High ETF trading volume does not automatically translate to net inflows, often creating a deceptive sense of market strength for miners. You might see a $40 billion trading day and assume the market is flooded with new capital, yet your operation is still squeezed by rising bitcoin mining difficulty and stagnant spot prices. If you are planning equipment upgrades based solely on headline volume, you are likely miscalculating your ROI window. This guide identifies how to separate “churn” from “real liquidity” to help you time your next hardware procurement cycle effectively.

Does high ETF volume always mean a price rally?

High ETF volume often represents high-frequency turnover and arbitrage rather than a bullish price rally, which can mislead your assessment of bitcoin mining difficulty trends. While trading activity suggests interest, it does not guarantee the sustained price floor needed to offset operational costs.

Why does volume spike without price gain?

You must understand that market makers frequently swap positions to maintain liquidity without adding net new coins to the fund. This “churn” inflates volume figures while the actual price remains trapped in a range-bound struggle.

- Arbitrage between spot and futures markets.

- High-frequency algorithmic trading strategies.

- Intraday speculation from retail desk participants.

Think about this: volume is energy, but net inflow is the battery charge.

Can trading churn impact your ROI?

Churn creates volatility that doesn’t necessarily provide a safety net for your monthly electricity bills. You need net inflows to push prices higher and sustain the profitability of your latest hardware deployments.

- Inconsistent price support for high-opex miners.

- Increased slippage during liquidation of mined rewards.

- False signals for scaling up hashpower capacity.

Here is the kicker: high volume with zero net inflow is just noise.

Volume vs. Inflow Impact

| Metric | Miner Outcome |

|---|---|

| High Volume/Low Inflow | Price Stagnation / Volatility |

| Low Volume/High Inflow | Bullish Price Floor |

Key Takeaway: Focus on net inflow data to confirm if price will support rising network competition.

This data suggests that miners should prioritize inflow trends over daily trading headlines to secure long-term power contracts.

How do we distinguish turnover from net inflows?

You can distinguish turnover from net inflows by looking at the daily creation and redemption units, which directly influence bitcoin mining difficulty as price stability attracts more hashpower. Turnover is simply the hands changing, while inflows represent new “digital gold” being locked away in vaults.

What are creation and redemption units?

These units are the only metrics that tell you if institutional money is actually buying the underlying asset. When creation units rise, the ETF is buying BTC from the market, providing the “buy wall” you need.

- Creation units signal actual asset accumulation.

- Redemption units signal institutional capital exit.

- Net change indicates the true market direction.

Check the data: daily flows are public and more vital than volume.

How does this data affect your rig buy?

Buying miners during high turnover but negative net inflows is risky because the price support is fragile. You should wait for consistent net inflow streaks before committing to a massive hardware refresh.

- Avoid buying at the peak of “fake” volume spikes.

- Identify accumulation phases for better hardware pricing.

- Align deployment with long-term institutional support.

Bottom line: don’t let the noise dictate your capital expenditure.

Liquidity Analysis Table

| Signal | Action for Wholesalers |

|---|---|

| Net Creation | Scale Operations / Expand |

| Net Redemption | Hold Cash / Optimize Efficiency |

Key Takeaway: Net creation is the “green light” for industrial-scale hardware expansion.

Institutional accumulation provides the liquidity buffer required to sustain mining operations during network difficulty jumps.

Why does trading volume fail to lower difficulty?

Trading volume fails to lower bitcoin mining difficulty because hashrate is driven by capital investment in hardware, not the frequency of asset exchange on secondary markets. In fact, high trading activity often masks the competitive reality of the network.

Is the network independent of ETF volume?

Yes, the network only cares about how many machines are plugged in. While ETFs trade millions of shares per minute, the network difficulty only adjusts based on block discovery times.

- Hashrate follows long-term price expectations.

- Hardware cycles last 3-5 years, ignoring daily volume.

- ASIC efficiency dictates the network’s bottom line.

Remember: Wall Street trades paper; you mine protocol.

