Summary: Eric Trump’s American Bitcoin recently announced its merger with Gryphon Digital Mining to become publicly traded on Nasdaq under ticker “ABTC.” This landmark deal highlights the evolving cryptocurrency mining landscape as Bitcoin hovers around $107,600 in November 2025. For miners and investors, this development signals increased institutional interest in Bitcoin mining infrastructure. Understanding how public mining companies operate, what equipment they use, and how to evaluate mining profitability has never been more crucial for those looking to enter or expand in this dynamic sector.

The American Bitcoin-Gryphon Merger: A New Era for Bitcoin Mining

Bitcoin Mining Farm Equipment

The cryptocurrency mining industry witnessed a significant milestone when American Bitcoin, co-founded by Eric Trump, announced its plan to go public through a merger with Gryphon Digital Mining (GRYP). The combined entity will operate under the American Bitcoin name and trade on Nasdaq as “ABTC.”

Deal Structure and Market Impact

This stock-for-stock transaction represents more than just a corporate merger—it exemplifies the maturation of the Bitcoin mining sector. Gryphon’s shares surged 285% to $2.00 upon the announcement, demonstrating strong market appetite for legitimate, well-structured mining operations. The deal positions American Bitcoin as an “investable bitcoin accumulation platform,” designed to offer investors exposure to Bitcoin mining without directly purchasing cryptocurrency.

Why This Matters for Mining Equipment Buyers

For those considering entering Bitcoin mining or expanding operations, this public listing sets important precedents. Public companies face stricter scrutiny regarding equipment choices, operational efficiency, and profitability metrics. As Eric Trump stated, Bitcoin is “one of the most important asset classes of our time,” and professional miners are increasingly choosing proven, high-performance equipment to maximize returns. Investopedia

Current Bitcoin Market Conditions and Mining Profitability

As of November 3, 2025, Bitcoin is trading at approximately $107,600, maintaining strong momentum despite recent market volatility. This price level makes mining increasingly attractive for operators with access to efficient hardware and competitive electricity rates.

The 2025 Mining Landscape

Following the 2024 halving event that reduced block rewards to 3.125 BTC, mining profitability now depends heavily on three factors: hardware efficiency, electricity costs, and operational scale. The latest generation of ASIC miners from manufacturers like Bitmain, WhatsMiner, and others offer significantly improved efficiency ratios, making them essential for competitive operations.

Real-World Profitability Analysis

Current market data shows that miners like the Bitmain Antminer S21 Pro (234Th/s) generate approximately $11.15 per day before electricity costs. With average electricity rates of $0.10 per kWh, daily profit margins around $2.71 per unit are achievable. However, these figures fluctuate with Bitcoin price movements, network difficulty adjustments, and local energy costs—factors that professional mining operations like American Bitcoin must carefully manage.

Top Mining Equipment Powering Professional Operations in 2025

Large-scale mining operations like American Bitcoin rely on cutting-edge hardware to maintain competitive advantages. Understanding which equipment delivers the best performance-to-cost ratio is critical for anyone looking to build or scale mining operations.

