Summary: As Bitcoin surges past $107,000 in November 2025, a new investment trend is reshaping the cryptocurrency landscape. Companies are adopting treasury strategies similar to what made Strategy (formerly MicroStrategy) famous, but with a twist—they’re targeting Ethereum. BitMine Immersion Technologies has emerged as the world’s largest publicly traded Ether holder, accumulating over 833,000 ETH worth $2.9 billion in just 35 days, attracting major investors including ARK Invest and Founders Fund. This article explores how crypto treasury strategies are evolving, the current profitability of mining operations, and what this means for the future of digital asset accumulation in 2025.

Understanding the Crypto Treasury Strategy Revolution

The crypto treasury strategy has evolved from a controversial experiment into mainstream corporate finance. What began with Strategy’s bold Bitcoin accumulation strategy in 2020 has now spawned over 200 publicly traded companies adopting similar approaches. The concept is straightforward: companies use their balance sheets to acquire and hold cryptocurrencies as treasury assets, betting on long-term appreciation.

What Makes This Strategy Attractive

Companies adopting crypto treasuries are essentially converting traditional corporate assets into digital holdings. With Bitcoin trading at $107,885 (as of November 2025) and Ethereum at $3,716, these firms offer investors leveraged exposure to crypto price movements without directly holding digital assets. The strategy provides liquidity, regulatory compliance, and professional management—benefits individual investors may struggle to achieve independently.

From Bitcoin to Ethereum: The Strategy Pivot

While Bitcoin remains the dominant choice for corporate treasuries, 2025 has witnessed a significant shift toward Ethereum holdings. BitMine Immersion Technologies exemplifies this trend, pivoting from Bitcoin mining to aggressively accumulating ETH. Their goal of acquiring 5% of Ethereum’s total supply represents an unprecedented ambition in the crypto treasury space. Other players like SharpLink Gaming and The Ether Machine have followed suit, creating a competitive landscape for Ethereum accumulation.

The Bitcoin and Ethereum Market Landscape in November 2025

Bitcoin has maintained remarkable momentum throughout 2025, having reached an all-time high of $126,210 in October before settling into current levels. The post-halving dynamics continue to play out, with reduced block rewards intensifying scarcity. Institutional adoption through spot ETFs has provided steady demand, while companies like Strategy (holding 640,250 BTC) and MARA Holdings demonstrate confidence in Bitcoin’s long-term value proposition.

Ethereum’s Performance Trajectory

Ethereum enters November 2025 with cautious optimism. Trading around $3,716, ETH has gained 2.2% weekly despite short-term volatility. Market experts predict November prices will range between $3,866 (support) and $4,664 (resistance), with potential to reach $4,272 by month’s end. The critical support zone of $3,600-$3,750 remains intact, suggesting underlying strength despite bearish short-term sentiment.

Key Market Drivers in 2025

Several factors influence current crypto markets: institutional investment through ETFs continues growing, regulatory clarity in major jurisdictions improves investor confidence, and the emergence of crypto treasury companies creates sustained buying pressure. Additionally, Ethereum’s continued network upgrades and expanding DeFi ecosystem support its value proposition beyond simple speculation.

Comparing Top Crypto Treasury Companies in 2025

Table 1: Leading Crypto Treasury Companies by Holdings

| Company | Primary Asset | Total Holdings | Market Value | Strategy Focus |

|---|---|---|---|---|

| Strategy (MSTR) | Bitcoin | 640,250 BTC | ~$69 billion | Aggressive BTC accumulation |

| MARA Holdings | Bitcoin | Undisclosed | Multi-billion | Mining + Treasury |

| BitMine Immersion | Ethereum | 833,000 ETH | $2.9 billion | 5% ETH supply target |

| XXI | Bitcoin | Substantial | Significant | Corporate treasury |

| SharpLink Gaming | Ethereum | Moderate | Growing | ETH-focused strategy |

This table illustrates the diversity emerging in crypto treasury strategies. While Bitcoin dominates total value, Ethereum-focused strategies represent the fastest-growing segment, reflecting broader institutional interest in the second-largest cryptocurrency.

Mining Profitability and Equipment Analysis for 2025

Bitcoin mining remains profitable in 2025, with miners collectively earning approximately $20 million daily ($600 million monthly). However, profitability heavily depends on electricity costs and equipment efficiency. The 2024 halving reduced block rewards to 3.125 BTC, making hardware selection more critical than ever.

