Summary: Marathon Digital’s entry into Kaspa mining signals a paradigm shift in cryptocurrency mining strategy. As miners explore diversification beyond Bitcoin, multi-chain PoW mining presents compelling opportunities alongside significant risks. This comprehensive guide examines Kaspa mining profitability, hardware selection, and strategic considerations for building a resilient multi-asset mining portfolio in today’s dynamic market.

Marathon Digital’s Strategic Move into Kaspa Mining

Marathon Digital Holdings, one of the largest publicly traded Bitcoin mining companies, made headlines in June 2024 by announcing its first venture beyond Bitcoin — mining Kaspa (KAS). This strategic diversification marks a significant milestone, with Marathon having mined 93 million KAS tokens valued at approximately $15 million as of June 2024.

The decision validates Kaspa’s growing relevance in the mining ecosystem. Kaspa utilizes the kHeavyHash algorithm and operates on a proof-of-work consensus mechanism, making it attractive for miners seeking to leverage existing ASIC infrastructure while reducing dependency on Bitcoin’s increasingly competitive landscape.

Why Institutional Miners Choose Kaspa

Marathon’s move wasn’t arbitrary — it reflects calculated risk management. Kaspa offers several advantages: faster block times (approximately 1 block per second), a deflationary tokenomics model, and growing exchange support. For miners operating at Marathon’s scale, diversification provides insurance against Bitcoin’s volatility and network difficulty fluctuations.

The institutional validation has sparked renewed interest among retail and mid-sized mining operations. However, as Kaspa’s network hashrate climbs, profitability dynamics shift rapidly, making hardware selection and timing crucial factors for success.

Understanding Kaspa: Technology and Mining Fundamentals

Kaspa emerged as a next-generation PoW blockchain designed to address scalability limitations inherent in Bitcoin’s architecture. The protocol implements a blockDAG (Directed Acyclic Graph) structure called GHOSTDAG, enabling parallel block creation without compromising security.

Technical Advantages of Kaspa

Unlike Bitcoin’s single-chain architecture producing blocks every 10 minutes, Kaspa generates multiple blocks per second. This innovation dramatically increases transaction throughput while maintaining decentralization. The kHeavyHash mining algorithm was specifically engineered for ASIC efficiency, creating an optimal environment for dedicated mining hardware.

Key technical specifications include:

- Block Time: ~1 second

- Algorithm: kHeavyHash (ASIC-optimized)

- Consensus: Proof-of-Work via GHOSTDAG

- Maximum Supply: Deflationary schedule with emission reduction

- Network Security: Growing hashrate currently exceeding 1.5 EH/s

Mining Profitability Considerations

Current market conditions present a complex profitability landscape for Kaspa miners. According to multiple industry sources, Kaspa mining profitability has declined from its peak in early 2024, with daily earnings ranging from $8-25 per terahash depending on electricity costs and hardware efficiency.

Miners with access to electricity rates below $0.06/kWh can still achieve positive returns, particularly with latest-generation ASICs. However, the network’s rapid hashrate growth — driven partly by Marathon’s institutional entry — has compressed margins significantly throughout 2025.