Premium Tier: Maximum Hashrate Machines

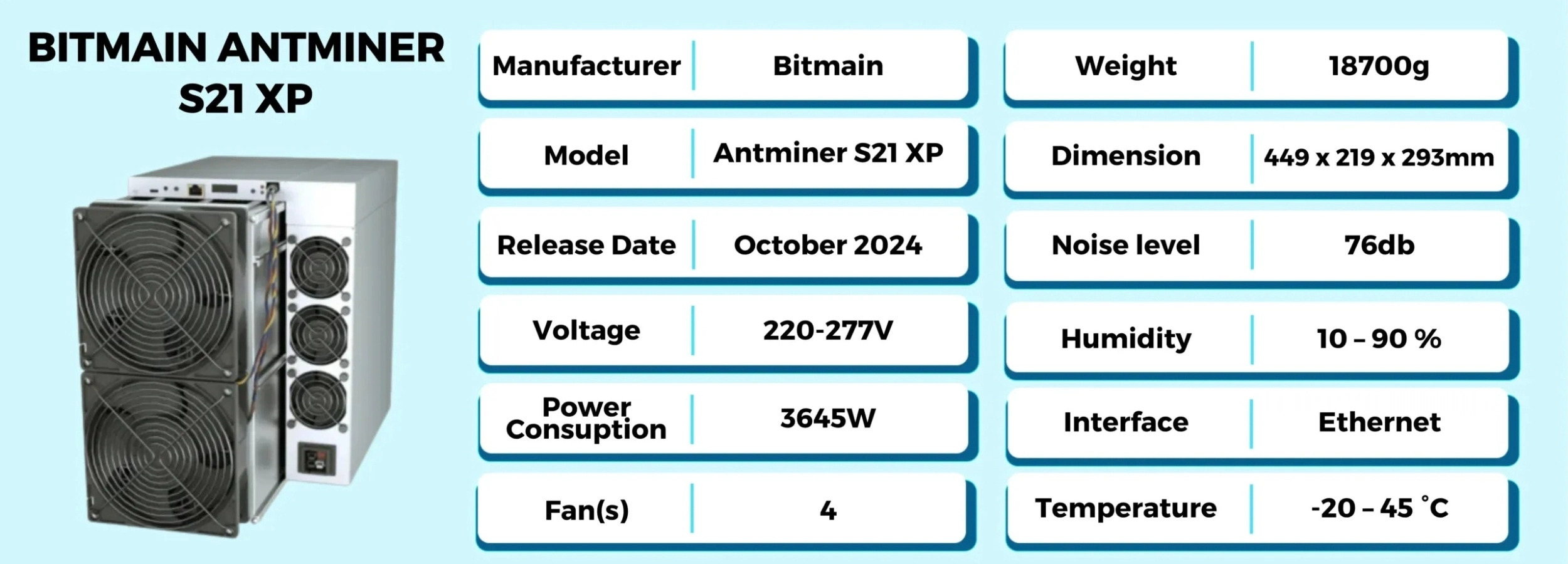

Bitmain Antminer S21 XP (270Th/s) leads the industry with the highest hashrate available, making it ideal for large-scale farms prioritizing maximum output. With energy efficiency of approximately 13.5J/Th, this model represents the pinnacle of current ASIC technology. Current pricing ranges from $5,300-$6,000 depending on delivery timelines and hosting options.

Bitmain Antminer S21 Pro (234Th/s) offers an excellent balance of performance and cost, priced around $3,400-$4,700. Its 15J/Th efficiency and 234Th/s hashrate make it a popular choice for serious miners. At current Bitcoin prices, operators can expect daily revenues of $11+ before electricity costs, translating to payback periods of 12-18 months under favorable conditions.

Mid-Range Options: Efficiency-Focused Models

Bitmain Antminer S21+ (216Th/s) provides 216Th/s at 3,560W, offering strong performance at a more accessible price point of approximately $4,260. This model suits miners who want near-flagship performance without premium pricing.

MicroBT Whatsminer M60S delivers competitive hashrates with proven reliability. MicroBT’s reputation for durable hardware makes this series attractive for operators prioritizing uptime and maintenance cost reduction.

Mining Equipment Comparison Table

| Model | Hashrate | Power Consumption | Efficiency (J/Th) | Est. Daily Profit* | Approx. Price |

|---|---|---|---|---|---|

| Bitmain S21 XP | 270 Th/s | 3,645W | 13.5 | $12-14 | $5,300-$6,000 |

| Bitmain S21 Pro | 234 Th/s | 3,510W | 15.0 | $10-12 | $3,400-$4,700 |

| Bitmain S21+ | 216 Th/s | 3,560W | 16.5 | $9-11 | $4,260 |

| Whatsminer M60S | 218 Th/s | 3,344W | 15.3 | $9-11 | $3,800-$4,200 |

| Canaan Avalon Q | 90 Th/s | 1,674W | 18.6 | $3-5 | $1,200-$1,600 |

*Based on BTC at $107,600, network difficulty as of Nov 2025, and $0.10/kWh electricity

Alternative Cryptocurrencies: Diversifying Your Mining Portfolio

While Bitcoin mining dominates headlines with deals like American Bitcoin’s public listing, savvy miners understand the value of portfolio diversification. Multi-algorithm operations hedge against Bitcoin-specific volatility while capturing opportunities in emerging cryptocurrencies.

