Summary: Bitcoin miners face challenging conditions in December 2025 as BTC stabilizes around $90K amid weak ETF flows and declining hashprice. New mining hardware from Bitmain and MicroBT offers efficiency gains, but profitability remains compressed as hashrate climbs and network difficulty adjusts.

Market Overview – Bitcoin Stabilizes After Volatile November

Bitcoin’s price action in December 2025 reflects a market caught between recovery optimism and persistent demand weakness. After touching lows near $80,000 in late November, BTC has stabilized in the $89,000-$92,000 range, showing signs of seller exhaustion rather than aggressive buyer demand CoinDesk.

The stabilization comes as multiple on-chain cost basis metrics converged around the $80,000-$83,000 support zone. According to Glassnode data, three critical levels provided confluence: the 2024 yearly volume-weighted cost basis near $83,000, the True Market Mean at approximately $81,000, and the average US spot ETF cost basis around $83,844 CoinDesk.

Current Price Dynamics and Support Levels

The True Market Mean represents the average on-chain purchase price of bitcoin held by active market participants, filtering out long-dormant supply. Bitcoin first moved above this $81,000 level in October 2023 and has not traded below it since, reinforcing its importance as a structural threshold during this period.

The ETF cost basis metric tracks the weighted average price at which bitcoin has flowed into US-listed spot ETFs. This level has acted as reliable support during previous corrections, including the tariff-driven selloff earlier in 2025, demonstrating institutional conviction at these price points.

Market Sentiment and Forward Indicators

Despite the technical support holding, market sentiment remains cautious. The 14-day RSI has moved back into its midrange, signaling recovery from oversold conditions but without the momentum typically associated with sustained rallies. Spot cumulative volume delta (CVD) remains deeply negative, indicating that selling pressure continues to outweigh buying activity on aggregate.

