Introduction

As the clock ticks down to the next Bitcoin halving, excitement and speculation ripple through the cryptocurrency landscape. This significant event, which halves the reward that miners receive for validating new blocks, isn’t just a routine update in the Bitcoin protocol—it’s a pivotal moment that has historically triggered seismic shifts in Bitcoin’s market value. The Bitcoin halving is a designed mechanism to introduce scarcity to the digital currency, echoing the deflationary characteristic of precious metals like gold. With the upcoming halving, both seasoned investors and curious newcomers are closely monitoring the market for shifts and opportunities.

Understanding Bitcoin Halving

Definition and Mechanism

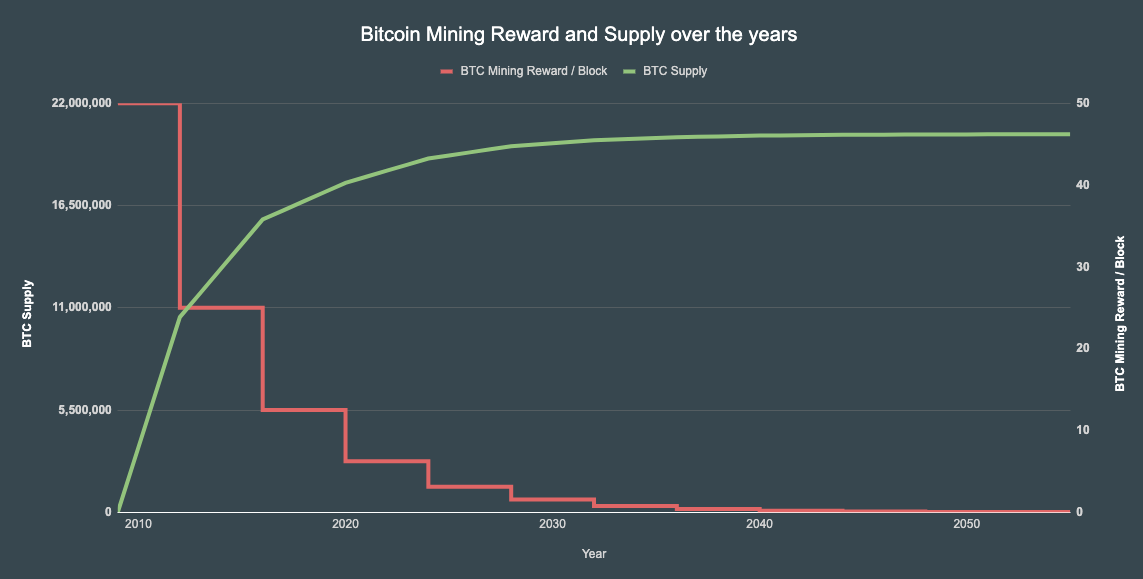

Bitcoin halving is a fundamental part of Bitcoin’s economic model, intended to control inflation and extend the distribution of new Bitcoins over time. Approximately every four years, or after every 210,000 blocks mined, the reward given to Bitcoin miners for processing transactions is cut in half. This halving reduces the rate at which new Bitcoins are created and, thus, increases the scarcity of Bitcoin. Originally set at 50 BTC per block when Bitcoin was created in 2009, the block reward has halved several times and currently stands at 6.25 BTC as of the last halving in 2020.

The halving mechanism is embedded in the Bitcoin protocol by Satoshi Nakamoto, Bitcoin’s anonymous creator, to ensure that Bitcoin remains a deflationary asset. Unlike fiat currencies, which can be printed endlessly, Bitcoin’s total supply is capped at 21 million coins. The halving event is critical because it ensures that this total supply isn’t reached too quickly, preserving the asset’s value over a longer period.

Historical Context

To fully appreciate the impact of Bitcoin halving, it’s essential to review the historical context and its implications on the cryptocurrency’s price and market dynamics. Historically, halving events have been catalysts for bullish behavior in Bitcoin’s market. For instance, the first Bitcoin halving in 2012 saw the block reward drop from 50 BTC to 25 BTC, which coincided with a substantial price increase in the following year. Similarly, the 2016 halving (from 25 BTC to 12.5 BTC) preceded the 2017 cryptocurrency bull run, where Bitcoin’s price reached what was then an all-time high.

However, it’s important to note that while past halvings have been associated with price increases, they are also accompanied by significant volatility and speculative trading. The reduction in miner revenue immediately after the halving can lead to short-term instability as miners adjust their operations to the new reward level.

Each halving has been a unique event that influenced Bitcoin’s economy in varying ways, shaped by the broader financial environment, technological advancements, and changes within the mining industry itself. These factors collectively play a role in determining how drastically the halving impacts Bitcoin’s price and market capitalization.

Current Market Analysis

State of the Bitcoin Market

As we approach the upcoming Bitcoin halving, the state of the Bitcoin market is marked by anticipation and a heightened sense of speculation. Investors, traders, and analysts are keenly observing market trends, trying to decipher how the impending halving will reshape the landscape. Currently, Bitcoin exhibits a mix of bullish and bearish signals, with volatility expected to increase as the halving draws nearer.