Litecoin and Dogecoin: Scrypt Mining Opportunities

Litecoin (LTC) currently trades around $91.84, up 6.96%, while Dogecoin (DOGE) sits at $0.174, gaining 5.04%. The Bitmain Antminer L9 (16Gh/s) and ElphaPex DG2+ (20.5Gh/s) efficiently mine these coins, offering miners additional revenue streams beyond Bitcoin. This diversification strategy mirrors how professional operations manage risk exposure.

Emerging Algorithms: Kaspa and Beyond

Kaspa (KAS), trading at $0.049 with 6.56% gains, represents the next generation of proof-of-work cryptocurrencies. As Bitcoin mining becomes increasingly competitive, early adoption of emerging coin mining can provide outsized returns. Equipment like the IceRiver KAS miners enables participation in these markets with lower initial capital requirements than Bitcoin mining demands.

Why Choose Miners1688 for Your Bitcoin Mining Equipment

As the mining industry matures with public listings like American Bitcoin, equipment sourcing becomes increasingly critical. Miners1688 has established itself as one of China’s top three ASIC miner suppliers, serving both individual miners and institutional operations for seven years.

Direct Manufacturer Relationships

Unlike resellers adding markup layers, Miners1688 maintains direct partnerships with industry leaders including Bitmain, MicroBT (WhatsMiner), Canaan, IceRiver, and Goldshell. This results in competitive pricing that enables faster ROI for your mining investment. When American Bitcoin scales operations, they prioritize suppliers who deliver both quality and value—the same standards Miners1688 upholds.

Comprehensive Global Logistics

Mining hardware is time-sensitive; every day of delayed delivery is potential revenue lost. Miners1688 partners with DHL, UPS, and FedEx for reliable international shipping, complemented by specialized routes to Russia, the Middle East, and North America. Whether you’re launching a small home mining operation or scaling to industrial levels, timely equipment arrival directly impacts profitability calculations.

Expert Technical Support Throughout Your Mining Journey

Unlike companies that disappear after purchase, Miners1688 provides ongoing technical guidance—from initial setup through operational troubleshooting. Remote assistance helps you maximize uptime, critical when Bitcoin prices are favorable. This support infrastructure mirrors what institutional investors expect from publicly-traded mining companies.

Comparing Mining Equipment: Performance Metrics That Matter

Professional mining operations evaluate equipment using multiple criteria beyond simple hashrate numbers. Understanding these metrics helps you make informed decisions whether investing thousands or millions in mining infrastructure.

Energy Efficiency: The Make-or-Break Metric

With electricity comprising 50-70% of mining operational costs, efficiency (measured in Joules per Terahash or J/Th) determines long-term profitability. The Bitmain S21 XP’s 13.5J/Th significantly outperforms older models like the S19 series at 29-34J/Th. Over a year of continuous operation, this efficiency difference can represent thousands of dollars per unit in savings.

Hashrate Stability and Downtime Considerations

Advertised hashrates mean little if hardware frequently malfunctions. Manufacturers like Bitmain and MicroBT have established reputations for reliability, typically achieving 95%+ uptime in well-maintained environments. When evaluating equipment suppliers, prioritize those offering manufacturer warranties and responsive technical support—factors that separate professional operations from amateur setups.

Multi-Algorithm Mining Equipment Table

| Cryptocurrency | Algorithm | Recommended Miner | Hashrate | Current Price | Daily Revenue Est. |

|---|---|---|---|---|---|

| Bitcoin (BTC) | SHA-256 | Antminer S21 Pro | 234 Th/s | $107,600 | $10-12 |

| Litecoin (LTC) | Scrypt | Antminer L9 | 16 Gh/s | $91.84 | $25-30 |

| Dogecoin (DOGE) | Scrypt | ElphaPex DG2+ | 20.5 Gh/s | $0.174 | $30-35 |

| Kaspa (KAS) | kHeavyHash | IceRiver KAS | Variable | $0.049 | $5-8 |

| Ethereum Classic | Ethash | Goldshell Miners | Variable | $15.35 | $3-6 |

Strategic Considerations: Home Mining vs. Industrial Operations

The American Bitcoin public listing highlights the increasing institutionalization of cryptocurrency mining. However, opportunities exist across all scales—from single-unit home miners to warehouse-scale operations.

