The 2024 Halving has fundamentally altered mining economics. Block rewards are slashed, forcing miners to prioritize operational efficiency and strategic hardware upgrades to maintain profitability in a hyper-competitive landscape.

What the Bitcoin Halving Means for the Network

A foundational overview of the Bitcoin halving mechanism, its purpose in controlling supply, and its historical significance for the network’s long-term value proposition.

The Core Principle: Digital Scarcity

The halving enforces Bitcoin’s 21 million supply cap, a core feature that creates digital scarcity. This predictable reduction in new supply contrasts sharply with the inflationary nature of traditional fiat currencies, which can be printed without limit.

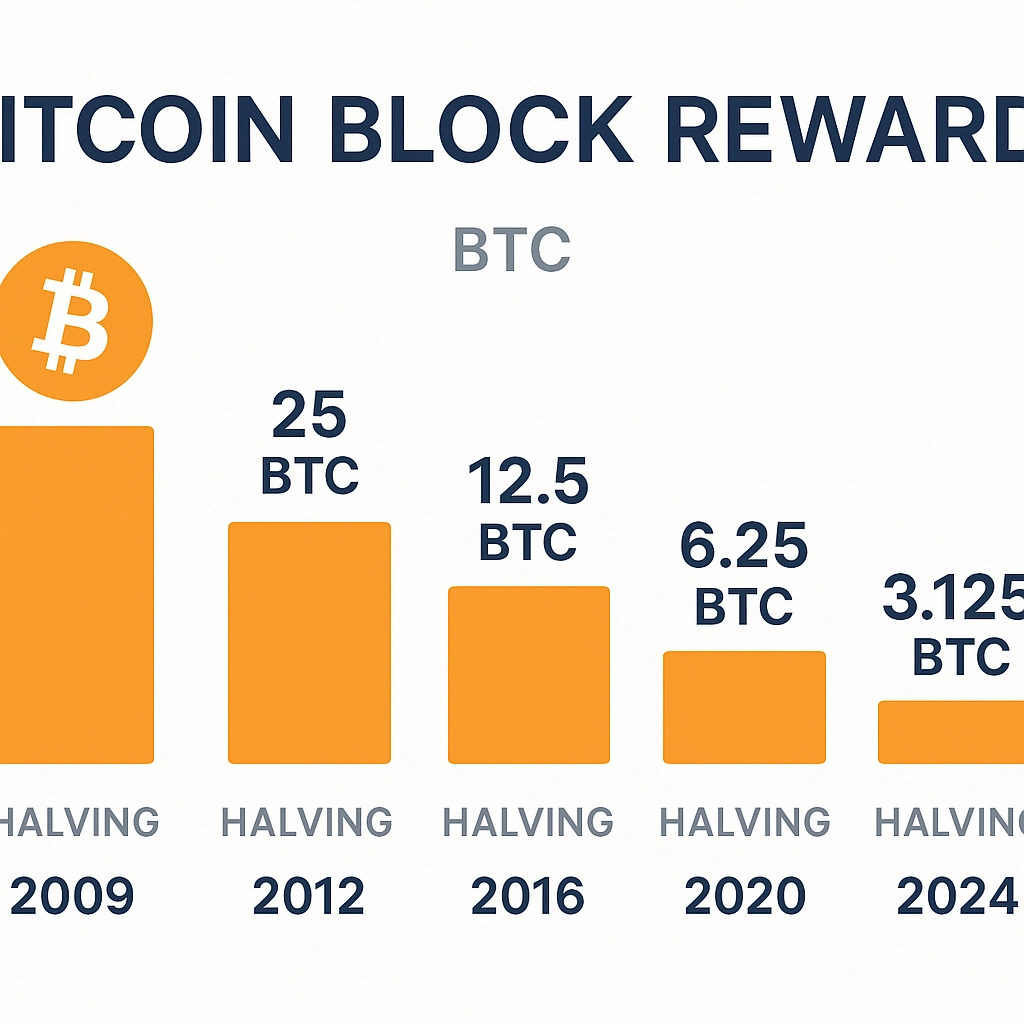

A Look Back: Previous Halvings and Their Aftermath

Historically, halvings in 2012, 2016, and 2020 were followed by significant price appreciation and hash rate growth. This context provides a potential, though not guaranteed, roadmap for what the market might expect in the coming months and years.

Analysis of the 2024 Halving Event

A factual recap of the April 2024 halving event, focusing on the immediate changes to block rewards and initial network reactions, drawing from post-event analysis.

The Reward Drop: From 6.25 to 3.125 BTC

The core economic shock of the halving is the permanent reduction of the block subsidy. Miners’ primary revenue source was cut in half overnight, a change that must be absorbed into every operator’s financial model to ensure survival.

