Discover the leading BTC mining pools for 2025. Our guide breaks down fees, payout methods (FPPS vs. PPLNS), and unique features to help you choose the best pool for your operation and boost your rewards.

Why a Mining Pool is Non-Negotiable in 2025

The network’s skyrocketing difficulty makes solo mining a lottery ticket. Mining pools are essential for ensuring a stable and predictable revenue stream. By pooling hashrate, miners combine their power to find blocks more frequently and share the rewards proportionally. This transforms mining from a high-risk gamble into a consistent business operation. To achieve a positive ROI on powerful equipment like modern Bitcoin Miners, consistent payouts from a pool are critical.

How to Choose a Bitcoin Mining Pool: The 5 Key Factors

Selecting the right pool is a strategic decision. We’ll analyze the critical factors: payout schemes, fee structures, server latency, pool size, and reputation.

H3: Payout Method & Fee Structure

Briefly introduce the main models (FPPS, PPLNS, etc.) and explain how fees (typically 0.5% to 2.5%) are deducted. This is the most important factor for your income.

H3: Server Location & Latency

Choosing a pool with servers in North America or Europe is crucial for miners in those regions. Lower latency reduces stale shares, ensuring more of your submitted work gets rewarded and maximizing efficiency.

H3: Pool Size & Hashrate

Large pools offer more frequent, smaller payouts, providing stable income. Smaller pools might offer higher rewards during lucky streaks but with less consistency. Your choice depends on your risk tolerance.

H3: Transparency and Reputation

Stress the importance of choosing pools with a proven track record of timely payments, clear user dashboards, and responsive customer support. A trustworthy pool is paramount.