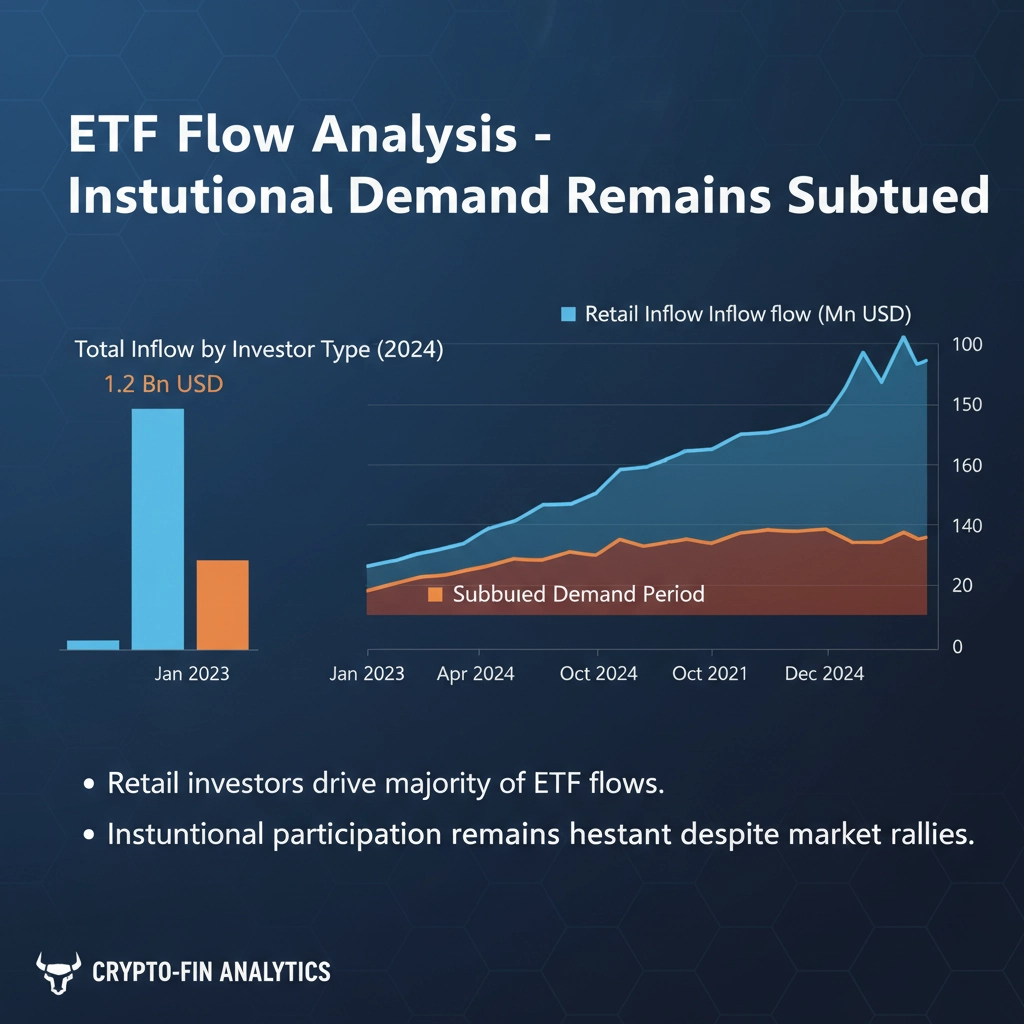

ETF Flow Analysis – Institutional Demand Remains Subdued

The recovery in Bitcoin ETF flows has been real but shallow, marking a significant departure from the aggressive accumulation patterns seen throughout late 2024. According to SoSoValue data, US ETF flows recorded a modest $56.5 million inflow on December 9, representing the first stabilization after more than $1.1 billion in weekly redemptions throughout November.

However, this recovery pales in comparison to historical patterns. The market has not witnessed a single day exceeding $500 million in net spot ETF inflows since November 11, 2025. Prior to that period, the last occurrence was October 7, marking a dramatic slowdown from the November-December 2024 period when such flows materialized one to two times per week.

Institutional Behavior Patterns

The tepid ETF flow environment suggests that institutional allocators remain on the sidelines, waiting for clearer directional signals before committing significant capital. Derivatives positioning reflects this cautious stance, with futures open interest declining and options skew showing traders continue paying premiums for downside protection rather than positioning for upside breakouts.

Comparison With Previous Accumulation Phases

The April through October 2025 period, which saw BTC advance from $70,000 to over $126,000, was characterized by consistent large-scale ETF inflows. The current environment lacks this institutional conviction, with on-chain activity near cycle lows and realized cap growth at only 0.7%, signaling weak capital inflows from new market participants.

