Summary: Ethereum tumbled over 8% as spot ETF outflows reached $1.4 billion over three weeks, with long-term holders accelerating sell-offs. The breach of critical $3,325 support signals bearish momentum, while network fundamentals deteriorate. Miners face challenging conditions as market volatility intensifies, making strategic hardware selection and diversification crucial for profitability.

Understanding the ETH Market Downturn

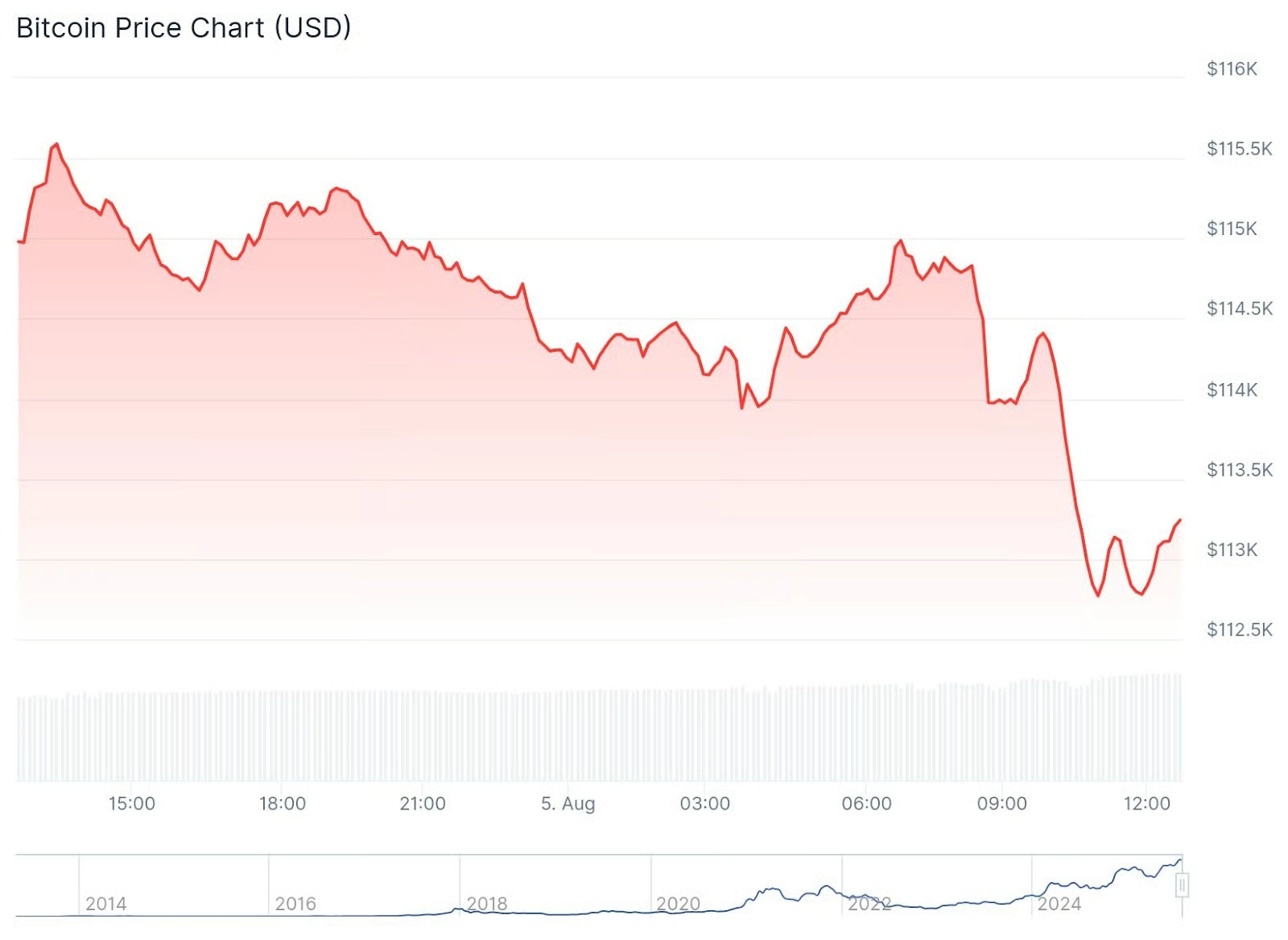

The cryptocurrency market experienced significant turbulence in mid-November 2025, with Ethereum bearing the brunt of institutional selling pressure. ETH plunged from $3,565 to below $3,100 within 48 hours, erasing gains from the previous week’s recovery. This dramatic sell-off coincided with Bitcoin losing the psychological $100,000 level, triggering a broader market liquidation.