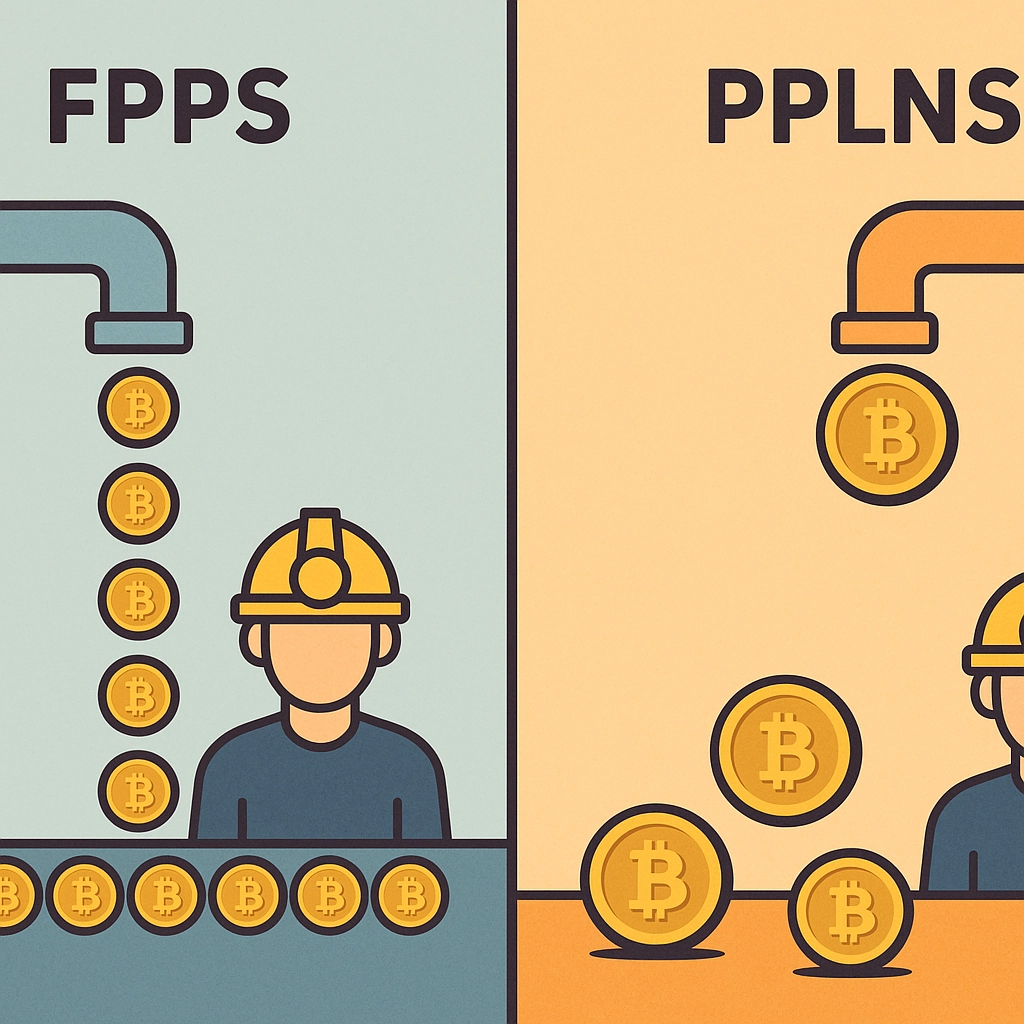

Decoding Payout Schemes: FPPS vs. PPLNS vs. PPS+

Your payout method directly impacts income stability. This section demystifies the most common models so you can choose based on your risk appetite and financial strategy. Full-Pay-Per-Share (FPPS) is low-risk, providing guaranteed income for every share submitted. Pay-Per-Last-N-Shares (PPLNS) is a higher-risk, potentially higher-reward model where you are paid only when the pool finds a block. Pay-Per-Share Plus (PPS+) is a hybrid model offering a guaranteed base rate plus a share of transaction fees.

| Payout Model | Best For | Risk Level | Income Stability |

|---|---|---|---|

| FPPS | Miners seeking predictable revenue | Low | Very High |

| PPLNS | Risk-tolerant miners, loyal to one pool | High | Low / Variable |

| PPS+ | Miners wanting a balance of safety & upside | Medium | High |

Deep Dive: The Top Bitcoin Mining Pools of 2025

A detailed review of the industry’s leading players, with a focus on options for European and North American miners.

H3: Foundry USA

The market leader in North America. Ideal for institutional miners and those prioritizing compliance (SOC2 certified). It uses a stable FPPS model, ensuring predictable revenue.

H3: Antpool

A global giant integrated with Bitmain’s hardware ecosystem. It’s a strong choice if you run Antminer ASICs, like those in our Bitcoin Miners collection, and offers flexible PPS+ and PPLNS options.

H3: Luxor Pool

A US-based innovator perfect for tech-savvy miners. It offers custom firmware (LuxOS) and hashrate hedging products alongside a reliable FPPS model for stable payouts.

H3: Braiins Pool

The world’s first mining pool, known for its transparency and open-source contributions like Braiins OS+. An excellent choice for miners who value control, efficiency, and use an FPPS model.

H3: Ocean Pool

A decentralization-focused newcomer backed by influential figures. Its unique PPLNS model and filtering of non-standard transactions appeal to Bitcoin purists who prioritize network health.

Decision Matrix: Which Pool is Right for Your Operation?

Match your mining profile—from a small home setup to a large-scale farm—with the perfect pool. This section provides clear recommendations based on your goals. We advise using a miner profitability calculator to model potential earnings with different pool fees.

| Miner Profile | Recommended Pools | Key Consideration |

|---|---|---|

| The Home Hobbyist | Braiins Pool, Luxor Pool | Stability (FPPS) & user-friendliness |

| The Small Business Miner | Antpool, Foundry USA | Balance of fees, stability, & features |

| The Large-Scale/Institutional Farm | Foundry USA, Luxor Pool | Compliance (SOC2), and advanced tools |

Let’s Get Mining: Connecting Your ASIC to a Pool

A simple, step-by-step guide to get your miner connected and hashing.

- Create an account on your chosen pool’s website to get your Stratum URL and worker details.

- Log in to your ASIC miner’s web interface using its local IP address.

- Navigate to ‘Miner Configuration’ and enter the pool’s stratum URL, your worker name, and a password.

Our comprehensive guide on Setting Up an ASIC Miner provides more detail. If you purchase hardware from us, our support team is ready to assist.

Frequently Asked Questions (FAQ)

What is the best Bitcoin mining pool for a beginner in 2025?

For beginners, we recommend a large, reputable pool with an FPPS payment model, such as Foundry USA or Braiins Pool. This ensures you receive stable, predictable payouts while you learn the ropes.

How often can I switch mining pools?

You can switch mining pools as often as you like. The process is simple and only requires updating the configuration in your ASIC miner’s dashboard. It’s a good idea to test different pools to see which performs best for you.

What’s more important: low fees or the right payout method?

While low fees are attractive, the payout method has a greater impact on your income’s consistency. For most miners, the stability of FPPS is worth a slightly higher fee compared to the volatility of PPLNS.

How do I estimate my profitability after pool fees?

Your profitability depends on your miner’s efficiency, your electricity cost, and the pool’s fee structure. Use our miner profitability calculator for a detailed estimate based on your specific setup.