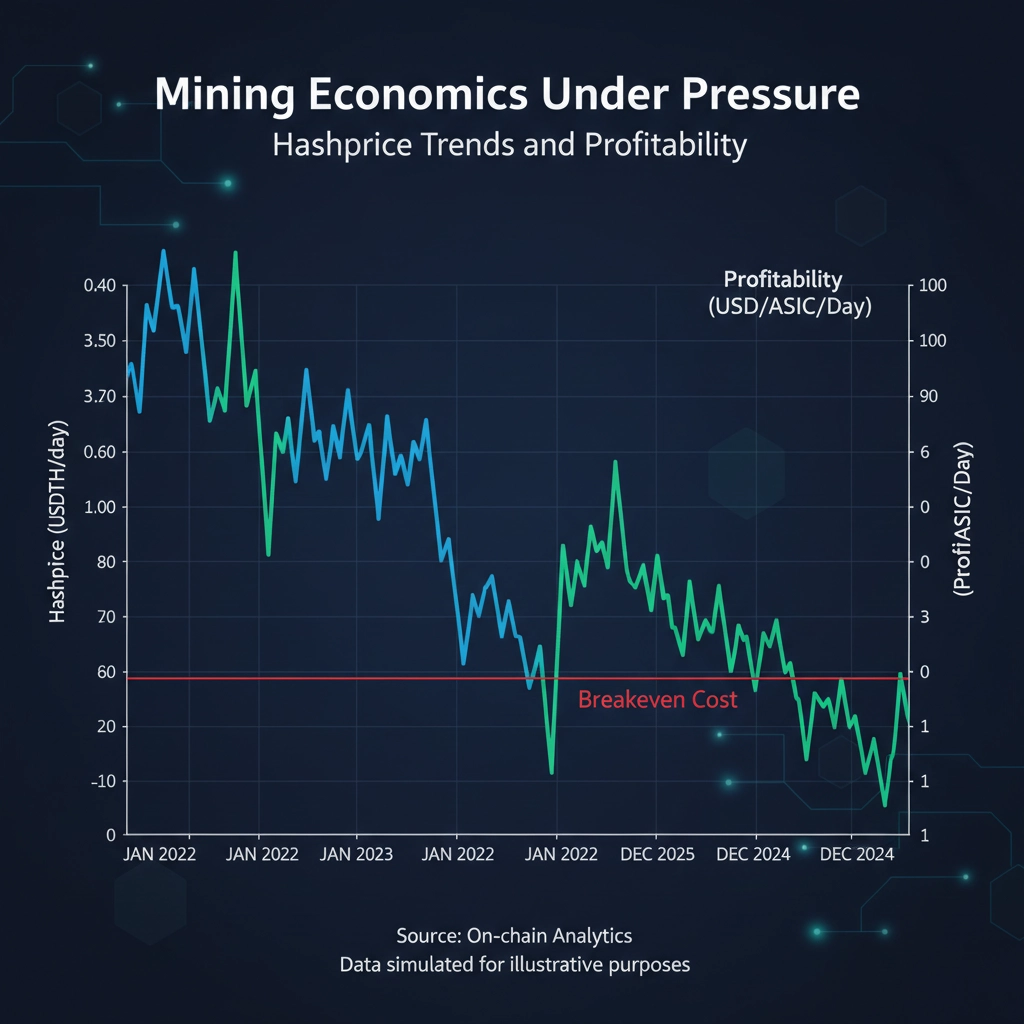

Mining Economics Under Pressure – Hashprice Trends and Profitability

Bitcoin miners are navigating one of the most challenging profitability environments in recent memory. According to Hashrate Index data, USD hashprice increased modestly by 4.4% week-over-week to $38.31 per PH/s/day as of December 8, 2025, recovering slightly from recent lows but remaining well below levels that provide comfortable margins for many operations Hashrate Index.

Network hashrate decreased 4.0% to a seven-day simple moving average of 1,054 EH/s, down from 1,098 EH/s the previous week. This decline reflects marginal miners shutting down operations as profitability compressed, though the 30-day average remains elevated at 1,078 EH/s, indicating the network remains highly competitive.

Hashprice Breakdown by Fleet Efficiency

Based on fleet efficiency, current compute revenues per watt break down as follows:

| Fleet Efficiency | Revenue per MWh | Profitability Status |

|---|---|---|

| Under 19 J/TH | $95 per MWh | Profitable at most power costs |

| 19-25 J/TH | $73 per MWh | Marginal profitability |

| 25-38 J/TH | $50 per MWh | At or below breakeven |

Operators running older generation equipment in the 25-38 J/TH efficiency range face particularly acute pressure. At $38 per PH/s/day hashprice, these miners are operating at or below breakeven depending on their specific power costs and operational overhead.

Network Difficulty and Block Discovery Rates

The latest difficulty adjustment on November 26 decreased network difficulty by 1.95% to 149.30T. Blocks were found at an average time of approximately 10 minutes and 1 second over the 24-hour period preceding December 8, with the next adjustment estimated to show a further decrease of approximately 0.29%.

Transaction fees provided minimal relief, with miners collecting an average of 0.0223 BTC per block per day, representing only a modest 8% increase from the prior week’s 0.0206 BTC. Fee income remains negligible relative to block subsidies, comprising less than 1% of total mining rewards.