Top Performing Mining Equipment

The Bitmain Antminer S21 series dominates 2025’s mining landscape. The S21 XP delivers 270 TH/s at 3,645W (13.5 J/TH efficiency), generating approximately $9-10 daily profit at typical electricity rates. The S21 Pro (234 TH/s) and S21 Hyd (335 TH/s hydro-cooled) offer alternatives for different operational scales. These machines represent significant improvements over previous generations, essential for maintaining profitability in the post-halving environment.

Alternative Mining Opportunities

Beyond Bitcoin, profitable mining opportunities exist for altcoins. The Bitmain Antminer L9 excels at Dogecoin/Litecoin mining with 16 GH/s performance. The Goldshell AE Max II targets Aleo mining at 540 MH/s. For operations seeking diversification, multi-algorithm miners provide flexibility as market conditions change throughout 2025.

Investment Considerations for Mining

Modern mining requires substantial upfront capital—top-tier ASICs cost $3,000-$10,000+ per unit. ROI calculations must account for electricity costs (typically $0.05-$0.10 per kWh), cooling infrastructure, and network difficulty increases. At current Bitcoin prices around $108,000, well-managed operations with efficient equipment can achieve 12-18 month ROI, though this varies significantly based on individual circumstances.

Investment Vehicles: Direct Mining vs. Treasury Company Stocks

Table 2: Investment Approach Comparison Matrix

| Investment Type | Initial Capital | Risk Level | Liquidity | Technical Knowledge | Potential Returns |

|---|---|---|---|---|---|

| Direct Mining | $10,000-$100,000+ | High | Low | Expert Required | Variable 15-30% annually |

| Treasury Stocks | $100-$10,000+ | Medium-High | High | Moderate | Leveraged crypto exposure |

| Spot Crypto | $10-Unlimited | High | Very High | Basic | Direct price correlation |

| Mining ETFs | $100-$10,000+ | Medium | High | Low | Diversified exposure |

| Mining Equipment | $3,000-$15,000/unit | High | Very Low | Expert | Equipment-dependent |

This comparison reveals that different investment approaches suit different investor profiles. Treasury company stocks offer leveraged crypto exposure without operational complexity, making them attractive for traditional equity investors seeking crypto allocation.

Why Ethereum Treasury Strategies Are Gaining Momentum

Several compelling factors drive the shift toward Ethereum treasury strategies in 2025. First, Ethereum’s market capitalization and liquidity rival Bitcoin’s, making large-scale accumulation feasible without excessive price impact. Second, Ethereum’s utility beyond store-of-value—powering DeFi, NFTs, and enterprise solutions—provides additional value drivers independent of pure speculation.

The Network Effect Advantage

Ethereum’s expansive ecosystem creates network effects that Bitcoin, focused primarily on value storage, cannot replicate. Smart contract functionality, decentralized applications, and institutional DeFi adoption generate ongoing demand for ETH. Companies holding substantial ETH positions benefit from this utility-driven demand alongside speculative appreciation.