ETF Outflows Drive Institutional Exodus

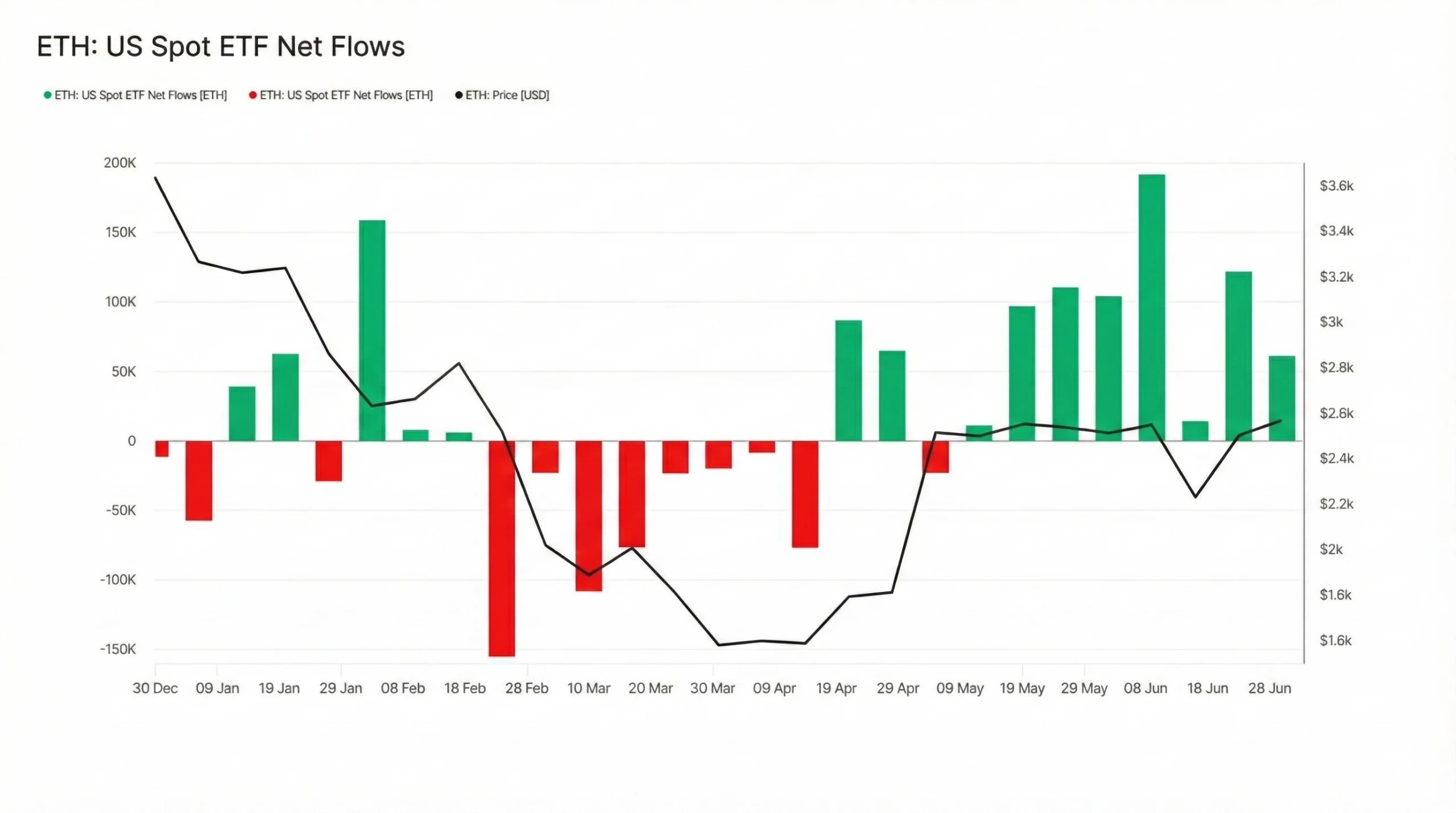

Since late October 2025, when Federal Reserve Chairman Jerome Powell dampened expectations for December rate cuts, U.S.-listed spot Ethereum ETFs have hemorrhaged $1.4 billion in net outflows. Thursday’s $260 million single-day withdrawal marked the largest exodus in a month, reflecting waning institutional confidence. Unlike Bitcoin ETFs which maintained relative stability, Ethereum funds faced sustained redemption pressure, suggesting investors are repositioning away from altcoin exposure during economic uncertainty.

Long-Term Holders Accelerate Distribution

Blockchain analytics from Glassnode revealed alarming trends among veteran ETH holders. Long-term investors holding positions for 3-10 years are now distributing approximately 45,000 ETH daily (worth $140 million at current prices) on a 90-day moving average—the highest selling pace since February 2021. This cohort traditionally represents strong hands who accumulate during bear markets and distribute near cycle peaks, making their sustained selling a bearish signal for medium-term price action.

Technical Analysis: Bearish Structure Emerges

Critical Support Levels Breached

ETH shattered the pivotal $3,325 support level, establishing a clear bearish trend with consecutive lower highs. Technical models now identify primary support at $3,080, with secondary floors at $3,050 and $2,880. Breaking below $3,050 could expose downside targets toward $2,880, representing an additional 8% decline from current levels. Resistance has formed at the former support level of $3,330, creating a significant barrier for any recovery attempt.

Volume Analysis Signals Exhaustion

