Introduction

In the intricate tapestry of the cryptocurrency world, Bitcoin’s hashrate stands as a testament to the network’s robustness and the relentless pursuit of miners in their quest for digital gold. As of November 19, 2023, this hashrate, a quantifiable expression of the computational power percolating through the Bitcoin network, has reached unprecedented heights, painting a vivid picture of the ever-evolving landscape of cryptocurrency mining.

The hashrate, a term that resonates with the rhythmic hum of millions of ASIC miners, serves as the heartbeat of the Bitcoin blockchain. It’s not just a number; it’s a symphony of computational prowess, echoing the collective effort of miners worldwide. As they compete to solve complex cryptographic puzzles, their success not only validates transactions but also fortifies the network against adversarial threats, making Bitcoin not just a currency, but a fortress of trust in the digital age.

On this date, the network hashrate has soared to a staggering 479.81 EH/s, as per the data from Hashrate Index. This figure is not merely a statistic; it’s a narrative of human endeavor, technological advancement, and the unyielding spirit of the crypto community. It tells a story of miners, undeterred by market volatilities and the caprices of cryptocurrency economics, continuously adding their computational strength to the network. This relentless increase in hashrate not only underscores the growing security and resilience of the Bitcoin network but also reflects the unwavering faith of the miners in the intrinsic value and future potential of Bitcoin.

As we delve deeper into the nuances of Bitcoin’s hashrate, we find ourselves at the confluence of technology and economics. The current state of the hashrate is a beacon, guiding us through the fog of market uncertainties and shining a light on the path forward for Bitcoin mining. It’s a dynamic ecosystem, where the interplay of network difficulty, mining profitability, and technological innovation creates a constantly shifting landscape, challenging miners to adapt, evolve, and thrive.

In this ever-changing realm of digital mining, the hashrate is more than a measure of power; it’s a barometer of the health and vitality of the Bitcoin network. As we stand on the brink of another epoch in the annals of cryptocurrency, the hashrate not only tells us where we are but also hints at the exciting journey that lies ahead.

Current Trends in Bitcoin’s Hashrate

In the realm of Bitcoin, the hashrate is not just a metric; it’s a narrative, a story of relentless pursuit, technological evolution, and the unwavering spirit of a decentralized community. As we delve into the current trends of Bitcoin’s hashrate, we uncover layers of complexity and innovation that define the state of this digital ecosystem as of November 19, 2023.

The Zenith of Computational Power: Analyzing Current Hashrate Statistics

The present landscape of Bitcoin’s hashrate is marked by towering figures that speak volumes of the network’s strength and the miners’ dedication. As per the latest data from Hashrate Index, the network hashrate has reached a monumental 479.81 EH/s on a 7-day average, with the 30-day average not far behind. These numbers are not mere digits; they are the epitome of a technological crescendo, a culmination of years of innovation and growth in the field of cryptocurrency mining.

This all-time high in the hashrate is a testament to the robustness of the Bitcoin network. It reflects the unwavering commitment of miners who, armed with cutting-edge ASIC miners, continue to fortify the network’s security. Each hash is a stroke in the grand canvas of Bitcoin, each miner a diligent artist contributing to this masterpiece of decentralized finance.

Unraveling the Catalysts: Factors Driving the Hashrate Surge

The surge in Bitcoin’s hashrate is not an isolated phenomenon; it’s the result of a confluence of factors that have coalesced to propel this growth. One of the primary drivers is the relentless advancement in mining technology. The advent of more efficient and powerful ASIC miners has enabled miners to extract more hashes per second, pushing the hashrate to new heights.

Another contributing factor is the increasing global interest in Bitcoin and cryptocurrency at large. As Bitcoin continues to cement its position as a digital store of value and a hedge against traditional financial systems, more individuals and institutions are drawn into mining, expanding the network’s computational power.

Moreover, the economic incentives of mining, including the rewards and transaction fees, continue to attract investment and interest in Bitcoin mining, further fueling the hashrate growth. This economic allure, intertwined with technological advancements, creates a self-reinforcing cycle that drives the hashrate upward.

A Journey Through Time: Historical Hashrate Growth

To truly appreciate the current state of Bitcoin’s hashrate, one must look back at its historical trajectory. The growth of Bitcoin’s hashrate over the years is not just a curve on a graph; it’s a story of resilience, adaptation, and triumph.

