Summary: Bitcoin’s dramatic fall below $100,000 in November 2025 marked a significant sentiment shift after hitting record highs above $126,000 in October. This analysis explores the ATH-to-drawdown dynamics, examines Fear & Greed Index shifts, and provides mining-focused insights for navigating volatile market conditions with strategic hardware deployment.

Understanding the October Peak and November Correction

Bitcoin’s trajectory in late 2025 delivered both euphoria and caution. After reaching an all-time high surpassing $126,000 in early October, the cryptocurrency entered what analysts now call the “Black Friday aftermath”—a sharp correction that saw prices tumble below $100,000 for the first time since May 2025. Investopedia

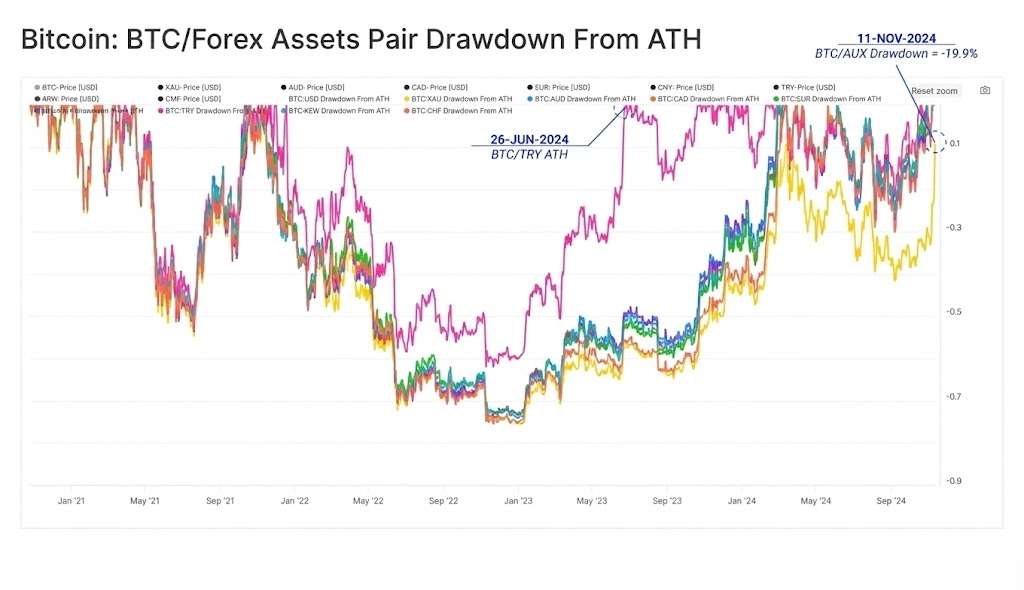

The ATH-to-Drawdown Pattern

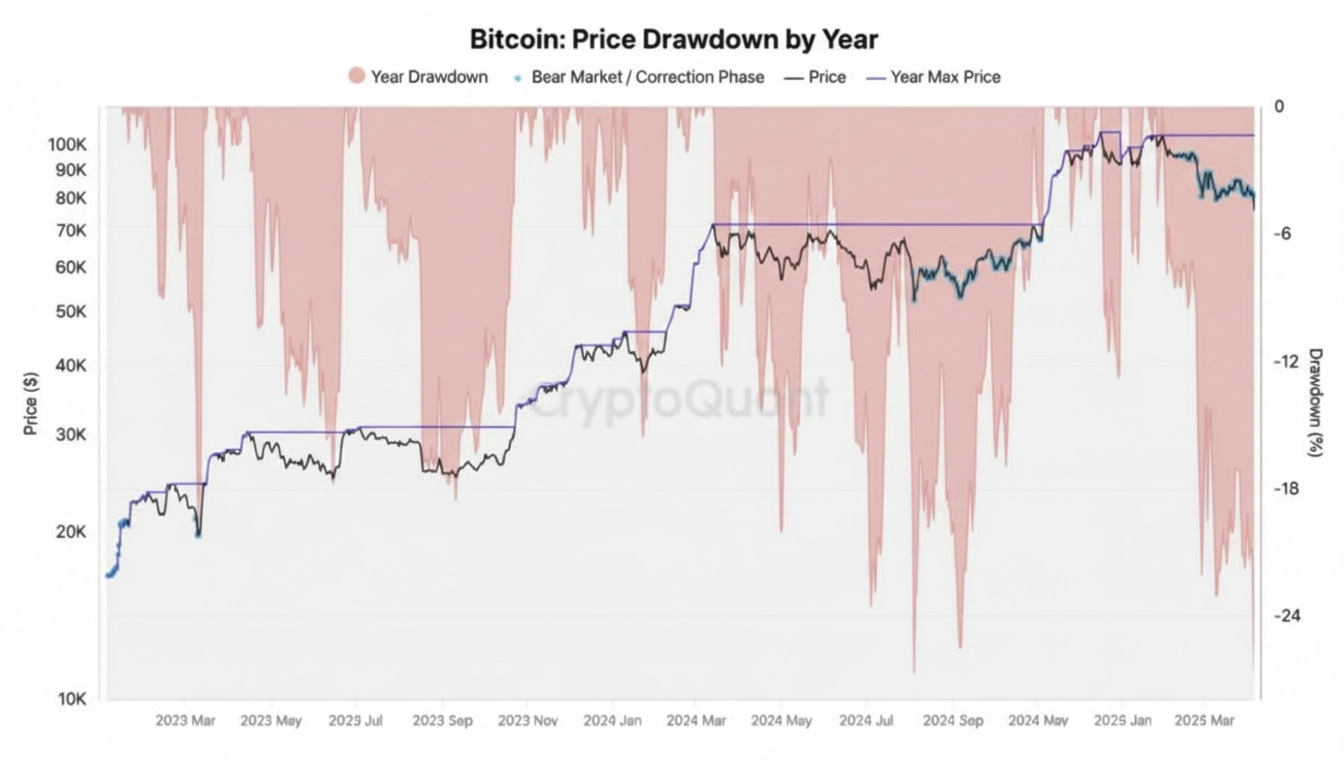

Historical Bitcoin cycles reveal that steep corrections typically follow prolonged rallies. The current ~20% drawdown from October’s ATH aligns with post-halving patterns observed in previous cycles. According to Glassnode’s analysis, over 95% of Bitcoin supply remained in profit even during the correction, suggesting this pullback represents healthy consolidation rather than a fundamental trend reversal.

Institutional Flows Signal Caution

The correction coincided with significant ETF outflows. Spot Bitcoin ETFs including BlackRock’s IBIT, Fidelity’s FBTC, and Grayscale’s GBTC collectively experienced approximately $1.3 billion in net outflows since October 29. Ethereum spot ETFs followed suit with nearly $500 million in outflows during the same period, indicating broader risk-off sentiment across crypto markets.

Sentiment Shift: From Greed to Fear

Market psychology plays a crucial role in cryptocurrency price movements. The Crypto Fear & Greed Index, which measures investor sentiment on a scale from 0 (Extreme Fear) to 100 (Extreme Greed), provides valuable insights into collective market behavior.

November’s Sentiment Reversal

In late October, the Fear & Greed Index reached elevated levels (88) indicating “Extreme Greed” as Bitcoin approached its ATH. By mid-November, sentiment had shifted dramatically. CoinMarketCap data showed the index dropping into “Fear” territory below 40, with some measures reaching as low as 13 during peak selling pressure.