Home Mining: Entry Points and Realistic Expectations

Home miners typically start with 1-5 units, focusing on equipment balancing noise levels (76-80db), space requirements, and electrical capacity. Models like the Canaan Avalon Q (90Th/s, 1674W) offer accessible entry points around $1,200-$1,600 while still generating meaningful returns. At current Bitcoin prices, home miners with electricity costs below $0.12/kWh can achieve profitability, though payback periods extend to 18-24 months.

Small Business Mining: Scaling Strategically

Operations deploying 10-50 units enter semi-professional territory where efficiency gains materialize. Bulk equipment purchasing, negotiated electricity rates, and dedicated cooling infrastructure significantly improve margins. At this scale, diversifying across Bitcoin and altcoin mining equipment provides revenue stability. Suppliers like Miners1688 offer volume discounts that matter at these quantities.

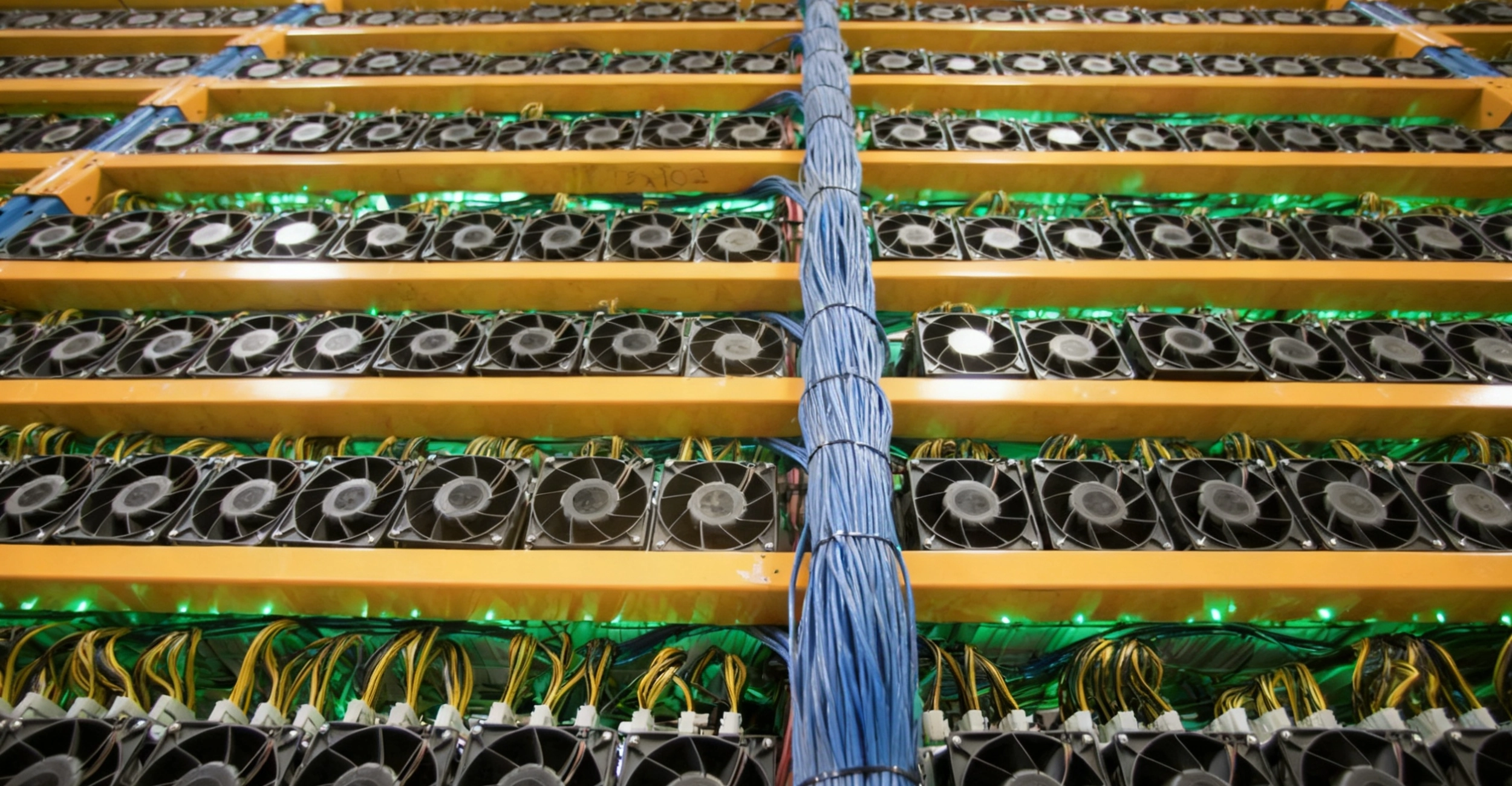

Industrial Mining: Following American Bitcoin’s Model

Thousand-unit+ operations like American Bitcoin require sophisticated infrastructure: redundant power supplies, industrial cooling systems, and professional maintenance teams. These operations prioritize top-tier equipment like the S21 XP, accepting higher upfront costs for superior long-term efficiency. Public scrutiny from stock market listing adds pressure to maximize operational metrics—standards that trickle down throughout the industry.

Frequently Asked Questions About Bitcoin Mining Equipment and Profitability

Q: Is Bitcoin mining still profitable in November 2025?

A: Yes, Bitcoin mining remains profitable for operators with efficient equipment and electricity costs below $0.12/kWh. At Bitcoin’s current price of $107,600, latest-generation miners like the Antminer S21 series generate $8-14 daily profit per unit after electricity costs. However, profitability varies significantly based on local electricity rates, cooling costs, and equipment efficiency.

Q: What’s the best mining machine for beginners in 2025?

A: The Canaan Avalon Q (90Th/s) or Bitmain Antminer S21 (200Th/s) offer excellent starting points. The Avalon Q requires lower initial investment ($1,200-$1,600) with manageable power consumption (1674W), making it suitable for residential electrical systems. For those with higher budgets, the S21 provides better long-term efficiency and faster ROI potential.

Q: How does the American Bitcoin public listing affect mining equipment prices?