New Mining Hardware Launches – S21 XP Hyd and WhatsMiner M70

The mining hardware landscape is evolving rapidly as manufacturers race to deliver efficiency gains that can help operators maintain profitability in compressed margin environments. Two significant product launches in late 2025 are reshaping miner purchasing decisions.

Bitmain Antminer S21 XP Hyd Q4 2025 Sales Batch

Bitmain officially launched its S21 XP Hyd model with Q4 2025 sales batch availability, targeting large-scale operations with hydro-cooling infrastructure Bitmain. The hydro-cooled variant offers enhanced efficiency compared to air-cooled alternatives, making it particularly attractive for operators with existing liquid cooling systems or those building new facilities designed around immersion or hydro-cooling technology.

Current hardware pricing shows the S21XP trading at $25.70 per TH/s, representing a premium over older generation equipment but offering superior efficiency that translates to lower operating costs over the machine’s lifespan. For miners operating in regions with power costs above $0.06 per kWh, the efficiency differential can mean the difference between profitability and losses.

MicroBT WhatsMiner M70 Series Launch in Abu Dhabi

MicroBT unveiled its WhatsMiner M70 series at Bitcoin MENA in Abu Dhabi, with CEO Dr. Yang Zuoxing highlighting the company’s focus on sustainable mining and energy innovation Bitcoin Magazine. The M70 line features models with power efficiencies of 14.5J/T, 13.5J/T, and 12.5J/T, representing significant improvements over previous generations.

| Model Specification | Bitmain S21 XP Hyd | MicroBT M70 (Top Tier) |

|---|---|---|

| Power Efficiency | ~16-17 J/TH | 12.5 J/TH |

| Cooling Method | Hydro-cooling | Advanced air/hybrid |

| Target Market | Large-scale operations | Efficiency-focused miners |

| Price Point | $25.70/TH | Premium pricing expected |

| Availability | Q4 2025 | Launching 2025 |

Strategic Considerations for Hardware Procurement

Miners evaluating new hardware purchases must balance upfront capital expenditure against projected operational savings and payback periods. At current hashprice levels of $38 per PH/s/day, the payback calculation for new equipment purchases extends significantly compared to periods when hashprice exceeded $50.

The forward hashrate market, as tracked by Luxor’s derivatives platform, prices in an average hashprice of $37.17 (or 0.00041 BTC) over the next six months. This forward curve suggests the market expects continued pressure on mining economics, making the efficiency gains offered by the M70 and S21 XP Hyd increasingly critical for maintaining competitive positioning.

Energy Innovation and Sustainable Mining Approaches

The mining industry’s focus has shifted dramatically toward energy efficiency and sustainable power sourcing as operational margins compress. MicroBT’s M70 launch emphasized this trend, with presentations highlighting off-grid solar solutions capable of 200kW output using an 800V DC supply and “load-following-source” design that improves efficiency compared to traditional AC setups.

Renewable Energy Integration

Dr. Yang Zuoxing’s keynote at the Abu Dhabi launch framed technological leadership around energy innovation, presenting strategies that aim to integrate renewable sources into mining operations. The off-grid solar system demonstrated enables uninterrupted operation while reducing dependence on grid power, particularly valuable in regions with abundant solar resources but limited electrical infrastructure.

Hybrid energy approaches combining gas-powered generation with careful miner selection can extend hardware lifespan and operational reliability. These strategies become especially relevant as miners seek to differentiate their operations based on carbon footprint and energy sourcing, responding to increasing scrutiny from stakeholders and potential regulatory frameworks around energy-intensive computing.

Ecosystem Partnerships and Collaborative Models

MicroBT’s ecosystem strategy extends beyond hardware sales to encompass shared-value partnerships and collaborative mining arrangements. Sales and Marketing Director Wright Wang outlined a vision connecting certified solution partners who provide expertise in cooling, energy management, and operations, positioning MicroBT as a facilitator of an interconnected mining ecosystem rather than simply a hardware supplier.