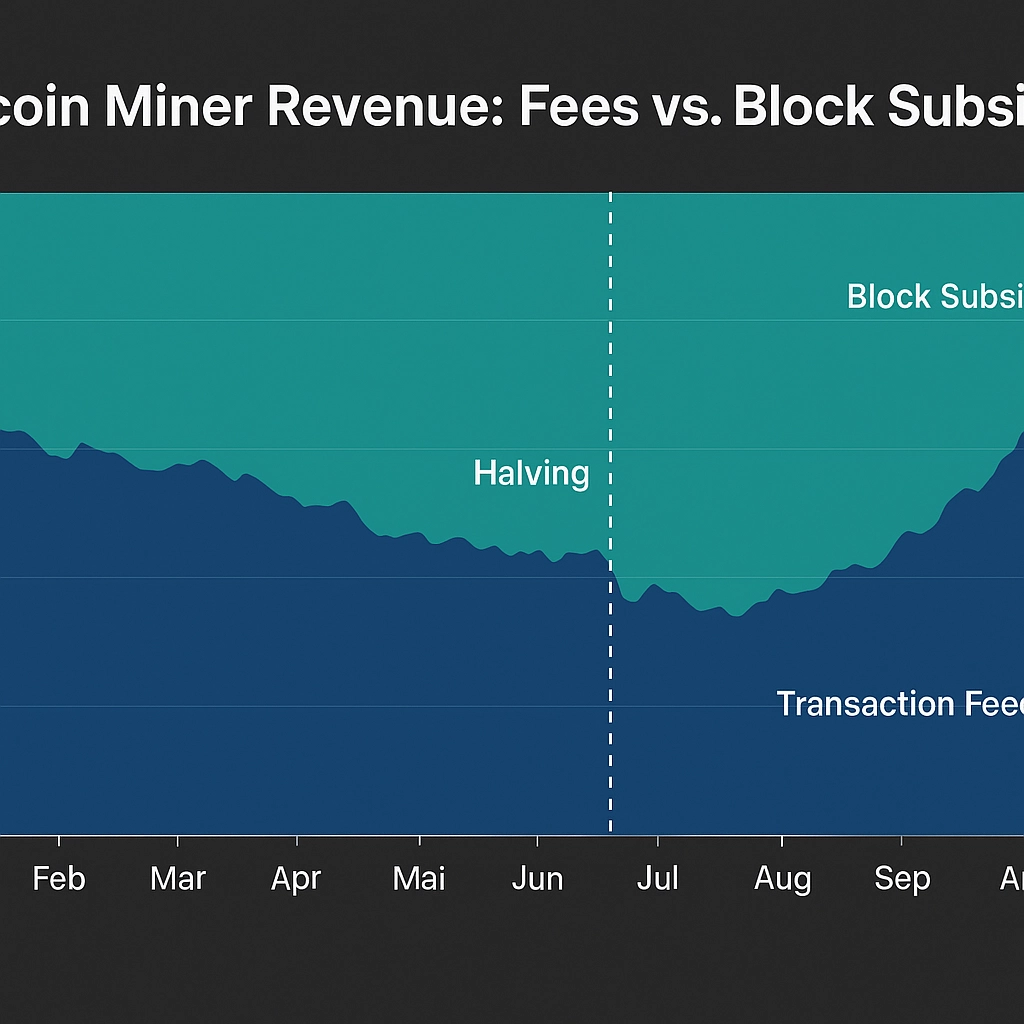

The Unexpected Fee Spike

A notable surge in transaction fees occurred around the halving block, driven by new protocols like Runes. This event highlighted the growing importance of fees as a critical component of miner revenue, supplementing the diminished block reward.

Initial Market and Hash Rate Reaction

While Bitcoin’s price remained relatively stable post-halving, a decline in the global hash rate is anticipated. This occurs as less efficient miners, unable to cover costs with the new reward structure, are forced to shut down their operations.

The New Economics: Miner Profitability in the Post-Halving Era

A deep dive into how the halving directly impacts a mining operation’s revenue and costs, forcing a re-evaluation of profitability and operational strategy.

Recalibrating Your Breakeven Point

With block revenue halved, the breakeven electricity cost per bitcoin mined has effectively doubled. This new reality places immense pressure on miners to ruthlessly manage costs and optimize every facet of their operation to stay profitable.

The Rise of Transaction Fees and L2s

New protocols like Ordinals and the expansion of Layer-2 networks are driving more on-chain activity. This trend is making transaction fees a vital, albeit volatile, revenue stream that can no longer be treated as just a small bonus.

