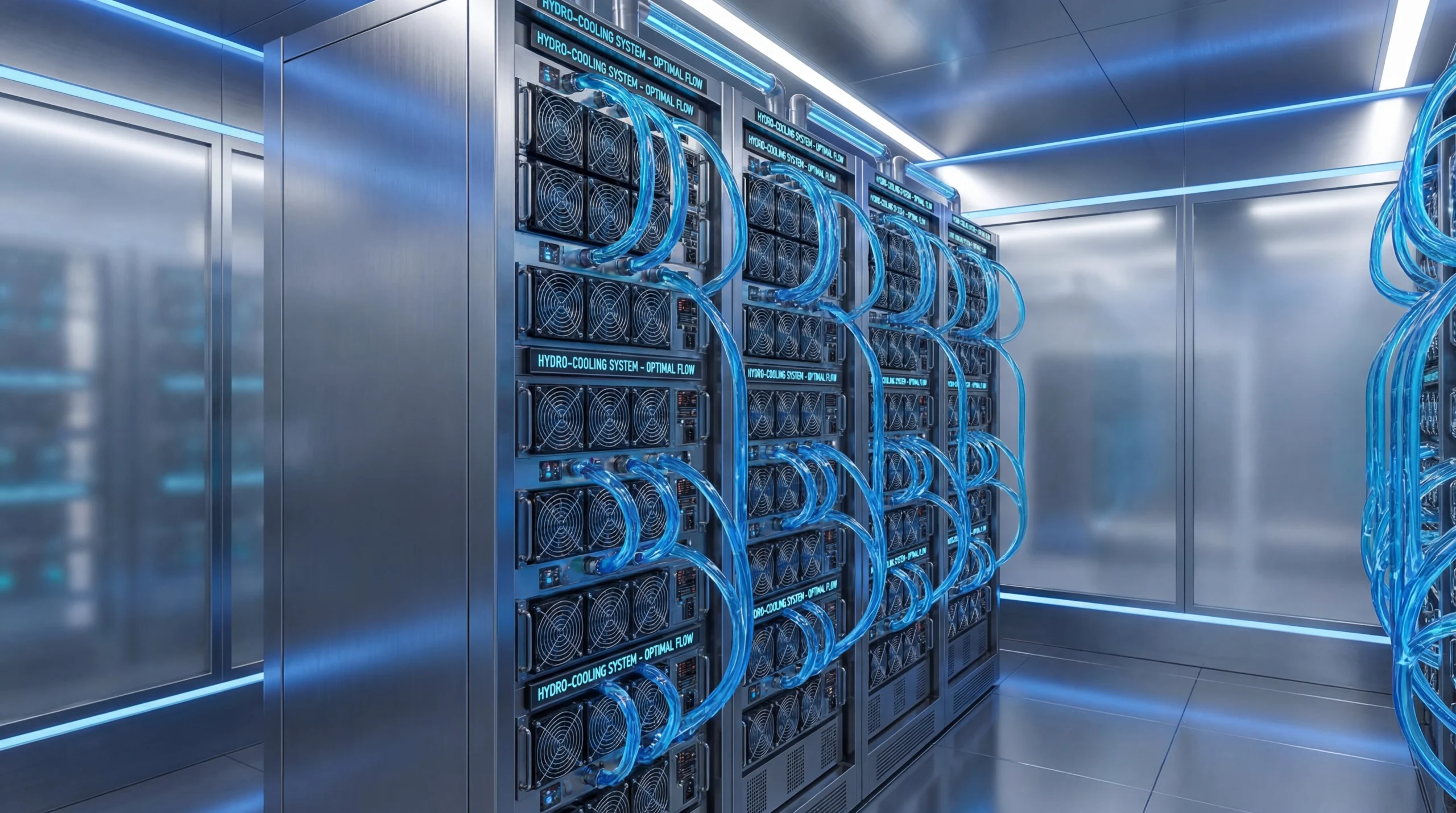

Should you consider hydro cooling for better performance?

The 149T difficulty level directly forces a contraction in operational efficiency requirements for all participants. In this high-stakes environment, monitoring the bitcoin mining difficulty becomes the single most important daily task for any serious mine manager.