Historical Context and Contrarian Opportunities

Experienced miners and investors often view extreme fear as potential accumulation zones. When the index drops below 25, markets are typically oversold, creating entry opportunities for long-term positions. Conversely, readings above 75 historically preceded corrections—exactly what materialized in November 2025. Bitcoin Magazine

Mining Profitability During Market Volatility

For cryptocurrency miners, price volatility directly impacts operational economics. Understanding hashrate dynamics, difficulty adjustments, and equipment efficiency becomes critical during market turbulence.

December 2025 Mining Landscape

Despite price corrections, Bitcoin mining remained profitable in December 2025. Jefferies analysis noted that November’s price rally outpaced hashrate growth, creating favorable mining economics that extended into December. However, network difficulty reached new all-time highs above 108.52T, requiring more efficient hardware to maintain profitability margins.

Strategic Hardware Deployment

Current market conditions favor miners utilizing latest-generation ASICs with superior efficiency ratios. According to Hashrate Index, top-performing machines for 2024-2025 include:

| Mining Machine | Hashrate | Power Consumption | Efficiency | Best For |

|---|---|---|---|---|

| Bitmain Antminer S21 Pro | 234 TH/s | 3,510W | 15 J/TH | Large-scale operations seeking premium efficiency |

| Bitmain Antminer S21+ | 216 TH/s | 3,360W | 15.6 J/TH | Balanced performance for medium operations |

| MicroBT Whatsminer M60S | 186 TH/s | 3,192W | 17.2 J/TH | Budget-conscious miners with lower electricity costs |

| Canaan Avalon Made A1566 | 185 TH/s | 3,420W | 18.5 J/TH | Entry-level professional mining |

Note: Profitability calculations based on $0.06/kWh electricity rate and current network difficulty

Alternative Coin Mining Opportunities

While Bitcoin mining requires significant capital investment, alternative cryptocurrency mining presents accessible entry points for smaller operations and hobbyist miners.