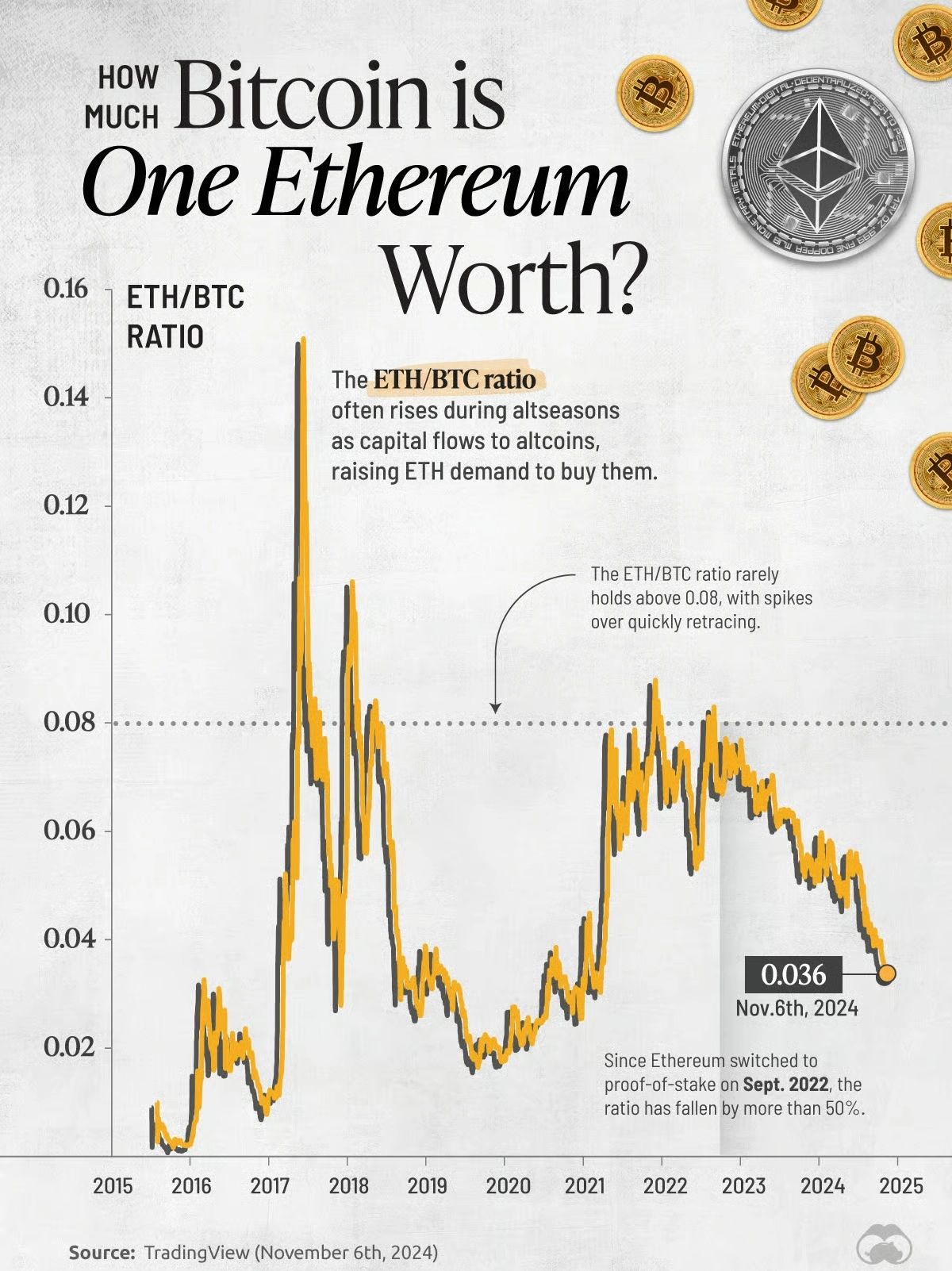

Valuation Opportunities

With Bitcoin commanding $107,885 per coin and Ethereum at $3,716, the ETH/BTC ratio suggests potential undervaluation. If Ethereum captures even a fraction of Bitcoin’s “digital gold” narrative while maintaining its technological advantages, significant appreciation remains possible. Treasury companies betting on this convergence aim to maximize returns through strategic accumulation timing.

Strategic Considerations for Mining Operations in 2025

Successful mining operations in 2025 require sophisticated planning beyond simply purchasing equipment. Location selection dramatically impacts profitability—regions with electricity costs below $0.05/kWh (like parts of Texas, Kazakhstan, or Scandinavia) offer substantial competitive advantages. Infrastructure considerations including cooling, networking, and physical security cannot be overlooked.

Equipment Selection Criteria

When evaluating mining equipment, efficiency (joules per terahash) matters more than raw hashrate. The Antminer S21 XP’s 13.5 J/TH efficiency significantly outperforms older models consuming 20-30+ J/TH. Calculate break-even points assuming Bitcoin difficulty increases of 3-5% monthly and plan for 12-24 month ROI timelines. Consider Miners1688 for sourcing authenticated hardware directly from manufacturers like Bitmain, ensuring warranty coverage and optimal pricing.

Operational Best Practices

Professional mining operations implement monitoring systems tracking temperature, hashrate, and power consumption in real-time. Preventive maintenance schedules maximize uptime—even 5% downtime can significantly impact annual profitability. Consider pool selection carefully; larger pools provide steadier payouts while smaller pools offer higher variance but potentially greater rewards.

The Future Landscape: Where Crypto Treasuries Are Heading

Industry experts predict continued expansion of crypto treasury strategies through 2025 and beyond. The $150 billion treasury boom shows no signs of slowing, despite increased competition and valuation concerns. Major technology companies are rumored to be considering Bitcoin or Ethereum positions by year-end, potentially catalyzing another wave of corporate adoption.

Regulatory Evolution and Institutional Acceptance

Regulatory clarity continues improving across major jurisdictions. The success of Bitcoin and Ethereum spot ETFs in the United States has legitimized crypto as an institutional asset class. This regulatory maturation enables more conservative corporations to explore treasury strategies previously considered too risky or uncertain.

Beyond Bitcoin and Ethereum

While Bitcoin and Ethereum dominate current treasury strategies, diversification into alternative cryptocurrencies may emerge. Projects with strong fundamentals, clear utility, and institutional backing could attract corporate treasury interest. However, liquidity constraints and volatility concerns currently limit alternatives to niche players rather than mainstream adoption.