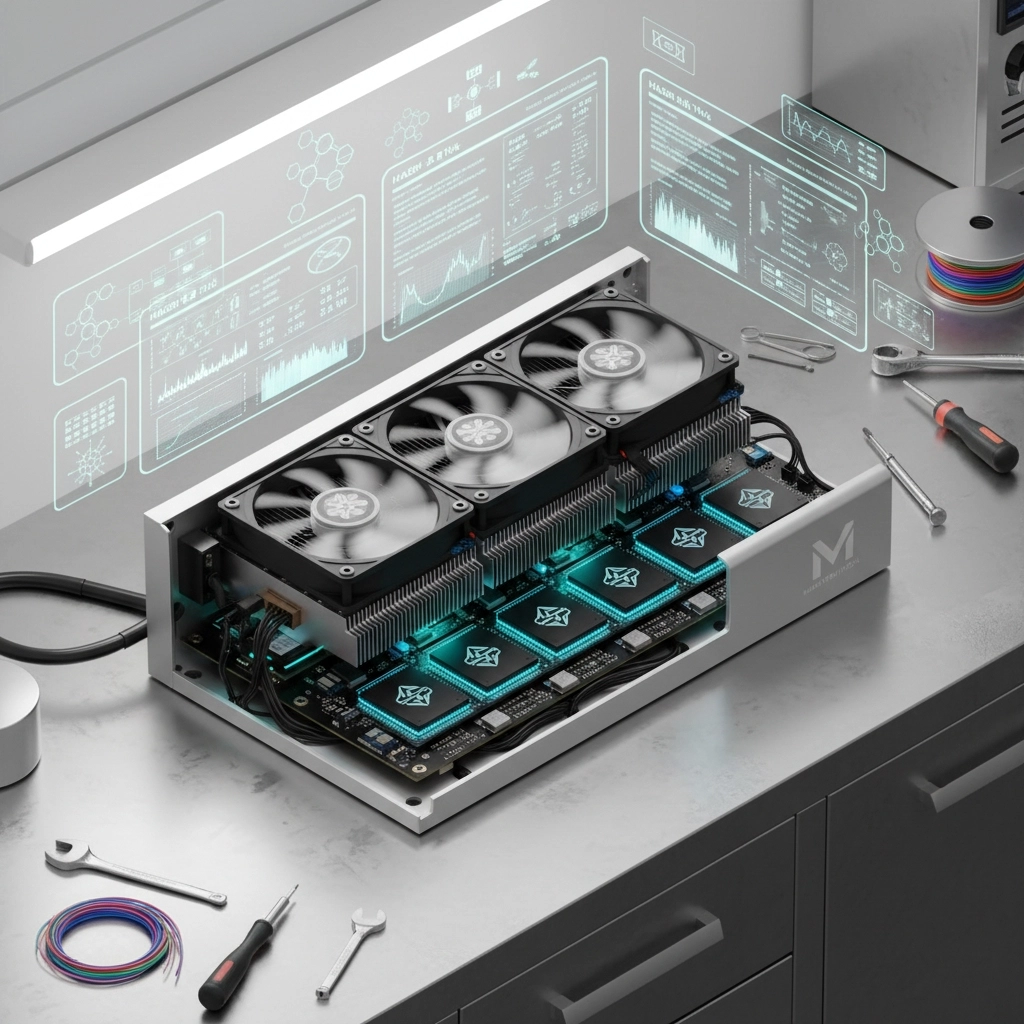

Top Kaspa Mining Hardware in 2025

Selecting appropriate hardware determines long-term mining viability. The Kaspa ASIC market has matured significantly, with major manufacturers releasing progressively more efficient models.

Current Generation Leaders

Bitmain Antminer KS7 leads the pack with 23 TH/s hashrate and approximately 3,300W power consumption, representing the cutting edge of Kaspa mining technology. Released in late 2024, the KS7 delivers superior efficiency compared to predecessors, making it suitable for competitive mining environments.

Bitmain Antminer KS5 Pro offers a balanced approach with 21 TH/s at 3,150W (150 J/TH efficiency). This model has become popular among mid-sized operations seeking optimal price-to-performance ratios. At current KAS prices, the KS5 Pro generates approximately $15-22 daily revenue before electricity costs.

IceRiver KS7 Series provides competitive alternatives to Bitmain’s dominance. The IceRiver KS7 matches similar specifications to Bitmain’s offerings while potentially offering better availability and customer support in certain markets.

Hardware Comparison: Kaspa ASIC Miners

| Model | Hashrate | Power Consumption | Efficiency (J/TH) | Est. Daily Revenue* |

|---|---|---|---|---|

| Bitmain Antminer KS7 | 23 TH/s | 3,300W | 143 | $18-25 |

| Bitmain Antminer KS5 Pro | 21 TH/s | 3,150W | 150 | $15-22 |

| IceRiver KS7 | 22 TH/s | 3,200W | 145 | $16-23 |

| Bitmain Antminer KS5 | 20 TH/s | 3,000W | 150 | $14-20 |

| IceRiver KS3 | 8 TH/s | 3,200W | 400 | $5-10 |

*Based on $0.06/kWh electricity and current network conditions (November 2025)

Avoiding Obsolete Equipment

Earlier generation miners like the original Antminer KS3 (9.4 TH/s at 3,500W) have become marginally profitable or unprofitable in most markets. These models’ poor efficiency ratios (370+ J/TH) make them unsuitable unless electricity is nearly free. Miners considering equipment purchases should focus exclusively on KS5 generation or newer models to ensure reasonable return timelines.