GPU-Minable Coins Gaining Traction

With Ethereum’s transition to proof-of-stake, GPU miners have diversified into coins like Ravencoin (RVN), Ergo (ERG), and Kaspa (KAS). These networks offer lower difficulty barriers and growing ecosystems, though profitability fluctuates more dramatically than Bitcoin mining. Miners1688 provides specialized hardware for these emerging networks.

ASIC Alternatives for Diversification

Litecoin (LTC) and Dogecoin (DOGE) mining using Scrypt algorithm ASICs like the Bitmain Antminer L9 (16 GH/s) or Elphapex DG2+ (20.5 GH/s) offer diversification beyond Bitcoin. The merged mining capability allows simultaneous Litecoin and Dogecoin rewards, improving overall returns during Bitcoin price corrections.

Network Hashrate and Difficulty Analysis

Understanding Bitcoin’s hashrate and difficulty dynamics provides crucial context for mining profitability forecasts and market health assessment.

2025 Hashrate Growth Trajectory

Bitcoin’s network hashrate increased 54% throughout 2025, reaching new peaks above 1.2 EH/s (exahashes per second). While substantial, this growth decelerated compared to 2023’s 103% surge. Cambridge Digital Mining Industry Report attributes the slowdown to post-halving economics and temporary price weakness following the October ATH.

Difficulty Adjustment Dynamics

Bitcoin’s difficulty adjustment mechanism recalibrates approximately every two weeks (2,016 blocks) to maintain 10-minute average block times. Following the November correction, difficulty increased 4.43% to 108.52T in mid-December—an all-time high. This relentless difficulty growth, despite price volatility, demonstrates continued miner confidence and industrial-scale operations deployment. Hashrate Index

| Period | Network Difficulty | Change % | Average Hashrate | Price Impact |

|---|---|---|---|---|

| October 2025 | 95.67T | +3.2% | 680 EH/s | ATH reached ($126K+) |

| November 2025 | 101.65T | +6.3% | 725 EH/s | Correction to $95K |

| December 2025 | 108.52T | +6.8% | 775 EH/s | Recovery to $105K |

| January 2026 (proj.) | 112.50T | +3.7% | 800 EH/s | Consolidation phase |

Data compiled from CoinWarz and blockchain.com statistics

Risk Management Strategies for Mining Operations

Cryptocurrency mining requires sophisticated risk management approaches, especially during periods of heightened volatility. Successful operators balance hardware investments, operational costs, and market exposure.

Electricity Cost Optimization

Electricity represents 60-80% of mining operational expenses. Miners should target regions with rates below $0.06/kWh for competitive advantage. Renewable energy sources including hydroelectric, solar, and wind power offer price stability and increasingly, regulatory advantages as environmental scrutiny intensifies.

Dollar-Cost Averaging for Hardware Acquisition

Rather than deploying all capital during single purchases, strategic miners implement staggered hardware acquisition. This approach averages entry costs across market cycles and reduces exposure to sudden price drops (like November 2025) that can render newly purchased equipment temporarily unprofitable.

Hedging Strategies and Treasury Management

Professional mining operations increasingly adopt financial hedging instruments. Selling forward contracts on future Bitcoin production locks in revenue certainty, protecting against price downturns. Pantheon Mining’s analysis shows miners utilizing options contracts saw smoother cash flow during November’s correction compared to unhedged competitors.

Market Cycle Positioning and Long-Term Outlook

Understanding Bitcoin’s four-year halving cycle provides essential context for current market positioning and future expectations.

Post-Halving Correction Patterns

The April 2024 halving reduced block rewards from 6.25 BTC to 3.125 BTC, cutting miner revenue by 50%. Historical patterns show 6-18 month periods of volatility following halvings before sustained rallies emerge. The October ATH followed by November correction fits established cycle patterns, suggesting current conditions represent mid-cycle consolidation rather than cycle termination.