Frequently Asked Questions (FAQ)

Q: How do crypto treasury companies generate returns for investors? A: Crypto treasury companies provide leveraged exposure to cryptocurrency price appreciation. When the underlying asset (Bitcoin or Ethereum) increases in value, the company’s net asset value rises proportionally, theoretically driving stock price appreciation. Some companies also engage in active strategies like staking or lending to generate yield on holdings.

Q: What are the main risks of investing in crypto treasury stocks? A: Primary risks include cryptocurrency price volatility (company valuations directly correlate with crypto prices), premium/discount dynamics (stocks may trade above or below net asset value), dilution risk (companies often issue new shares to fund additional crypto purchases), and regulatory uncertainty. These companies essentially offer levered crypto bets with additional corporate governance complexity.

Q: Is Bitcoin mining still profitable in November 2025? A: Yes, Bitcoin mining remains profitable for operations with efficient equipment and low electricity costs (preferably below $0.06/kWh). Daily mining revenue averages $20 million industry-wide. However, individual profitability varies dramatically based on electricity rates, equipment efficiency, and operational scale. The April 2024 halving reduced block rewards to 3.125 BTC, making efficiency more critical than ever.

Q: What makes the Bitmain Antminer S21 series the top choice in 2025? A: The S21 series offers optimal efficiency (13.5-17 J/TH) combined with proven reliability from the industry’s leading manufacturer. Models like the S21 XP (270 TH/s) deliver maximum hashrate per watt, crucial for post-halving profitability. Widespread availability, established service networks, and competitive pricing from suppliers like Miners1688 make them accessible for both large-scale operations and serious hobbyists.

Q: Should I invest in Bitcoin or Ethereum for treasury-style holdings? A: This depends on your risk tolerance and market outlook. Bitcoin offers greater liquidity, institutional acceptance, and an established “digital gold” narrative. Ethereum provides technological utility, smart contract functionality, and potential for greater percentage gains if it captures more of Bitcoin’s market dominance. Many sophisticated investors allocate to both, typically with higher Bitcoin weighting (60-80%) for conservative profiles.

Q: How can I source reliable mining equipment in 2025? A: Work with established distributors who source directly from manufacturers. Miners1688 specializes in authenticated Bitmain, WhatsMiner, IceRiver, and Goldshell products with competitive pricing and international logistics through DHL, UPS, and FedEx. Verify warranty coverage, check seller reputation, and confirm equipment specifications match manufacturer listings. Avoid deals significantly below market price—they often indicate refurbished, damaged, or counterfeit products.

Q: What electricity cost makes Bitcoin mining viable? A: Generally, electricity costs below $0.08/kWh enable profitable mining with current-generation equipment like the Antminer S21 series. Below $0.05/kWh provides excellent profit margins, while costs above $0.10/kWh significantly challenge profitability unless Bitcoin prices increase substantially. Calculate your specific situation using online profitability calculators, factoring in local rates, equipment costs, and network difficulty projections.

Conclusion: Navigating the 2025 Crypto Investment Landscape

The convergence of crypto treasury strategies and mining operations presents unprecedented opportunities for informed investors in 2025. Whether you’re considering direct mining investments through equipment like the Antminer S21 series, exposure through treasury company stocks like Strategy or BitMine, or simply exploring how these trends affect the broader cryptocurrency market, understanding the fundamentals is crucial.

Bitcoin’s position above $107,000 and Ethereum’s stability around $3,716 reflect maturation in crypto markets. The emergence of Ethereum-focused treasury strategies alongside Bitcoin accumulation demonstrates increasing sophistication in corporate digital asset management. For those interested in participating through mining operations, equipment selection, location strategy, and operational efficiency will determine success.

As we progress through November 2025 and beyond, the crypto treasury trend shows no signs of slowing. With proper research, risk management, and strategic planning, both individual miners and equity investors can position themselves to benefit from this transformative shift in how companies—and ultimately, traditional finance—approach digital assets.

For those ready to enter the mining space, start by evaluating your electricity costs, available capital, and technical expertise. Explore equipment options through reliable suppliers like Miners1688, calculate realistic ROI scenarios, and remember that successful mining combines technological understanding with business acumen. The opportunities are substantial, but so are the complexities—approach with diligence and long-term perspective.

Note: Cryptocurrency investments and mining operations carry significant financial risks. This article provides educational information only and should not be construed as financial advice. Conduct thorough research and consult financial professionals before making investment decisions. Cryptocurrency prices, mining profitability, and regulatory conditions can change rapidly.