Comparing the current hashrate with historical data reveals a staggering growth trend. From the early days of Bitcoin, where mining was a pursuit for hobbyists using simple CPUs, to the current era of specialized ASIC miners, the hashrate has grown exponentially. This growth is reflective of the increasing security and maturity of the Bitcoin network, as well as the growing confidence and investment in the cryptocurrency space.

The historical growth trend of Bitcoin’s hashrate is a chronicle of the network’s evolution. It’s a tale of technological advancements, economic shifts, and a community’s unwavering belief in the transformative power of Bitcoin. As we stand at this juncture, witnessing the hashrate reaching new zeniths, we are not just observing a statistic; we are witnessing history in the making, a testament to the enduring legacy of Bitcoin.

Impact of Hashrate Changes on Bitcoin Mining

In the intricate dance of Bitcoin mining, the hashrate plays a lead role, orchestrating a complex interplay of computational power, economic incentives, and network security. As we delve into the impact of hashrate changes on Bitcoin mining, we uncover a multifaceted narrative that shapes the very foundation of this digital gold rush.

The Symbiosis of Hashrate and Mining Difficulty: A Delicate Balance

The hashrate’s rise and fall are inextricably linked to the mining difficulty of Bitcoin, a dynamic equilibrium that maintains the blockchain’s integrity. As the hashrate climbs, propelled by the influx of miners and advanced mining rigs, the Bitcoin network, in its wisdom, adjusts the mining difficulty accordingly. This automatic recalibration, occurring every 2016 blocks, is akin to a self-correcting mechanism that ensures block generation times remain consistent, approximately every ten minutes.

This dance between hashrate and difficulty is not just a technical routine; it’s a testament to the ingenuity of Bitcoin’s design. As the difficulty increases with a rising hashrate, miners are challenged to deploy more computational power, ensuring the network’s security remains ironclad. However, this escalation also impacts mining profitability, creating a competitive arena where only the most efficient miners thrive.