Institutional Adoption Continues

Despite ETF outflows during the November correction, long-term institutional accumulation trends remain intact. Strategy (formerly MicroStrategy) acquired an additional 397 BTC at $114,771 average price during October-November, demonstrating conviction despite short-term volatility. Such institutional buying during corrections historically precedes renewed price discovery phases.

Mining Industry Consolidation

Market volatility accelerates mining industry consolidation. Less efficient operators exit during price corrections, while well-capitalized miners expand hashrate share. Compass Mining’s December report projects this consolidation trend will continue through 2025, favoring operations with access to sub-$0.05/kWh electricity and latest-generation ASICs.

Technical Analysis: Support and Resistance Levels

Chart-based technical analysis provides actionable insights for miners planning hardware expansion timing and treasury management decisions.

Key Price Levels to Monitor

Current Bitcoin price action (as of November 2025) suggests several critical levels:

- Support Zone: $92,000-$95,000 (200-day moving average alignment)

- Resistance Zone: $108,000-$112,000 (previous consolidation area)

- Bull Market Continuation: Sustained move above $115,000 signals renewed uptrend

- Correction Extension: Break below $88,000 suggests deeper drawdown to $75,000-$80,000

On-Chain Metrics for Validation

On-chain analysis tools provide data-driven perspective beyond price charts. Glassnode metrics show:

- Supply in Profit: 91% (elevated but below cycle peaks of 98%+)

- Long-Term Holder Supply: Increasing despite correction (bullish accumulation signal)

- Exchange Reserves: Declining (reduced selling pressure)

- Realized Cap: Growing steadily (new capital entering market)

These metrics suggest current correction represents healthy consolidation within broader uptrend structure rather than trend reversal.

Frequently Asked Questions

Q: Is Bitcoin mining still profitable after the November 2025 price correction?

A: Yes, Bitcoin mining remained profitable through November-December 2025 for operations with efficient hardware and low electricity costs (below $0.06/kWh). Latest-generation ASICs like the Antminer S21 Pro maintain positive margins even during price corrections. However, profitability varies significantly based on operational efficiency and local electricity rates.

Q: Should I buy mining equipment during market downturns?

A: Market corrections often present opportunities to acquire hardware at discounted prices. However, assess total cost of ownership including electricity, cooling, and maintenance. Target equipment with efficiency below 20 J/TH for Bitcoin mining. Diversification into alternative coins like Litecoin or Kaspa may offer better risk-adjusted returns for smaller operations.

Q: How does the Fear & Greed Index inform mining strategy?

A: Extreme Fear readings (below 25) historically coincide with Bitcoin price bottoms, suggesting favorable periods to expand mining capacity or accumulate mined Bitcoin rather than immediately selling. Conversely, Extreme Greed (above 75) may signal appropriate times to take profits or hedge positions before corrections.

Q: What hashrate growth should miners expect in 2025?

A: Industry analysts project 30-40% hashrate growth through 2025, slower than previous years due to post-halving economics and maturing hardware efficiency gains. This implies continued difficulty increases but at moderated pace, creating stable conditions for well-planned operations.

Q: Are altcoin mining opportunities more attractive during Bitcoin volatility?

A: Alternative cryptocurrency mining can offer diversification benefits, particularly GPU-minable coins like Kaspa, Ergo, and Ravencoin. However, these markets carry higher volatility and liquidity risks. For most professional operations, Bitcoin mining with strategic hedging provides more predictable economics.

Q: How long do Bitcoin market corrections typically last?

A: Historical data shows Bitcoin corrections ranging from 30-60 days for standard pullbacks (10-30%) to 6-18 months for deeper bear markets (50%+ drawdowns). The November 2025 correction (~20% from ATH) suggests a standard mid-cycle pullback rather than prolonged bear market, though each cycle varies.

Conclusion: Strategic Positioning for Market Cycles

The October ATH to November drawdown narrative illustrates Bitcoin’s persistent volatility even as institutional adoption grows. For mining operations, success requires balancing hardware efficiency, operational cost management, and strategic timing of capacity expansion. Current market conditions—characterized by elevated hashrate, moderating difficulty growth, and consolidating price action—favor well-capitalized miners with access to competitive electricity rates.

As sentiment shifts between fear and greed, disciplined operators maintain focus on fundamental metrics: hashrate profitability, equipment ROI, and long-term cycle positioning. The “Black Friday aftermath” represents not crisis, but characteristic mid-cycle recalibration presenting opportunities for strategic accumulation and infrastructure development.

Explore mining hardware solutions at Miners1688 to optimize your operation for the next market phase.