Does high volume hide mining risks?

High volume can create a “halo effect” where you feel the industry is booming while the network difficulty is actually pricing you out of the market. You need to keep your eyes on the mempool and hashrate, not just the NASDAQ.

- Ignore hype when calculating your break-even point.

- Focus on J/TH efficiency rather than trading charts.

- Monitor global power distribution and hashrate shifts.

Look closer: the difficulty chart is your real boss.

Market vs Network Metric

| Indicator | What it Measures |

|---|---|

| ETF Volume | Speculative Velocity |

| Hashrate | Network Security Investment |

Key Takeaway: Network security grows through hardware, regardless of how many times a share is traded.

Miners should treat ETF volume as a sentiment indicator rather than a structural mining metric.

Is market depth more important than daily volume?

Market depth is significantly more important than daily volume because it determines how much you can sell without crashing the price, directly impacting your ability to handle rising bitcoin mining difficulty. If the depth is shallow, even high volume won’t save your margins during a sell-off.

Why does depth matter for large farms?

When you are liquidating hundreds of BTC to cover electricity or pay off hardware loans, you need a deep order book. High volume with low depth leads to massive slippage, eating into your profits.

- Depth ensures price stability during large sales.

- Reduces the impact of “whale” movements.

- Protects against flash crashes during high difficulty.

Simply put: depth is the thickness of the ice you are skating on.

Can ETFs improve market depth?

Institutional involvement generally deepens the market, providing a more stable exit for miners. However, you must verify that the volume is building depth and not just creating superficial “wash trading” signals.

- Institutions bring professional market-making.

- Bid-ask spreads narrow with true liquidity.

- Stabilizes the floor price for hardware financing.

Consider this: a deep market is a miner’s best friend.

Depth vs Volume Correlation

| Condition | Miner Risk Level |

|---|---|

| Thin Depth / High Volume | Extreme Risk (Flash Crashes) |

| Deep Depth / High Volume | Low Risk (Healthy Market) |

Key Takeaway: Monitor 2% market depth metrics to ensure your liquidation won’t damage your own ROI.

Stable market depth allows for predictable revenue forecasting even when network competition intensifies.

How do miners hedge against high-frequency volatility?

You can hedge against high-frequency volatility by utilizing derivative products and fixing your electricity costs, ensuring your operation survives fluctuations in bitcoin mining difficulty. Hedging provides the “insurance” needed to stay operational when the ETF-driven market becomes irrational.

What are the best hedging tools?

Miners typically use futures contracts or hashpower derivatives to lock in a price for their future production. This strategy removes the stress of watching the 1-minute ETF charts every morning.

- Futures contracts for price locking.

- Put options to protect against floor drops.

- Hashrate swaps to hedge against difficulty spikes.

Don’t gamble: professional mining is about managing risk, not catching pumps.

Why is fixed-rate power a hedge?

Your biggest variable expense is electricity. By locking in a multi-year rate, you stabilize your J/TH cost, making the ETF volume irrelevant to your immediate survival.

- Predictable OPEX regardless of market swings.

- Stronger balance sheet for loan applications.

- Competitive advantage over miners on floating rates.

Watch out: floating rates will kill your margins in a bear market.

Hedging Efficiency Comparison

| Strategy | Protection Focus |

|---|---|

| Price Hedging | Market Crash Mitigation |

| Power Contracts | Operational Cost Stability |

Key Takeaway: Combining price hedging with fixed power creates a “fortress” mining business model.

Strategic hedging separates institutional miners from hobbyists who are wiped out by short-term volatility.

What role do institutional inflows play in ROI?

Institutional inflows directly shorten your ROI timeline by establishing a robust price floor, which allows you to weather the relentless climb of bitcoin mining difficulty without shutting down rigs. When new money enters the system permanently, the “lower bound” of bitcoin’s price typically shifts upward.

Does institutional money reduce risk?

Yes, because institutions have a longer time horizon than retail traders. Their “sticky” capital reduces the likelihood of the 80% drawdowns that previously devastated the mining sector.