Partner presentations at the Abu Dhabi launch covered topics ranging from advanced cooling techniques to financial models for hashrate management, underscoring the industry’s increasing interdependence. Companies like HeatCore, HashHouse, FogHashing, and others provide specialized capabilities that complement hardware manufacturing, creating integrated solutions for modern mining operations.

Macro Environment and Federal Reserve Policy Impact

Bitcoin’s December price action cannot be divorced from broader macroeconomic conditions, particularly Federal Reserve policy decisions and their implications for risk asset valuations. The Fed’s December rate cut of 25 basis points was widely anticipated, but the hawkish forward guidance projecting only one additional rate cut in 2026 dampened enthusiasm across risk assets Barron’s.

Interest Rate Environment and Crypto Correlation

The growing divide among policymakers and cautious guidance overshadowed the immediate easing effect, pushing Bitcoin and broader crypto markets lower following the announcement. BTC dropped from levels above $92,000 to test support near $90,000 as traders reassessed the trajectory of monetary policy and its implications for liquidity conditions.

Treasury yields exhibited stickiness on the higher side, with the 10-year US Treasury recovering from post-Fed lows of 4.11% to 4.14%. Analysts at ING have suggested this level is more likely to rally sustainably than decline, indicating that the bond market continues to price in persistent inflation pressures and limited room for aggressive rate cuts despite current policy adjustments.

Correlation With Traditional Risk Assets

Bitcoin’s movement pattern increasingly correlates with traditional risk assets, particularly technology stocks represented by the Nasdaq. Oracle’s disappointing earnings triggered weakness across tech futures, with crypto markets following suit in a pattern that has become familiar throughout 2025. This correlation suggests that institutional participants increasingly view bitcoin through a risk-on/risk-off framework rather than as an independent alternative asset.