Deciphering the Triad: Hashrate, Hashprice, and Mining Rewards

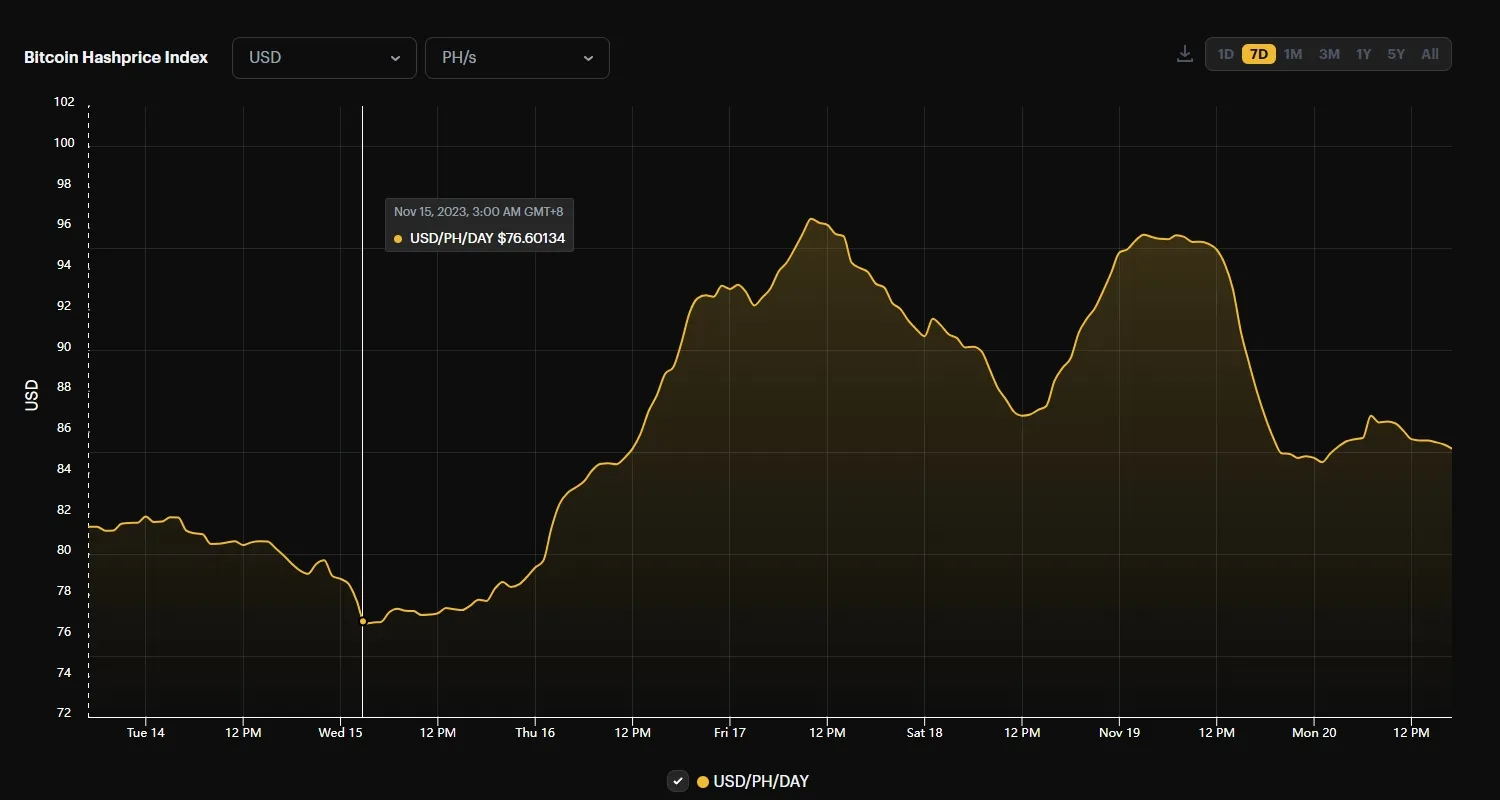

In the realm of Bitcoin mining, the relationship between hashrate, hashprice, and mining rewards is a complex yet fascinating narrative. The hashrate, a beacon of the network’s computational strength, directly influences the hashprice – the expected value of mining rewards per unit of hashing power. As the hashrate surges, the hashprice often fluctuates, reflecting the changing landscape of mining profitability.

This intricate relationship is a dance of supply and demand, where the increasing hashrate can lead to a decrease in hashprice, assuming Bitcoin’s price remains constant. However, the overall mining rewards, a combination of block rewards and transaction fees, can offset this impact. The miners’ quest for profitability is thus a delicate balance, hinging on the interplay of these three critical factors.

Navigating the Future: Anticipating Bitcoin’s Difficulty Adjustment

As the Bitcoin network witnesses a sustained increase in hashrate, the horizon is marked by an expected positive difficulty adjustment. This adjustment is not merely a routine change; it’s a forward-looking indicator of the network’s health and the mining community’s confidence.

The rising hashrate, a chorus of computational power echoing across the globe, signals a robust and secure network. However, it also sets the stage for a higher difficulty level, challenging miners to innovate and optimize their operations. This expected adjustment is a harbinger of a more competitive mining landscape, where efficiency and technological advancement become paramount.

In this ever-evolving narrative of Bitcoin mining, the anticipated difficulty adjustment is a milestone, marking the network’s adaptive response to its own growth. It’s a testament to Bitcoin’s resilient design, ensuring that as the network grows stronger, it remains secure, decentralized, and true to its foundational principles. As miners and enthusiasts alike watch this unfolding story, they bear witness to the relentless march of a technology that continues to redefine the boundaries of finance and trust.

Technological Advancements and Their Influence

In the ever-evolving landscape of Bitcoin mining, technological advancements are not just incremental improvements; they are revolutionary leaps that redefine the parameters of what’s possible. These innovations in mining technology and hardware, like the fabled Antminer S21, are reshaping the efficiency, power, and overall dynamics of mining operations, casting a profound impact on the hashrate and the broader mining ecosystem.

The Vanguard of Mining Technology: Spotlight on Antminer S21 and Beyond

The Antminer S21 stands as a paragon of the new age of mining technology. It’s not just a piece of hardware; it’s a symbol of the relentless pursuit of efficiency and power in the mining arena. This advanced ASIC miner, with its unparalleled hash rate and energy efficiency, represents a significant leap forward from its predecessors. It’s a harbinger of a future where mining operations are not just about brute force, but about the elegance of efficiency and the art of maximizing output while minimizing energy consumption.

But the story doesn’t end with the Antminer S21. The horizon of mining technology is ever-expanding, with innovations emerging at a breakneck pace. From liquid cooling systems to AI-driven optimization algorithms, the future of mining hardware is a tapestry of technology, woven with the threads of ingenuity and ambition.