A: Increased institutional interest from public mining companies typically drives demand for premium equipment, potentially increasing prices for top-tier models. However, this also stimulates manufacturer production, eventually stabilizing supply. For individual miners, this reinforces the importance of establishing relationships with reliable suppliers like Miners1688 who can secure equipment during high-demand periods.

Q: Should I mine Bitcoin or alternative cryptocurrencies?

A: Diversification offers risk management benefits. While Bitcoin provides the largest market and most liquidity, coins like Litecoin (currently $91.84) and Kaspa ($0.049) offer opportunities for miners willing to accept slightly higher volatility. Many successful operators allocate 60-70% of hashpower to Bitcoin while mining altcoins with remaining capacity, balancing stability with growth potential.

Q: What warranty and support should I expect when buying mining equipment?

A: Reputable suppliers provide manufacturer warranties ranging from 180 days to 2 years, depending on the model. Professional suppliers like Miners1688 additionally offer technical support, remote troubleshooting, and maintenance guidance throughout your equipment’s operational life. Avoid suppliers who only provide hardware without ongoing support—downtime costs far exceed initial equipment savings.

Q: How long until my mining equipment pays for itself?

A: At current Bitcoin prices and difficulty levels, premium miners like the S21 Pro (approximately $4,000-$4,700) achieve breakeven in 12-18 months with electricity costs at $0.10/kWh. Budget-friendly models may require 18-24 months. These calculations assume stable Bitcoin prices and network difficulty—factors that fluctuate. Conservative miners plan for 24-month payback periods to account for market variability.

Final Thoughts: The American Bitcoin public listing represents more than a single company’s achievement—it signals the cryptocurrency mining industry’s maturation into a legitimate investment sector. Whether you’re considering your first mining machine or scaling to industrial operations, success depends on strategic equipment selection, reliable supplier relationships, and understanding market dynamics. As Bitcoin continues trading above $100,000 in late 2025, the mining opportunity remains strong for those who approach it professionally.

Ready to start your mining journey? Explore Miners1688’s complete equipment catalog and connect with mining experts who understand both the technology and the business.