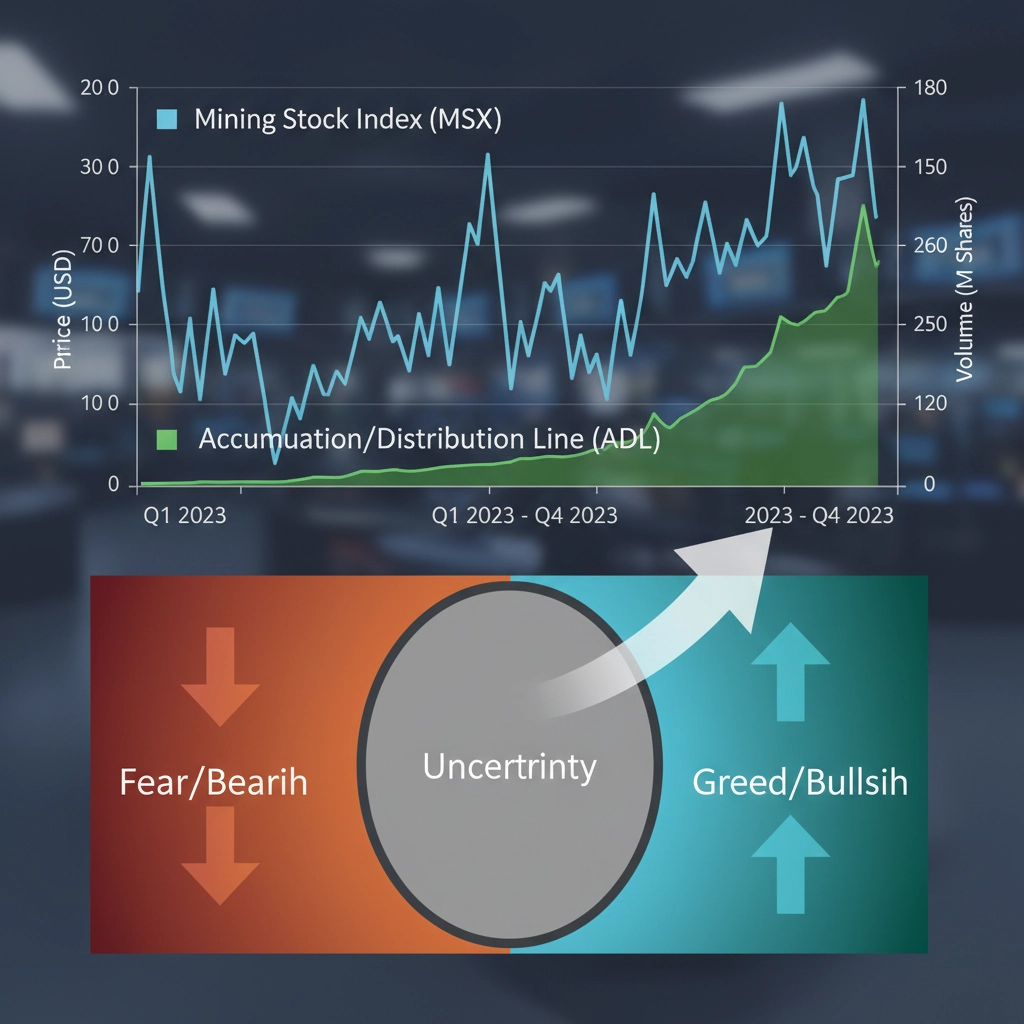

Mining Stock Performance and Market Sentiment

Bitcoin mining stocks reflected the challenging operational environment, with the Hashrate Index Mining Stock Index showing mixed performance and a modest +0.4% change over the five-day period ending December 8, 2025. Individual stock movements revealed divergent fortunes among operators:

Notable performers included Marathon Digital (MARA) with a +6.0% weekly gain and Core Scientific (CORZ) advancing +5.2%, suggesting investor confidence in these operators’ ability to navigate difficult conditions. Conversely, Bitfarms (BITF) declined -9.6% and CleanSpark (CLSK) fell -3.2%, potentially reflecting concerns about operational efficiency or balance sheet strength.

Market Capitalization and Valuation Metrics

As of the December 8 close, the mining sector displayed a wide range of valuations:

- Iris Energy (IREN): $13.4B market cap at $44.71 per share

- Cipher Mining (CIFR): $7.7B market cap at $19.28 per share

- TeraWulf (WULF): $6.3B market cap at $14.50 per share

- Riot Platforms (RIOT): $5.6B market cap at $14.94 per share

- Marathon Digital (MARA): $4.5B market cap at $11.74 per share

The sector’s aggregate valuation reflects market expectations for a prolonged period of compressed margins, with premium valuations assigned to operators demonstrating superior operational efficiency, favorable power contracts, or strategic positioning for the next cycle of mining economics.

Smart Money Accumulation Patterns

Despite weak ETF flows and cautious institutional positioning, on-chain data reveals accumulation by sophisticated market participants. According to BRN analytics, large holders controlling 1,000-10,000 BTC wallets have added approximately 42,565 BTC since December 1, representing a clear smart-money accumulation signal while short-term holders and retail participants continue trimming positions.

This divergence between institutional ETF flows and on-chain whale accumulation suggests that certain sophisticated participants view current price levels as attractive long-term entry points, even as broader market sentiment remains uncertain about near-term direction.

Looking Ahead – Key Factors for Q1 2026

As the mining industry moves into early 2026, several critical factors will determine profitability trajectories and operational strategies. The forward hashrate curve’s projection of $37.17 per PH/s/day over the next six months sets a sobering baseline, suggesting continued margin pressure unless Bitcoin price appreciation provides relief.

Hardware Upgrade Decisions and Capital Allocation

Miners face strategic decisions about capital allocation between hardware upgrades, expansion projects, and balance sheet preservation. The efficiency gains offered by the WhatsMiner M70 (12.5 J/T) and Antminer S21 XP Hyd become increasingly compelling as hashprice remains depressed, with the payback calculation favoring efficiency improvements despite extended payback periods.