Multi-Chain PoW Mining Strategy: Beyond Single-Asset Focus

The concept of multi-chain PoW mining extends beyond simple diversification — it represents a fundamental approach to risk management and revenue optimization. Rather than committing exclusively to Bitcoin or any single cryptocurrency, strategic miners allocate computational resources across multiple protocols.

Strategic Advantages of Diversification

Revenue Stability: Different cryptocurrencies experience varying market cycles. While Bitcoin may face bear market conditions, alternative PoW coins like Kaspa, Litecoin, or Ethereum Classic might maintain stronger relative performance. Multi-chain strategies enable miners to capture opportunities across market segments.

Hardware Utilization: Modern mining operations can deploy algorithm-specific ASICs for maximum efficiency. A diversified facility might operate SHA-256 miners for Bitcoin, Scrypt ASICs for Litecoin and Dogecoin, and kHeavyHash hardware for Kaspa — ensuring optimal hardware utilization regardless of individual coin performance.

Network Opportunity Capture: Emerging PoW blockchains occasionally present arbitrage opportunities where mining profitability temporarily exceeds established networks. Flexible operations can quickly pivot resources to capitalize on these windows before market equilibrium reestablishes.

Risk Mitigation Through Asset Allocation

Professional mining operations increasingly adopt portfolio approaches similar to traditional investment strategies. A typical allocation might dedicate 60-70% of hashpower to Bitcoin (stable, liquid, widely accepted), 20-30% to established alternatives like Litecoin or Kaspa, and 10% to emerging opportunities for speculative upside.

This structure provides downside protection when individual assets underperform while maintaining exposure to potential outperformers. The strategy particularly benefits miners with access to competitive electricity rates who can maintain profitability across various network difficulty levels.

The Pitfalls: Challenges in Multi-Chain Mining

While multi-chain strategies offer compelling advantages, significant challenges complicate execution. Understanding these pitfalls separates successful operations from failed ventures.

Hardware Fragmentation and Capital Requirements

Unlike single-asset mining, multi-chain operations require diverse equipment. Bitcoin miners cannot efficiently mine Kaspa; Scrypt ASICs cannot process kHeavyHash algorithms. This necessitates substantially higher capital investment to build diversified infrastructure.

For example, establishing a meaningful multi-chain operation might require:

- 50 Bitmain S21 Pro units for Bitcoin ($400,000+)

- 20 Antminer L9 units for Litecoin/Dogecoin ($100,000+)

- 15 Antminer KS5 Pro units for Kaspa ($180,000+)

Total capital requirement: $680,000+ before facility costs, infrastructure, and operational reserves.

Operational Complexity

Managing multiple mining algorithms introduces significant operational challenges:

Technical Expertise: Each blockchain requires specific configuration knowledge, pool selection, and optimization strategies. Teams must maintain expertise across various protocols simultaneously.

Monitoring and Maintenance: Different ASICs have varying failure rates, maintenance schedules, and firmware update requirements. Operations managing multiple hardware types face exponentially greater maintenance burdens.

Liquidity Management: Converting multiple cryptocurrencies into fiat or stablecoins for operational expenses requires sophisticated treasury management. Exchange relationships, conversion timing, and tax implications multiply across assets.

Market Risk Concentration

Counter-intuitively, multi-chain mining doesn’t eliminate market risk — it transforms it. Most PoW cryptocurrencies maintain strong correlation with Bitcoin during major market movements. A systemic crypto bear market impacts Bitcoin, Kaspa, Litecoin, and other PoW coins simultaneously, potentially rendering entire operations unprofitable regardless of diversification.

Comparative Risk Analysis: Mining Strategies

| Risk Factor | Single-Asset Mining | Multi-Chain Mining | Mitigation Strategy |

|---|---|---|---|

| Market Volatility | High (single exposure) | Moderate (diversified) | Position sizing, hedging |

| Hardware Obsolescence | Moderate (focused risk) | High (multiple assets) | Staggered upgrades, resale planning |

| Operational Complexity | Low | High | Automation, standardized processes |

| Capital Requirements | Lower | Higher | Phased deployment |

| Liquidity Risk | Moderate | Moderate-High | Multi-exchange relationships |

Price Outlook and Mining Viability Assessment

Understanding cryptocurrency price trajectories helps miners make informed capital allocation decisions. Kaspa’s price performance directly impacts mining profitability and equipment ROI timelines.

