Summary: Riot Platforms’ Q3 2025 results reveal how demand response programs and curtailment credits have become essential profit buffers for Bitcoin miners. This analysis examines the ERCOT model and its implications for operational strategy in 2025’s dynamic market environment.

Understanding the Demand Response Paradigm in Bitcoin Mining

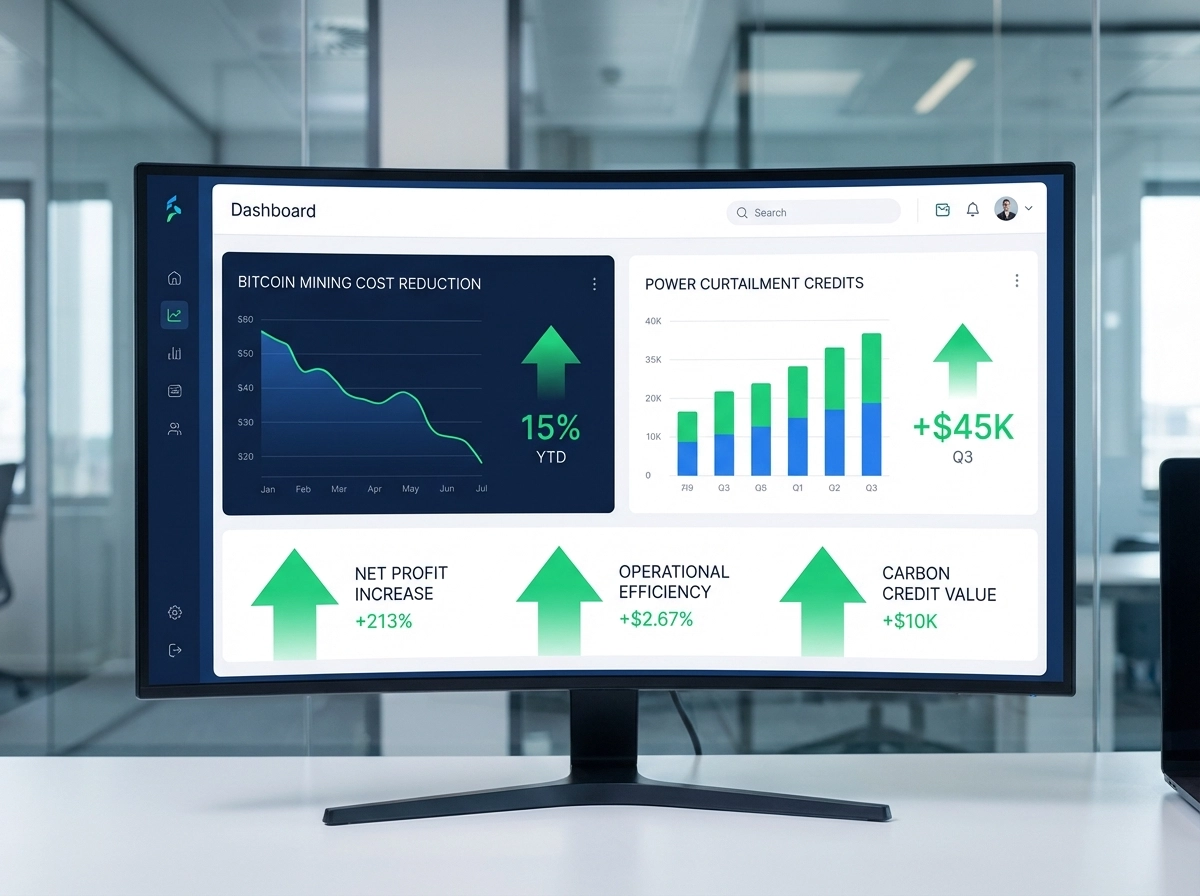

The Bitcoin mining industry has entered a new operational era where success depends not just on hash rate efficiency, but on sophisticated energy management strategies. Riot Platforms’ third quarter 2025 financial results demonstrate this evolution dramatically, with the company reporting record quarterly revenue of $180.2 million and net income of $104.5 million, despite a 52% increase in global network hash rate.

The key differentiator? Strategic participation in demand response programs that generated $30.6 million in power curtailment credits during Q3 2025, representing a 147% increase compared to the same period in 2024. This strategic approach allowed Riot to maintain an all-in power cost that remained competitive even during periods of elevated electricity prices.

For miners operating in competitive markets like Texas, demand response participation has shifted from optional revenue enhancement to essential margin protection. The ERCOT grid, which serves most of Texas, offers multiple programs that allow large electricity consumers to reduce load during peak demand periods in exchange for substantial financial compensation.

ERCOT Demand Response Programs Explained

The Electric Reliability Council of Texas (ERCOT) operates several demand response mechanisms that have proven particularly valuable for Bitcoin mining operations. These programs include the Emergency Response Service (ERS), the Load Resource program, and various ancillary service markets that compensate participants for providing grid flexibility.