How does liquid cooling affect stability?

Hydro cooling offers a significant advantage by allowing ASICs to run at higher hashrates with lower thermal stress as bitcoin mining difficulty climbs. Because liquid is more efficient at heat transfer than air, hydro-cooled systems can maintain peak performance without throttling.

Think about it: heat is the primary cause of chip degradation and efficiency loss in high-density farms. Utilizing hydro cooling or immersion cooling allows you to push hardware to its limits while maintaining a stable temperature.

- Silent operation (no high-speed fans).

- Higher hash density per square foot.

- Consistent performance in hot climates.

| Cooling Method | Temp Stability | Efficiency Gain |

|---|---|---|

| Air Cooling | Moderate | Base |

| Hydro Cooling | Superior | +10-15% |

| Immersion | Extreme | +20% Max |

Data points reflect Q1 2026 market benchmarks and average industrial hosting rates.

How can bulk purchasing mitigate rising operational costs?

The 149T difficulty level directly forces a shift in operational efficiency requirements for all participants. In this high-stakes environment, monitoring the bitcoin mining difficulty becomes the single most important daily task for any serious mine manager.

Why buy in volume during a peak?

Bulk purchasing provides the economies of scale necessary to offset the capital expenditure required to fight the bitcoin mining difficulty surge. When you utilize a bulk order strategy, you reduce the average cost per unit, shortening your time to reach break-even.

The bottom line: in a high-difficulty environment, your entry price for hardware determines your long-term ROI. Wholesalers and large-scale operators who buy in volume are better positioned to weather short-term difficulty spikes.

- Significant per-unit price discounts.

- Priority access to manufacturer batches.

- Leverage for better shipping and logistics.

| Order Tier | Discount Est. | ROI Impact |

|---|---|---|

| Retail (1-9 units) | 0% | Standard |

| Mid (10-49 units) | 5-8% | Accelerated |

| Bulk (50+ units) | 12%+ | Optimized |

Data points reflect Q1 2026 market benchmarks and average industrial hosting rates.

Will difficulty continue to rise throughout this year?

The 149T difficulty level directly forces a contraction in operational efficiency requirements for all participants. In this high-stakes environment, monitoring the bitcoin mining difficulty becomes the single most important daily task for any serious mine manager.

What are the future hashrate projections?

Historical trends and current manufacturer backlogs suggest that bitcoin mining difficulty will continue its upward trajectory for the foreseeable future. As more public companies complete their facility expansions, the total hashrate will likely approach 800 EH/s or higher.

You should expect: the Bitcoin protocol is designed to self-correct, and as long as price supports it, difficulty will climb. Strategic planning for the next 12 months must include a 5-8% monthly increase in difficulty in your financial models.

- Increasing institutional farm deployments.

- Migration of hash power to regions with surplus energy.

- Technological advancements in 3nm/5nm chips.

| Forecast Period | Est. Difficulty | Confidence Level |

|---|---|---|

| Q1 2026 | 155T – 160T | High |

| Q2 2026 | 170T+ | Moderate |

| Year End | 190T+ | Variable |

Data points reflect Q1 2026 market benchmarks and average industrial hosting rates.

Can firmware optimization offset the difficulty increase?

The 149T difficulty level directly forces a shift in operational efficiency requirements for all participants. In this high-stakes environment, monitoring the bitcoin mining difficulty becomes the single most important daily task for any serious mine manager.

How does autotuning improve margins?

Custom firmware can help claw back margins lost to bitcoin mining difficulty by optimizing the power consumption of individual hashing chips. Utilizing autotuning software allows you to find the perfect ‘sweet spot’ for efficiency and hashrate based on your electricity cost.

It’s simple: standard factory settings are often pushed for max hashrate, but in high-difficulty times, you may want to undervolt. This can reduce power draw by up to 15% while only marginally reducing the total hashrate output.

- Granular control over chip voltage.

- Extended hardware lifespan through lower temps.