Current Market Position

As of November 2025, Kaspa trades near $0.0377, representing approximately 5% daily price volatility. The asset has experienced significant price discovery throughout 2024-2025, with peaks above $0.15 and corrections below $0.03 demonstrating the market’s speculative nature.

Various analysts project conflicting scenarios for 2025-2026:

- Conservative estimates: $0.07-0.10 range

- Moderate projections: $0.15-0.25 potential

- Optimistic scenarios: $0.60-1.00 targets

Mining Profitability Scenarios

These price variations dramatically affect mining economics. Consider a Bitmain KS5 Pro (21 TH/s, 3,150W) operating at $0.06/kWh electricity:

Bear Case ($0.035 KAS): Daily revenue ~$12, electricity cost $4.54, net profit $7.46/day (ROI: 500+ days)

Base Case ($0.075 KAS): Daily revenue ~$25, electricity cost $4.54, net profit $20.46/day (ROI: 180-220 days)

Bull Case ($0.15 KAS): Daily revenue ~$50, electricity cost $4.54, net profit $45.46/day (ROI: 80-100 days)

These calculations exclude facility costs, maintenance, and downtime, but illustrate how price sensitivity determines mining viability.

Market Conditions: Navigating Uncertainty

The current cryptocurrency market exhibits characteristics neither definitively bullish nor bearish — better described as “volatile equilibrium.” Miners should exercise caution with absolute market timing predictions. Instead of betting on “bull market” continuation or “bear market” arrival, successful operations focus on:

- Operational efficiency that maintains profitability across price ranges

- Conservative financial planning assuming moderate price scenarios

- Flexible capital deployment allowing quick strategic adjustments

Building a Resilient Multi-Chain Mining Operation

Success in multi-chain mining requires systematic planning and disciplined execution. These principles guide sustainable operations capable of weathering market volatility.

Site Selection and Infrastructure

Electricity cost dominates mining economics. Competitive operations require rates below $0.08/kWh, with optimal performance at $0.04-0.06/kWh. Geographic locations offering industrial electricity rates, renewable energy incentives, or deregulated markets provide strategic advantages.

Infrastructure considerations include:

- Power capacity: 3MW+ for meaningful scale operations

- Cooling systems: Climate control suitable for year-round operation

- Network connectivity: Redundant high-bandwidth internet

- Physical security: Protection against theft and unauthorized access

Portfolio Construction Methodology

Rather than equal-weight allocation across all available PoW coins, strategic miners should employ tiered approaches:

Tier 1 (Core Holdings – 60-70%): Bitcoin and established assets with deep liquidity, proven security, and institutional acceptance. These provide stable baseline revenue.

Tier 2 (Growth Opportunities – 20-30%): Proven alternatives like Kaspa, Litecoin, and Ethereum Classic offering attractive risk-adjusted returns with moderate liquidity.

Tier 3 (Speculative – 5-10%): Emerging PoW protocols with innovative technology but higher risk profiles. These positions provide asymmetric upside while risking minimal capital.

Operational Best Practices

Standardize Management Systems: Deploy unified monitoring platforms compatible across hardware types. Solutions like mining OS management software reduce operational complexity despite hardware diversity.

Implement Automated Switching: Profit-switching algorithms can dynamically allocate hashpower to most profitable coins within compatible algorithm families. This maximizes revenue without manual intervention.

Maintain Vendor Relationships: Direct manufacturer relationships ensure priority access to new hardware releases, favorable warranty terms, and technical support. For miners exploring Kaspa ASICs and other equipment, established supplier connections provide competitive advantages.

Develop Exit Strategies: Plan hardware lifecycle management including depreciation schedules, resale markets, and upgrade timelines. Equipment with strong secondary markets preserves capital even as efficiency declines.

Kaspa Mining Setup: Practical Implementation Guide

For miners ready to enter Kaspa mining, systematic deployment ensures optimal results. This section provides actionable implementation guidance.

Hardware Procurement Strategy

Direct Manufacturer Purchase: For large-scale deployments (50+ units), direct relationships with Bitmain, IceRiver, or other manufacturers offer best pricing and warranty terms. Expect 2-4 month lead times for bulk orders.

Authorized Distributors: Mid-sized operations (5-50 units) benefit from working with established distributors who maintain inventory and provide faster fulfillment. Companies like Miners1688 specialize in competitive pricing with professional logistics for international delivery.

Secondary Markets: Experienced miners can find value in used equipment markets, though this requires careful inspection, warranty verification, and hardware testing before deployment.