- Lower volatility leads to better financing terms.

- Institutional adoption increases network legitimacy.

- Reduces the frequency of forced miner liquidations.

Think long: institutions buy for years, not for minutes.

How do you calculate ROI with inflows?

You should adjust your conservative price models upward if net inflows remain positive for consecutive quarters. This allows for more aggressive equipment purchasing and facility expansion.

- Calculate ROI based on sustained inflow averages.

- Account for reduced volatility in your risk premium.

- Evaluate ASIC procurement timing against inflow cycles.

The trend is your friend: follow the net flow, not the daily candle.

ROI Cycle Analysis

| Inflow Trend | Typical ROI Timeline |

|---|---|

| Consistent Net Inflow | 8 – 14 Months |

| Net Outflow / Neutral | 18 – 24+ Months |

Key Takeaway: Sustained institutional inflows can accelerate hardware payback by up to 40%.

Institutional support is the most reliable leading indicator for profitable large-scale mining expansion.

Can high turnover hide a bearish trend for miners?

High turnover can absolutely hide a bearish trend because it creates an illusion of demand while investors are quietly exiting through redemptions, a dangerous signal during rising bitcoin mining difficulty. You might see billions in volume while the actual coin count in the ETF vaults is shrinking.

What is “exhaustion” volume?

Exhaustion occurs when volume spikes at the end of a price move. It often signals that the “buying power” is spent, and a trend reversal is imminent—bad news if you just bought new miners.

- Massive volume with little price movement.

- High retail participation at local peaks.

- Signs of professional distribution to retail.

Stay sharp: if volume is high but the price is flat, watch out.

How to avoid the “volume trap”?

Always verify volume with on-chain data. If miners are sending coins to exchanges while ETF volume is high, it likely means the smart money is exiting, regardless of what the CNBC tickers say.

- Monitor miner-to-exchange flow metrics.

- Cross-reference volume with the “HODL wave” chart.

- Look for divergence between volume and momentum.

Trust the chain: the ledger doesn’t lie, even if the ETF does.

Trend Divergence Table

| Metric Setup | Likely Market Phase |

|---|---|

| High Vol + Redemptions | Bearish Distribution |

| Low Vol + Creations | Bullish Accumulation |

Key Takeaway: Never buy infrastructure based on volume alone; verify with net creation data.

Identifying bearish divergence early allows you to pause hardware orders and preserve capital for cheaper entry points.

Do spot ETFs reduce the impact of local power costs?

Spot ETFs do not directly reduce your local power costs, but they provide the liquidity needed to pay those bills regardless of bitcoin mining difficulty spikes. While they don’t change your utility rate, they change your ability to convert digital assets into cash to cover those rates.

Why does energy remain the primary factor?

No amount of institutional trading can fix a bad energy contract. If your cost per kilowatt-hour is too high, even a $100k Bitcoin price might not save you from more efficient competitors.

- Energy efficiency (J/TH) is the ultimate survival metric.

- ETF liquidity only helps you exit, not operate.

- Local power regulations trump global ETF trends.

The truth is: electricity is the real currency of mining.

How does liquidity help with power bills?

Efficient ETFs mean less “miner discount” when you sell. You get closer to the spot price, which means more USD in your pocket to pay the utility company every month.

- Narrower spreads mean more revenue per BTC sold.

- Faster settlement times for operational cash flow.

- Access to more diverse OTC desks and liquidity pools.

Do the math: a 1% saving on slippage is a 1% gain on energy.

Cost vs Liquidity Table

| Variable | Impact on Net Profit |

|---|---|

| Local Electricity Rate | Critical / Foundational |

| ETF Trading Liquidity | Supporting / Secondary |

Key Takeaway: Use ETF-driven liquidity to maximize your cash-out, but stay focused on lowering power costs.

Optimization of energy sourcing remains the number one priority for industrial mining competitiveness.

When should you expand capacity despite low inflows?