The Efficiency Mandate: Joules per Terahash (J/TH)

In the post-halving world, Joules per Terahash (J/TH) is the single most important metric for success. A lower J/TH rating means lower energy consumption for the same hashrate, directly translating to survival and higher profitability.

| Factor | Pre-Halving Status (6.25 BTC) | Post-Halving Reality (3.125 BTC) | Strategic Response |

|---|---|---|---|

| Block Reward | Primary, predictable revenue. | Halved. Less predictable due to fees. | Focus on increasing transaction fee capture. |

| Energy Costs (per BTC) | Significant but manageable. | Effectively doubled relative to revenue. | Aggressively seek lower rates (<$0.05/kWh). |

| Hardware Efficiency | Important for maximizing profit. | Critical for survival. Defines breakeven. | Decommission old hardware; upgrade to sub-25 J/TH miners. |

| Network Hash Rate | High and consistently rising. | Potential for short-term drop, then new highs. | Maintain high hash rate uptime with an efficient fleet. |

| Transaction Fees | Secondary, bonus income. | A crucial, volatile part of total revenue. | Optimize block templates for high-fee transactions. |

Strategic Imperatives for a Competitive Edge

Moving from analysis to action, this section provides concrete strategies miners must adopt. Success now requires a holistic approach that goes beyond just hardware to encompass all aspects of the operation.

Auditing Your Current Operations

Miners must immediately conduct a full audit of their hardware, electricity costs, and hosting agreements. This deep dive is essential to identify immediate opportunities for cost-saving and performance optimization to improve margins.

Securing Low-Cost Energy Sources

Sourcing cheaper power is non-negotiable. Strategies include negotiating long-term power purchase agreements (PPAs), exploring off-grid solutions, or even relocating operations to regions with more favorable energy prices.

The Case for Fleet Modernization

Reinvesting in new-generation ASICs is an investment in future competitiveness, not a cost. The imperative of fleet modernization is the most direct path to staying profitable as network difficulty inevitably rises.

Choosing Your Tools: Next-Generation ASICs for a New Era

This hardware-focused section guides readers on selecting the right mining equipment for the post-halving world, emphasizing efficiency over raw hash rate as the key purchasing criterion.

Why Older Models Are Now Obsolete

Older machines like the Antminer S19 Pro, with their high J/TH ratings, are now largely unprofitable for most operators. At current Bitcoin prices and network difficulty, their energy consumption simply outweighs their mining rewards.

Evaluating the Market-Leading Miners

The latest models from leading manufacturers like Bitmain and Canaan offer superior J/TH ratings, ensuring long-term viability. Evaluating these next-generation ASICs is crucial for any serious mining operation.

ROI Calculation in a Post-Halving World

To accurately project ROI for new hardware, miners must now factor in the lower block reward, potential transaction fee revenue, and their specific electricity costs. This detailed calculation determines the true value of an upgrade.

| Miner Model | Hash Rate (TH/s) | Power (W) | Efficiency (J/TH) | Post-Halving Suitability |

|---|---|---|---|---|

| Bitmain Antminer S21 | 200 | 3550 | 17.75 | Excellent |

| Bitmain Antminer S21+ | 216 | 3564 | 16.5 | Superior |

| Canaan Avalon Q 90 | 90 | 1674 | 18.6 | Very Good |

| Generic Older Model (e.g., S19 Pro) | 110 | 3250 | 29.5 | Marginal/Obsolete |

Beyond 2024: The Future of Bitcoin Mining

A forward-looking conclusion discussing long-term trends and opportunities. The current challenges are part of the industry’s natural maturation cycle, paving the way for a more robust future.

The Trend Towards Industrialization

The mining sector is consolidating. Large-scale, professionally managed operations with access to capital markets and economies of scale possess a distinct competitive advantage that will only grow stronger over time.

Innovation in Cooling and Energy

Advanced solutions like immersion cooling and the integration of renewable energy sources are key trends. These innovations drive future efficiency gains, reduce operational costs, and help meet ESG compliance goals.

Mining as a Geopolitical Stabilizer

Beyond securing the network, Bitcoin mining can stabilize energy grids by consuming excess power and monetizing stranded energy assets. This positions the industry as a vital and symbiotic component of the global energy infrastructure.

Ready to upgrade your fleet for the post-halving era? Contact our experts for a personalized quote.

Frequently Asked Questions

Is Bitcoin mining still profitable after the 2024 halving?

Yes, but only for those with highly efficient operations. Profitability now hinges on having low electricity costs (<$0.05/kWh) and using next-generation ASIC miners with efficiency ratings below 25 J/TH.

My old ASIC miner (like an Antminer S19) was profitable before. Is it now obsolete?

For many operators, yes. Unless you have near-zero energy costs, older miners with efficiency above 30 J/TH are likely operating at a loss. Upgrading is the most viable long-term strategy.

How much of my revenue will come from transaction fees now?

This is becoming more significant but remains highly volatile. While the block subsidy is fixed, fee revenue can fluctuate wildly. Miners should view it as important, variable income rather than a predictable base.

What is the single most important factor for success now?

Operational efficiency, measured in Joules per Terahash (J/TH). The lower your J/TH, the more competitive you are. This is achieved through a combination of cutting-edge hardware and low-cost power.