Market liquidity, trading volumes, and the involvement of institutional investors have seen significant changes. There has been an influx of institutional money, evidenced by major financial firms increasing their stakes in Bitcoin and other cryptocurrencies. This move is partly driven by Bitcoin’s growing reputation as a ‘digital gold’—an asset that can act as a hedge against inflation and currency devaluation in times of economic uncertainty.

Options Market Insights

The Bitcoin options market offers critical insights into investor sentiment and potential price movements surrounding the halving. Options are financial instruments that give investors the right, but not the obligation, to buy or sell Bitcoin at a predetermined price within a specific time frame. The data derived from options trading—such as the put-to-call ratio—can indicate whether investors are betting on the price of Bitcoin going up or down.

Currently, the options market is signaling a cautious optimism. The increase in call options (bets that the price will rise) suggests that many investors are expecting the halving to lead to price increases, as historically seen. However, there is also a substantial amount of protective put options, indicating that some are hedging against potential downside risks.

Moreover, the implied volatility derived from Bitcoin options—an indicator of expected price swings—is trending higher as the halving approaches. This elevated volatility reflects the uncertainty and speculative nature of the market during these critical events. Investors are advised to monitor these metrics closely, as they can provide valuable clues about market sentiment and potential price directions in the short to medium term.

What the Experts Say

Expert Predictions

As the Bitcoin halving event approaches, a spectrum of predictions floods the cryptocurrency community, emanating from seasoned analysts, well-known investors, and cryptocurrency experts. These predictions generally share a bullish outlook on Bitcoin’s post-halving price, driven by historical precedents that have shown substantial price increases following previous halvings.

Many experts believe that the reduced supply of new Bitcoins, due to the halving, will lead to an increased scarcity that naturally drives up the price, assuming demand remains steady or grows. Economists and cryptocurrency specialists point out that as Bitcoin matures, its market behavior could start to stabilize, but the halving could still serve as a catalyst for growth by highlighting its deflationary nature.

Financial analysts from major investment banks have suggested that this upcoming halving could be different due to the increased participation of institutional investors who are likely to view Bitcoin as a more legitimate investment vehicle. This growing interest from larger financial entities could buffer and stabilize Bitcoin’s price dynamics.

Community Expectations

The sentiment within the Bitcoin community is a mix of excitement and cautious optimism. On social media platforms and cryptocurrency forums, traders and long-term investors are sharing their strategies and expectations for the halving. Many community members are focusing on the potential for a significant price uptick post-halving, while others warn new entrants about the potential for volatility and pullbacks.

Community influencers and veteran Bitcoin holders often discuss the importance of looking beyond the immediate effects of the halving. They encourage the community to consider the broader implications of reduced miner rewards, such as potential changes in mining efficiency and the environmental impact of mining.

In essence, while expert predictions and community expectations largely suggest a positive outcome from the upcoming Bitcoin halving, both voices emphasize the need for investors to stay informed and approach their investment decisions with a clear understanding of the risks and rewards involved. This balanced view helps temper overly speculative actions and encourages a more thoughtful, long-term approach to investing in Bitcoin.

Investment Opportunities

Pre-Halving Investment Strategies

As the Bitcoin halving approaches, strategic investment decisions become crucial. Seasoned investors and financial advisors suggest several strategies to capitalize on the potential market changes. One common strategy is to accumulate Bitcoin leading up to the halving, as historical trends have often shown significant price increases post-event. This approach is predicated on the idea that reduced future supply will drive up demand, particularly if mainstream adoption continues to grow.

Another strategy is diversifying into altcoins that might benefit from increased attention to the crypto space around the halving event. Some altcoins historically perform well during Bitcoin’s bullish phases because they are perceived as more affordable alternatives with higher potential returns.

For those looking for a more conservative strategy, setting up a dollar-cost averaging (DCA) plan leading into and through the halving can help mitigate risk. This method involves investing a fixed amount of money into Bitcoin at regular intervals, regardless of the price, reducing the impact of volatility.

Analysis of Potential Risks

While the opportunities around Bitcoin halving are enticing, they come with their set of risks which investors must carefully consider. The primary risk is volatility. Bitcoin’s price is notoriously volatile around major events like halvings, and while it can lead to high returns, it can also result in substantial losses.

Additionally, there is the risk that the market has already priced in the halving event, which could lead to a “buy the rumor, sell the news” scenario where the actual event leads to a decrease, or flat performance, in price. This situation can be particularly challenging for new investors who may enter the market at peak hype without a clear exit strategy.

Investors should also be aware of the potential changes in miner behavior. The halving reduces mining rewards, which could lead to decreased network security if miners exit the network due to lower profitability. This reduction in network security could affect Bitcoin’s price and investor confidence.