Operators running equipment less efficient than 25 J/TH face an existential choice: invest in upgrades despite challenging near-term economics, or risk falling behind competitors who secure next-generation efficiency. This dynamic typically drives industry consolidation, with well-capitalized operators acquiring distressed assets at discounted valuations.

Bitcoin Price Catalysts and Market Structure

The absence of significant ETF flows remains the most concerning factor for Bitcoin’s price trajectory. Historical analysis demonstrates that sustained price advances during 2024-2025 correlated strongly with multi-hundred-million-dollar daily ETF inflows. Until institutional allocators return with conviction, price action is likely to remain range-bound regardless of technical support levels.

Potential catalysts for renewed institutional interest include clearer regulatory frameworks under evolving US policy, breakthrough adoption by sovereign wealth funds or pension systems, or macroeconomic shifts that drive allocators toward alternative stores of value. The timing and magnitude of these potential catalysts remain highly uncertain.

Network Security and Hashrate Projections

Network hashrate dynamics will continue influencing mining economics through difficulty adjustments. The modest -0.29% projected adjustment for December 10 provides minimal relief, and any sustained Bitcoin price weakness could trigger more significant hashrate reductions as marginal miners capitulate.

Conversely, if Bitcoin stabilizes above $90,000 and gradually trends higher into early 2026, hashrate is likely to resume its long-term upward trajectory as efficient new hardware deployment accelerates. This creates a feedback loop where improving economics attract more competition, which subsequently compresses margins and eliminates weaker participants.

FAQ – Common Questions About Bitcoin Mining in December 2025

Q: Is Bitcoin mining still profitable at current hashprice levels?

A: Profitability depends entirely on operational efficiency and power costs. Miners operating equipment under 19 J/TH efficiency can remain profitable with power costs below $0.08/kWh. Operations running older 25-38 J/TH equipment face breakeven or negative margins at $38 per PH/s/day hashprice unless they have exceptionally low power costs under $0.04/kWh.

Q: Should miners purchase new hardware now or wait for better market conditions?

A: The decision requires careful analysis of specific circumstances. Miners with access to low-cost power and adequate capital should consider efficiency upgrades, as the WhatsMiner M70 and Antminer S21 XP Hyd offer substantial operational cost reductions. However, extended payback periods at current hashprice suggest caution for operators with higher capital costs or uncertain power arrangements.

Q: What Bitcoin price would restore healthy mining margins?

A: At current network hashrate and difficulty, Bitcoin prices above $100,000 would restore comfortable margins for most efficient operations. However, sustained price increases typically attract additional hashrate, partially offsetting the profitability improvement through difficulty adjustments. The dynamic equilibrium typically leaves marginal miners at breakeven regardless of absolute price levels.

Q: How do the new M70 and S21 XP Hyd miners compare to previous generation equipment?

A: The efficiency improvements are substantial, with the M70’s best models achieving 12.5 J/T compared to 19-21 J/T for previous flagships. This represents approximately 35-40% reduction in power consumption per unit of hashrate, translating directly to lower operational costs and extended profitability range as hashprice declines.

Q: Will ETF flows recover in early 2026?

A: This remains highly uncertain and depends on broader market sentiment, regulatory clarity, and macroeconomic conditions. The absence of $500M+ daily flows since November suggests institutional caution persists. Recovery would likely require either significant Bitcoin price appreciation creating FOMO dynamics, or material improvement in macro conditions supporting risk asset allocation.

Q: What role does sustainable energy play in modern mining operations?

A: Sustainable energy sourcing is becoming increasingly critical for competitive differentiation, stakeholder management, and potential regulatory compliance. Operations that can demonstrate renewable energy usage or carbon-neutral approaches may command valuation premiums and face lower regulatory risk as energy-intensive computing attracts greater scrutiny globally.