The Symphony of Efficiency: How Technological Advancements Shape Mining Operations

The influence of technological advancements on the efficiency and power of mining operations is akin to a symphony, where each innovation plays its part in harmony. The introduction of more powerful and energy-efficient ASIC miners has transformed the mining process from a power-hungry endeavor to a more sustainable operation. This shift is not just about reducing electricity costs; it’s about optimizing every joule of energy, every hash, to extract maximum value.

These advancements have also democratized mining, allowing smaller players to compete with large mining farms. The efficiency gains mean that mining is no longer the sole domain of those with access to cheap power; it’s increasingly about who can deploy the most efficient technology in the most strategic manner.

ASIC Miners: The Titans of Hashrate and Their Impact on the Mining Landscape

ASIC miners, the titans of the mining world, have had a profound impact on the hashrate and the overall mining landscape. These specialized machines, designed exclusively for mining cryptocurrencies, have elevated the hashrate to new heights, contributing to the robustness and security of the Bitcoin network.

The role of ASIC miners extends beyond just providing computational power. They represent a shift in the mining paradigm, from a hobbyist activity to a professional, industrial-scale operation. This shift has led to a more concentrated mining landscape, with large mining farms and pools dominating the scene. However, it has also spurred innovation and competition, driving the development of more advanced, efficient, and accessible mining solutions.

In conclusion, the technological advancements in Bitcoin mining are not just a series of developments; they are a revolution that is reshaping the very fabric of the mining industry. From the Antminer S21 to the next generation of mining technologies, these innovations are setting the stage for a more efficient, powerful, and sustainable mining ecosystem. As we witness this transformation, we are not just observing the evolution of technology; we are watching the dawn of a new era in the annals of cryptocurrency mining.

Market Dynamics and Bitcoin Mining

In the intricate web of Bitcoin mining, market dynamics play a pivotal role, shaping the contours of profitability and operational strategies. This complex interplay of factors such as ASIC prices, transaction fees, and emerging trends like the surge in BRC-20 activity, creates a constantly evolving landscape. Each element not only influences individual miners but also leaves an indelible mark on the entire mining ecosystem.

Navigating the Economic Terrain: ASIC Prices and Transaction Fees

The Bitcoin mining market is a microcosm of economic forces, where ASIC prices and transaction fees are crucial indicators of the health and viability of mining operations. ASIC prices, influenced by factors like technological advancements, production costs, and market demand, dictate the entry barrier and ROI for miners. A surge in prices can deter new entrants, while a drop can trigger a gold rush, bringing more competition and diversity to the mining landscape.

Transaction fees, on the other hand, are a direct reflection of the network’s activity and congestion. As the Bitcoin network handles more transactions, miners reap the benefits of higher fees, adding a lucrative layer to their mining rewards. This dynamic creates a delicate balance – higher fees can signify more revenue, but they can also indicate network congestion, potentially impacting Bitcoin’s usability and appeal.

The Ripple Effect: Market Trends Influencing Hashrate and Profitability

Market trends in Bitcoin mining are like ripples on a pond, each affecting the hashrate and profitability in unique ways. The hashrate, a collective measure of mining power, is sensitive to market conditions. A bullish market can attract more miners, pushing the hashrate up, while a bearish trend might lead to a decline as less efficient miners capitulate.

Profitability, intertwined with the hashrate, is also subject to the whims of the market. Factors like the price of Bitcoin, operational costs, and the aforementioned ASIC prices and transaction fees, all converge to determine the profitability landscape. This ever-changing scenario requires miners to be agile, adapting their strategies to the market’s ebb and flow to stay afloat and thrive.

The BRC-20 Surge: Implications for the Mining Industry

The recent surge in BRC-20 activity, a phenomenon within the broader Bitcoin ecosystem, has significant implications for the mining industry. BRC-20 tokens, representing a diversification in blockchain applications, bring a new dimension to the Bitcoin network. This surge not only indicates a growing interest and investment in blockchain technology but also impacts miners directly.

Increased BRC-20 activity can lead to higher transaction volumes and, consequently, higher transaction fees, benefiting miners. However, it also poses challenges, such as increased network congestion and the need for more sophisticated mining strategies. This trend underscores the need for miners to stay attuned to the broader developments within the blockchain space, adapting their operations to leverage new opportunities and mitigate potential risks.