To navigate these risks, investors are advised to thoroughly research their investment choices, maintain a balanced portfolio, and consider the timing of their investment entries and exits. Keeping an eye on broader market trends and staying informed through credible sources can also provide critical insights that guide investment decisions during such volatile periods.

Last Minute Deals and Offers

Spotlight on Deals

In the run-up to the Bitcoin halving, several cryptocurrency exchanges and trading platforms often launch promotional deals to attract both seasoned traders and new entrants. These deals can include reduced trading fees, special offers on Bitcoin purchases, and bonuses for new sign-ups or referrals. Notable platforms like Binance, Coinbase, and Kraken might offer these promotions to leverage the increased trading activity anticipated around the halving event.

Additionally, investment platforms may provide enhanced services such as improved leverage options or new trading tools designed to help traders take full advantage of the halving’s market impact. These tools can assist in more precise trading decisions during periods of high volatility expected during and after the halving.

How to Access These Deals

To access these deals, investors should first ensure they are registered with platforms that are known to offer halving-related promotions. Keeping an eye on official communications from these platforms as well as trusted cryptocurrency news websites can provide timely information on the latest offers.

Investors can also benefit from joining cryptocurrency community groups on platforms like Reddit, Telegram, and Discord. These communities often share insights into which platforms are offering the best deals and how to safely access them. Additionally, following these platforms on social media can provide immediate updates on promotions, especially flash deals that may only be available for a limited time.

It’s also important for investors to understand the terms and conditions associated with any deal. Some offers might come with specific requirements such as a minimum investment amount, or they might only be available to new users or those who participate in certain activities like trading competitions.

By staying informed and prepared, investors can make the most of these last-minute deals, potentially enhancing their investment outcomes as they navigate the financial opportunities presented by the Bitcoin halving.

How to Prepare Financially for Post-Halving

Post-Halving Strategies

The aftermath of a Bitcoin halving event can significantly alter the financial landscape for investors. To navigate these changes effectively, it is crucial to develop a robust post-halving strategy. One key approach is rebalancing your portfolio. After the halving, the increased volatility could shift the percentage of assets in your portfolio, making it either too aggressive or too conservative based on your risk tolerance. Periodic rebalancing helps maintain your desired asset allocation, thereby managing risk and enhancing potential returns.

Another strategy involves continuing or initiating a dollar-cost averaging (DCA) plan post-halving. Given the potential for high volatility and the uncertain impact on prices, DCA allows investors to spread their purchases out, reducing the potential risk of investing a large amount at an inopportune time.

Investors should also stay alert to the market dynamics and technological advancements within the blockchain industry that might arise following the halving. Innovations, regulatory changes, and shifts in consumer behavior can all influence Bitcoin’s value and should be considered when planning long-term investments.

Long-term Considerations

Looking beyond the immediate effects of the halving, investors should also consider the long-term implications of reduced Bitcoin supply on its value and demand. As Bitcoin approaches its maximum supply limit of 21 million, its scarcity could potentially enhance its value, particularly if public and institutional interest in cryptocurrency continues to grow. This aspect makes Bitcoin a viable component of a diversified investment portfolio aimed at long-term wealth generation.

Furthermore, the halving could encourage greater investment in Bitcoin infrastructure, such as more energy-efficient mining technologies and broader financial services integrating Bitcoin, which could foster broader economic implications and enhance Bitcoin’s market stability and growth potential.

To capitalize on these long-term trends, investors may consider engaging with financial advisors who specialize in cryptocurrency investments. These professionals can provide tailored advice that incorporates both the current market conditions and projections for future developments.

By preparing for both the immediate and distant future, investors can better position themselves to take advantage of the opportunities presented by the Bitcoin halving while mitigating potential risks.

Conclusion

As we’ve explored throughout this article, the Bitcoin halving is not just a pivotal event for miners but a significant moment for the entire cryptocurrency market. It serves as a critical test of Bitcoin’s economic model and a potential catalyst for substantial price movements and market behavior. By understanding the mechanics of the halving, analyzing current market conditions, and listening to expert predictions and community expectations, investors can better navigate the complexities associated with this event.

The strategies and insights shared here aim to equip you with the knowledge to make informed investment decisions both before and after the halving. From taking advantage of last-minute deals to preparing for the long-term implications of a reduced Bitcoin supply, the opportunities to enhance your investment portfolio in light of the halving are plentiful.

Remember, the key to successful investing during such a volatile event is to stay informed, remain vigilant, and approach each investment decision with a clear understanding of your financial goals and risk tolerance. As the Bitcoin halving approaches, keeping a close watch on market developments and continuously assessing your investment strategies will be crucial.

We encourage all readers to continue their exploration of Bitcoin and its upcoming halving by delving into the further resources provided, consulting with financial advisors, and engaging with the cryptocurrency community. This proactive approach will not only enhance your understanding but also help you seize the financial opportunities that arise as the world of cryptocurrency continues to evolve.