You should expand capacity despite low inflows when hardware prices drop significantly, creating a contrarian opportunity before the next bitcoin mining difficulty adjustment. Expansion is often most profitable when the market is quiet and hardware is selling at “fire sale” prices.

Is “boring” volume a buy signal?

In a stagnant market, rig manufacturers often offer deep discounts to move inventory. This is your chance to lower your average cost per terahash, preparing you for the next surge in institutional inflows.

- Rig prices usually track BTC price, not volume.

- Low volatility periods are perfect for infrastructure work.

- Securing future rack space while others are scared.

Fortune favors the prepared: build in the bear, harvest in the bull.

What are the risks of quiet expansion?

The main risk is that “low inflows” turn into “mass outflows,” leading to a sustained price drop. You must ensure you have enough cash reserves to survive at least 12 months of low revenue.

- Potential for further hardware price drops.

- Increased difficulty while your new rigs are shipping.

- Prolonged payback period if the market stays flat.

Know your limit: expansion requires a bulletproof balance sheet.

Expansion Timing Matrix

| Scenario | Action |

|---|---|

| Low Price / Low Vol | Aggressive Hardware Buy |

| High Price / High Vol | Halt Procurement / Optimize |

Key Takeaway: Strategic expansion occurs when sentiment is low, provided you have efficient energy access.

Contrarian procurement strategies often lead to the highest ROI when the network inevitably recovers.