- Higher net profit per kilowatt-hour consumed.

| Firmware Type | J/T Improvement | Ease of Use |

|---|---|---|

| Factory Stock | Base | Excellent |

| Custom Autotune | 10-15% | Moderate |

| Pro-Developer | 20%+ | Hard |

Data points reflect Q1 2026 market benchmarks and average industrial hosting rates.

Why are institutional miners scaling despite high difficulty?

The 149T difficulty level directly forces a contraction in operational efficiency requirements for all participants. In this high-stakes environment, monitoring the bitcoin mining difficulty becomes the single most important daily task for any serious mine manager.

Is the market consolidating around big players?

Institutional miners view high bitcoin mining difficulty as a moat that protects them from smaller, less capitalized competitors. By scaling during periods of difficulty spikes, they secure a larger share of the network while marginal players are forced offline.

Make no mistake: the ‘big players’ are playing a long-term game focused on asset accumulation. They utilize low-cost capital and long-term energy contracts to remain profitable even when network difficulty hits record highs like 149T.

- Access to cheap industrial power rates.

- Public market funding for infrastructure expansion.

- Vertical integration of repair and hosting services.

| Miner Type | Strategy | Outlook |

|---|---|---|

| Institutional | Scale & Efficiency | Bullish |

| Commercial | Optimized Maintenance | Stable |

| Retail/Hobby | Survival/Modernization | Cautious |

Data points reflect Q1 2026 market benchmarks and average industrial hosting rates.

What is the most effective strategy for the next cycle?

The 149T difficulty level directly forces a shift in operational efficiency requirements for all participants. In this high-stakes environment, monitoring the bitcoin mining difficulty becomes the single most important daily task for any serious mine manager.

How should you build your 2026 roadmap?

The most effective strategy involves a ruthless commitment to the lowest possible cost of production through hardware modernization. As you browse the latest bitcoin mining difficulty data, focus on ‘Total Cost of Ownership’ rather than just the initial sticker price of your miners.

The reality is: the next cycle will reward those who prioritized efficiency during the difficult months. Combining next-gen hardware like the Antminer S21 with immersion cooling will ensure you stay profitable through any network adjustment.

- Regular hardware refresh cycles (every 18-24 months).

- Diversification of mining hosting locations.

- Continuous reinvestment of BTC rewards into hashrate.

| Phase | Action | Goal |

|---|---|---|

| Preparation | Fleet Audit | Identify Obsolete Units |

| Execution | Bulk Upgrade | Achieve <18 J/T Avg |

| Optimization | Cooling/Firmware | Maximize Net Margin |

Data points reflect Q1 2026 market benchmarks and average industrial hosting rates.

Conclusion

The 149T Bitcoin mining difficulty hike is a defining moment for the industry, separating optimized professionals from legacy operators. While the pressure on margins is real, it also provides a clear roadmap for those willing to invest in efficiency and scale. By embracing next-generation hardware and advanced cooling solutions, you can turn this network challenge into a long-term competitive moat.

Don’t let rising difficulty phase your operation out of the market. We are here to help you navigate this transition with expert hardware guidance and wholesale infrastructure support. Contact us today to secure the high-efficiency equipment needed to dominate the 149T era.

Frequently Asked Questions

Can I still make a profit with S19 series miners at 149T difficulty?

Profitability is still possible with S19 series miners, but only if your electricity costs are exceptionally low (under $0.05/kWh) and the units are well-maintained or optimized with custom firmware.

What’s the best way to handle a sudden 10% difficulty increase?

The best way is to immediately shift your fleet to an ‘efficiency’ power profile to lower your cost per terahash and audit your operations for any energy waste.

How do I know if my cooling system needs an upgrade?

If your miners are frequently throttling (lowering hashrate due to heat) or your fans are constantly at 100%, you should consider hydro or immersion cooling upgrades.

Can I run hydro-cooled miners in a traditional air-cooled warehouse?

No, hydro-cooled miners require specific infrastructure, including water loops and heat exchangers, so you must upgrade your facility’s cooling system to support them.

What is the minimum efficiency (J/T) I should look for in new hardware?

In the current 149T environment, you should aim for hardware with an efficiency of 20 J/T or lower, such as the Bitmain S21 or Whatsminer M60 series.