During Q3 2025, Riot’s strategic curtailment activities generated significant revenue streams beyond Bitcoin production. The company earned $30.6 million in power curtailment credits and an additional $0.7 million from formal demand response program participation. These credits directly offset operational expenses, effectively reducing the net cost of electricity consumed during mining operations.

Understanding the economics requires examining how these programs function. When ERCOT forecasts high demand or supply constraints, wholesale electricity prices can spike dramatically—sometimes exceeding $5,000 per megawatt-hour compared to typical rates of $20-40 per MWh. During these events, miners who curtail operations avoid purchasing electricity at these extreme prices while simultaneously earning compensation for reducing grid load.

The financial impact extends beyond avoided costs. By participating in these programs, miners effectively transform their facilities into flexible grid resources, creating multiple revenue streams: Bitcoin production during normal operations, avoided high-cost electricity purchases during curtailment periods, and direct payments for providing demand response services.

Breaking Down All-In Power Costs and Margin Protection

The concept of “all-in power cost” has become the critical metric for evaluating mining profitability in 2025. Riot’s September 2025 data shows an all-in power cost of 4.2¢/kWh, calculated after netting curtailment credits and demand response revenues against gross electricity expenses. This represents a significant advantage over miners paying market rates without access to curtailment programs.

To understand the magnitude of this benefit, consider Riot’s Q3 2025 cost structure. The company reported cost of power for self-mining operations of $82.4 million before curtailment credits. After applying $30.6 million in power curtailment credits, the net power cost fell to approximately $51.8 million. This 37% reduction in net power expenses directly improved unit economics and protected margins during a period of increasing network difficulty.

Riot Platforms Q3 2025 Mining Economics

| Metric | Q3 2025 | Q3 2024 | Change |

|---|---|---|---|

| Bitcoin Produced | 1,406 BTC | 1,104 BTC | +27.4% |

| Cost to Mine (excl. depreciation) | $46,324 | $35,376 | +30.9% |

| Power Curtailment Credits | $30.6M | $12.4M | +147% |

| All-In Power Cost | 3.1¢/kWh* | 3.0¢/kWh* | +3.3% |

| Average Operating Hash Rate | 32.2 EH/s | 19.5 EH/s | +65.1% |

*Estimated quarterly average including curtailment credit benefits

The table illustrates a crucial point: despite rising base mining costs driven by network difficulty increases, strategic curtailment participation kept all-in power costs relatively stable. This stability becomes even more valuable during periods of Bitcoin price volatility, providing a buffer that helps miners weather market fluctuations without compromising operational viability.

For operations outside Texas or other markets with mature demand response programs, these results highlight the strategic importance of site selection and power contract structuring. Access to flexible, interruptible power agreements—even without formal demand response programs—can provide similar economic benefits through avoided demand charges and off-peak rate optimization.

Hardware Efficiency and Operational Optimization Strategies

While demand response strategies provide crucial margin protection, hardware efficiency remains the foundation of sustainable mining operations. Riot’s Q3 2025 fleet efficiency of 20.5 J/TH represented a 12% improvement year-over-year, achieved through systematic deployment of next-generation mining equipment and retirement of older, less efficient units.

The relationship between hardware efficiency and curtailment strategy deserves special attention. More efficient miners generate higher revenue per kilowatt-hour consumed, which means each hour of operation during high-price periods produces greater economic value. Conversely, during curtailment events, efficient fleets minimize the opportunity cost of shutdown since they would have generated slightly less relative profit compared to less efficient operations.

Mining operations planning equipment upgrades in 2025 should prioritize models offering power efficiency below 20 J/TH. The latest generation Bitmain Antminer S21 Pro, for example, delivers approximately 15 J/TH efficiency, representing a 27% improvement over the S19 XP models that dominated 2023-2024 deployments. For a 100 MW facility running at $0.06/kWh, this efficiency gain translates to approximately $1.4 million in annual electricity savings.

Equipment selection must also consider curtailment flexibility. Modern ASIC miners can be powered down and restarted without significant warm-up periods or mechanical stress, making them ideal for demand response participation. However, facility infrastructure—cooling systems, networking equipment, and monitoring tools—must also support rapid shutdown and restart cycles without creating operational risks or equipment damage.

Implementing a Profitable Curtailment Strategy

Developing an effective curtailment strategy requires systematic analysis of several key factors: local electricity market structure, historical price patterns, Bitcoin production economics, and operational capabilities. Miners operating in ERCOT markets can leverage historical data showing that summer afternoon periods (2pm-7pm) and winter morning peaks (6am-9am) typically generate the highest curtailment values.

The decision framework for curtailment involves real-time economic calculation. At any given moment, miners must compare the expected Bitcoin revenue from continued operations against the combined value of avoided electricity costs plus curtailment credits. When Bitcoin trades at $100,000 and a modern mining fleet generates approximately $0.05 per kWh in gross revenue, curtailment becomes economically attractive when electricity prices exceed $50-60 per MWh if curtailment credits add another $20-30 per MWh in value.