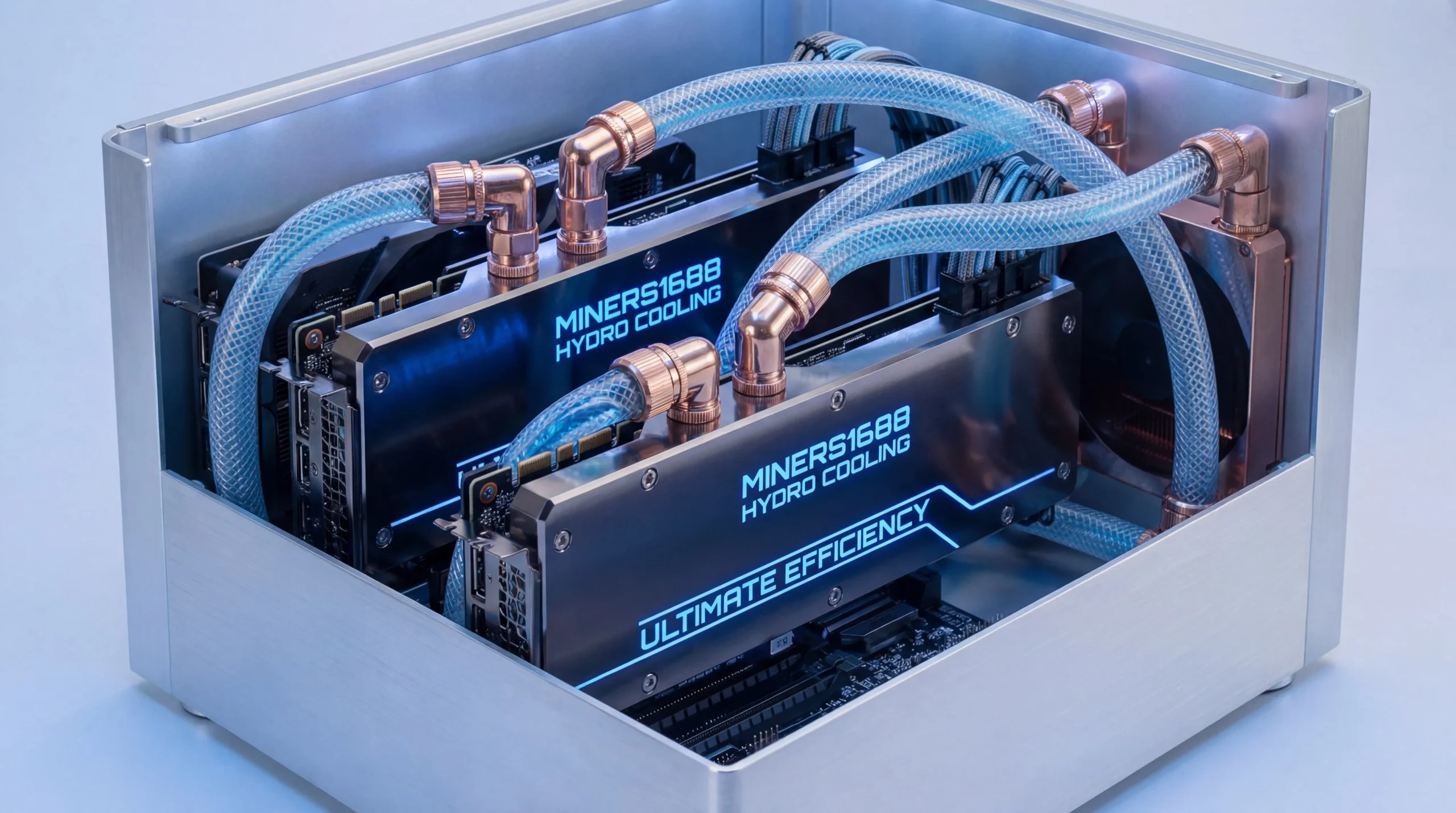

How does hydro cooling offset network competition?

Hydro cooling offsets network competition by allowing you to overclock your machines for higher hashrate while maintaining energy efficiency, a vital tactic as bitcoin mining difficulty continues to break records. It is the technological “edge” that keeps you profitable when others are forced to unplug.

Is hydro cooling worth the Capex?

While the initial investment is higher, the reduction in fan noise, dust, and heat-related failures leads to a much higher uptime. In mining, 99.9% uptime is the difference between profit and loss.

- Significant reduction in hardware failure rates.

- Ability to overclock safely for 20-30% more hash.

- Reuse of waste heat for secondary heating.

Think ahead: hydro is no longer a luxury, it’s a standard for scale.

How does it combat rising difficulty?

By squeezing more terahashes out of every watt of electricity, you stay below the network’s average cost of production. This ensures your rigs stay “on” longer than traditional air-cooled setups.

- Lower operational temperature extends chip life.

- Increased density allows for more rigs per square foot.

- Higher resale value for premium hydro-cooled units.

Stay cool: heat is the enemy of your mining margin.

Cooling Tech Comparison

| Method | Efficiency Rating |

|---|---|

| Standard Air | Baseline / Moderate Risk |

| Hydro / Immersion | Superior / Future-Proof |

Key Takeaway: Hydro cooling is the preferred solution for large-scale operations looking to outlast the difficulty curve.

Technological superiority is the only way to remain competitive as institutional capital drives up the global hashrate.

Frequently Asked Questions

Can I trust the $40B trading volume figures?

Not entirely. While accurate as a measure of activity, much of it is high-frequency trading that doesn’t result in net buying of Bitcoin.

What is the best way to track real ETF demand?

Monitor “Net Inflows/Outflows” daily. This metric shows the actual change in Bitcoin held by the funds, which is the only number that impacts spot supply.

How do I know if difficulty will rise soon?

Check the Hashrate moving average. If it consistently climbs while price is stable, a difficulty increase is inevitable as new rigs come online.

Can small miners benefit from ETF liquidity?

Yes, indirectly. Higher market depth means you can sell your daily rewards with less slippage, helping you keep more of your hard-earned profit.

What’s the best machine for high-difficulty environments?

Look for rigs with an efficiency of less than 20 J/TH. Machines like the latest Bitmain or Whatsminer models are designed to survive where others fail.

Data Sources & References:

- CoinWarz: Bitcoin Difficulty & Hashrate Analytics

- CoinDesk: ETF Volume and Structural Analysis

- Glassnode: Institutional Flow and On-chain Liquidity Reports