Pool Selection and Configuration

Joining mining pools reduces variance and ensures consistent revenue. Major Kaspa pools include:

- F2Pool: Largest hashrate, established reputation

- WoolyPooly: Competitive fees, user-friendly interface

- HeroMiners: Transparent statistics, multiple payout options

Configuration involves setting pool URLs, wallet addresses, and worker names in miner firmware. Most modern ASICs provide web interfaces simplifying setup processes.

Monitoring and Optimization

Successful operations implement comprehensive monitoring:

- Hashrate tracking: Real-time visibility into production rates

- Temperature monitoring: Early warning of cooling issues

- Error rate analysis: Detection of hardware degradation

- Profitability calculations: Automated revenue vs. cost tracking

Regular firmware updates, cleaning schedules (quarterly recommended), and thermal paste replacement (annually) maintain optimal performance throughout hardware lifespan.

Frequently Asked Questions

Is Kaspa mining profitable in 2025?

Profitability depends on electricity costs and hardware efficiency. Operations with electricity below $0.06/kWh using current-generation ASICs (KS5 Pro or newer) can achieve positive returns. However, margins have compressed significantly from 2024 peaks due to increasing network difficulty. Conservative projections suggest 12-18 month ROI periods for equipment purchased at current prices, assuming stable or moderately increasing KAS valuations.

What’s the best Kaspa mining hardware currently available?

The Bitmain Antminer KS7 (23 TH/s) represents the most powerful option, though the KS5 Pro (21 TH/s) offers superior price-to-performance ratios for most miners. IceRiver’s competing models provide viable alternatives with similar specifications. Avoid older generation equipment like original KS3 models due to poor efficiency metrics making them unprofitable in most scenarios.

How does multi-chain mining compare to Bitcoin-only strategies?

Multi-chain mining offers diversification benefits and potential access to undervalued opportunities, but requires significantly higher capital investment, operational complexity, and technical expertise. Bitcoin-only mining benefits from superior hardware liquidity, deeper capital markets, and operational simplicity. The optimal choice depends on capital availability, risk tolerance, and operational capabilities.

Should I start mining Kaspa now or wait?

Current market conditions present moderate opportunities with compressed margins. Miners with access to competitive electricity and willing to accept 12-18 month ROI timelines may find viable opportunities, particularly if they anticipate KAS price appreciation. However, those expecting rapid returns or lacking infrastructure advantages should carefully evaluate alternatives. Consider starting with smaller test deployments before full-scale commitment.

What electricity cost makes Kaspa mining profitable?

With current-generation hardware and November 2025 network conditions, electricity costs below $0.08/kWh enable marginally profitable operations, while costs below $0.06/kWh provide comfortable margins. Optimal profitability occurs below $0.04/kWh, though such rates are geographically limited. Operations planning should model multiple price scenarios across the expected equipment lifespan.

How does Marathon’s entry affect small miners?

Marathon’s institutional participation validates Kaspa’s long-term viability while simultaneously increasing network difficulty. This benefits the ecosystem’s security and credibility but compresses profit margins for all miners. Small operations must focus on operational efficiency, competitive electricity access, and potentially niche strategies to remain competitive alongside large players.

Conclusion: Strategic Positioning for Long-Term Success

Marathon Digital’s Kaspa mining initiative symbolizes the evolving cryptocurrency mining landscape where single-asset strategies give way to sophisticated multi-chain approaches. While opportunities exist across the PoW ecosystem, success requires disciplined capital allocation, operational excellence, and realistic expectations.

The miners who thrive in 2025 and beyond will combine technical proficiency with strategic flexibility — maintaining core positions in established assets while selectively pursuing emerging opportunities. Whether focusing exclusively on Bitcoin or building diversified portfolios including Kaspa and other PoW coins, the fundamentals remain constant: competitive electricity, efficient hardware, and systematic risk management.

For those ready to explore Kaspa mining equipment and begin their multi-chain journey, Miners1688 offers comprehensive hardware solutions backed by industry expertise and competitive international logistics.

References & Related Resources:

- Marathon Digital Official Press Release — Marathon’s Kaspa mining announcement

- ASIC Miner Value — Real-time mining profitability calculations

- Cross-Chain Mining Opportunities — Merged mining strategies analysis

- Kaspa Price Prediction 2025 — Market analysis and forecasts

- Top Kaspa Miners 2025 — Hardware comparison guide