Curtailment Economic Decision Model

| Scenario | BTC Price | Electricity Price | Curtailment Credit | Optimal Action | Economic Gain |

|---|---|---|---|---|---|

| Normal Operations | $100,000 | $30/MWh | N/A | Mine | $20/MWh net |

| Moderate Peak | $100,000 | $150/MWh | $40/MWh | Curtail | $70/MWh net |

| Extreme Event | $100,000 | $2,000/MWh | $200/MWh | Curtail | $2,150/MWh net |

| High BTC Price | $150,000 | $80/MWh | $30/MWh | Mine | $45/MWh net |

| Low BTC Price | $70,000 | $100/MWh | $35/MWh | Curtail | $100/MWh net |

This decision framework must be automated through sophisticated energy management systems that monitor real-time electricity prices, Bitcoin market values, and curtailment opportunities. Leading operations deploy software that executes curtailment decisions within seconds, maximizing the economic value of each operational hour.

Implementation also requires careful attention to mining hardware selection that supports rapid response cycles. Not all ASIC models handle frequent power cycling equally well, and facility designs must accommodate the thermal and electrical dynamics of regular shutdown and restart sequences.

Future Outlook and Strategic Considerations for Miners

The demand response model pioneered in Texas is expanding to other mining jurisdictions worldwide. As renewable energy integration increases globally, grid operators face growing challenges balancing supply and demand, creating opportunities for flexible loads like Bitcoin mining to provide valuable services while improving their own economics.

Several emerging trends will shape curtailment strategies through 2026 and beyond. First, the growing penetration of solar and wind energy creates predictable daily and seasonal patterns in electricity prices. Sophisticated miners will increasingly time operations to coincide with renewable energy abundance, curtailing during both peak demand periods and renewable generation lulls when backup generators drive prices higher.

Second, regulatory frameworks are evolving to facilitate demand response participation. Multiple U.S. states are developing programs similar to ERCOT’s model, while European and Asian markets are exploring analogous mechanisms. Miners evaluating site selection should prioritize jurisdictions with mature or developing demand response frameworks that allow monetization of operational flexibility.

Third, the integration of energy storage technologies—particularly battery systems—will enable more sophisticated arbitrage strategies. A mining facility paired with battery storage can capture extremely high curtailment values during brief price spikes while maintaining some operational continuity, optimizing both Bitcoin production and demand response revenue.

For individual mining operations and smaller-scale miners, the key strategic question is location and scale. While massive facilities like Riot’s Texas operations can access the most lucrative demand response programs, smaller operations can still benefit through aggregation services, interruptible rate programs offered by utilities, or strategic curtailment during self-identified high-cost periods.

The broader message from Riot’s Q3 2025 results is clear: successful Bitcoin mining in 2025 and beyond requires thinking beyond simple hash rate deployment. The most profitable operations will be those that view their facilities as flexible energy resources capable of generating value through multiple channels—Bitcoin production during favorable conditions and grid services during periods when curtailment delivers superior economics.

Frequently Asked Questions

Q: What are power curtailment credits in Bitcoin mining?

Power curtailment credits are financial compensation miners receive for voluntarily reducing electricity consumption during peak demand periods. Grid operators pay these credits to incentivize load reduction, helping balance supply and demand without resorting to emergency measures or blackouts.

Q: How much can demand response programs improve mining profitability?

Based on Riot’s Q3 2025 results, curtailment credits reduced net power costs by approximately 37%, translating to roughly $10,900 in savings per Bitcoin mined. The exact benefit varies by location, program structure, and operational flexibility.

Q: Can small-scale miners participate in demand response programs?

While large-scale operations access the most lucrative programs, smaller miners can benefit through aggregation services, utility interruptible rate programs, or simply curtailing operations during self-identified high-cost periods. Many utilities offer demand response programs for loads as small as 100 kW.

Q: Does frequent curtailment damage mining equipment?

Modern ASIC miners are designed to handle power cycling without significant degradation. However, proper shutdown and startup procedures must be followed, and supporting infrastructure (cooling systems, networking equipment) must be designed to support frequent cycling without operational risks.

Q: Which Bitcoin mining hardware is most efficient in 2025?

The Bitmain Antminer S21 Pro currently leads with approximately 15 J/TH efficiency. For operations prioritizing curtailment strategies, models offering quick startup capabilities and reliable performance after power cycling should be prioritized alongside pure efficiency metrics.

Q: Are demand response strategies only viable in Texas?

While Texas’s ERCOT market offers particularly mature demand response programs, similar opportunities exist in many electricity markets worldwide. Grid operators globally are developing programs to incentivize flexible loads as renewable energy integration increases and grid balancing becomes more challenging.

Q: How do I calculate if curtailment makes economic sense for my operation?

Compare the Bitcoin revenue you would generate per kWh (based on your efficiency, BTC price, and network difficulty) against the combined value of avoided electricity costs plus any curtailment payments. Curtailment is economically favorable when the latter exceeds the former, typically occurring when electricity prices spike significantly above your base power rate.