In conclusion, the market dynamics in Bitcoin mining are a complex tapestry of economic, technological, and social factors. Navigating this landscape requires a deep understanding of the interplay between various elements and an agile approach to adapt to the ever-changing conditions. As the mining industry continues to evolve, staying ahead of these dynamics is crucial for miners looking to carve out a profitable and sustainable path in the world of Bitcoin mining.

Bitcoin Mining News and Global Impact

In the ever-shifting landscape of Bitcoin mining, the confluence of industry news and global impact paints a picture of a sector at the forefront of technological and environmental discourse. This narrative is not just about the relentless pursuit of digital gold; it’s about understanding the broader implications of this pursuit on the global stage, where major players, regulatory shifts, and environmental concerns intersect.

The Current Chapter: Latest Developments in the Bitcoin Mining Sector

The Bitcoin mining sector is a tapestry of continuous evolution, marked by the activities of major players and the ever-changing regulatory environment. Recently, the industry has witnessed significant movements, including strategic expansions by leading mining companies and collaborations that are reshaping the mining landscape. These key players are not just mining entities; they are pioneers charting new territories in the realm of decentralized finance.

Regulatory changes are also a critical part of this narrative. Various countries and regions are reevaluating their stance on Bitcoin mining, balancing the economic opportunities it presents with regulatory and policy considerations. Some regions are embracing mining, recognizing its potential for economic growth, while others are imposing restrictions, citing concerns over energy consumption and environmental impact. This regulatory mosaic is a crucial factor shaping the future of Bitcoin mining, influencing where and how mining operations can thrive.

Beyond the Mines: The Global Impact of Bitcoin Mining

The global impact of Bitcoin mining extends far beyond the confines of mining farms and data centers. One of the most pressing issues is the sector’s energy consumption and its environmental footprint. As mining operations seek to harness more computational power, the question of sustainable energy sources comes to the fore. This challenge is not just about finding enough energy to power the mines; it’s about ensuring that this energy is sourced in a way that aligns with global environmental goals.

The environmental concerns surrounding Bitcoin mining have sparked a wave of innovation, with companies exploring renewable energy sources and more energy-efficient mining practices. This shift towards sustainability is more than a response to criticism; it’s a proactive move towards a more environmentally responsible future for Bitcoin mining. The industry’s journey towards sustainability is not just a technical challenge; it’s a moral imperative, reflecting the growing consciousness around the impact of our digital pursuits on the planet.

In conclusion, the narrative of Bitcoin mining is multifaceted, encompassing the latest industry developments and the broader global impact of these activities. As the sector continues to evolve, staying abreast of these changes and understanding their implications is crucial for anyone involved in or affected by Bitcoin mining. From the boardrooms of mining companies to the global forums discussing climate change, Bitcoin mining is a topic that commands attention and thoughtful discourse, reflecting its significant role in the digital and global ecosystem.

Conclusion

As we conclude our exploration of the dynamic world of Bitcoin mining, it’s essential to reflect on the journey we’ve undertaken and look ahead to the future of Bitcoin’s hashrate and its implications for the mining industry. Our journey revealed the unprecedented heights of Bitcoin’s hashrate, showcasing the network’s robustness and the relentless pursuit of miners. We delved into the symbiotic relationship between hashrate, mining difficulty, and profitability, and observed how technological advancements, particularly in ASIC mining hardware, are redefining efficiency and power in mining operations. The impact of market dynamics, including ASIC prices and transaction fees, and the surge in BRC-20 activity, add layers of complexity to this landscape, while global concerns about energy consumption and environmental sustainability underscore the industry’s responsibility and potential for innovation.

Looking forward, the hashrate of Bitcoin is poised for continued growth, driven by technological advancements and increasing global interest in cryptocurrency. This growth, however, brings challenges, necessitating a balance between mining difficulty, network security, and profitability. The mining industry must adapt to a more competitive landscape, where efficiency and innovation are crucial, and the quest for sustainable energy sources becomes increasingly important. This journey in Bitcoin mining is not an end but a continuous process of staying informed and engaged with the latest trends and developments. Whether as miners, investors, or observers, there is a rich tapestry of knowledge and opportunities in Bitcoin mining, inviting us all to remain vigilant and proactive in shaping a sustainable and prosperous future for the industry and the broader cryptocurrency ecosystem.