Selling volume spiked to 641,103 contracts during the $3,325 breakdown—71% above 24-hour averages—indicating intense capitulation. However, subsequent volume dropped to just 80% of 7-day norms, suggesting potential selling exhaustion. This pattern typically precedes consolidation ranges where markets digest losses before determining the next directional move. The $3,077-$3,146 range may serve as a temporary base.

Chart Patterns and Key Thresholds

ETH broke its April ascending channel, creating a bearish structure with lower highs. For bulls to regain control, a decisive push above $3,500 is required, targeting the $3,650-$3,800 resistance zone. Conversely, failure to hold $3,080 support exposes the $2,880 downside target. Risk/reward ratios currently favor patient accumulation near support zones rather than chasing bounces into resistance.

Table 1: ETH Technical Levels & Trading Zones

| Level Type | Price Point | Significance |

|---|---|---|

| Primary Support | $3,080 | Must-hold level for bulls; breakdown signals further decline |

| Secondary Support | $3,050 | Last defense before $2,880 target |

| Critical Support | $2,880 | Major downside target if selling continues |

| Immediate Resistance | $3,330 | Former support turned resistance |

| Key Resistance | $3,500 | Pivot level for bullish reversal |

| Major Resistance | $3,650-$3,800 | Descending channel highs; strong seller zone |

Network Fundamentals Deteriorate

Declining User Activity

Ethereum’s monthly active addresses plummeted to 8.2 million in November 2025, down from over 9 million in September—a 9% decline reflecting reduced network engagement. Fewer active users translate to lower transaction demand, reducing fee generation for validators and diminishing network value. This metric historically correlates with price action, as user growth drives adoption and value accrual.

Transaction Fee Collapse

Perhaps most concerning for network security, transaction fees over the past month collapsed 42% to just $27 million according to Token Terminal data. Ethereum’s transition to proof-of-stake means validators depend on fee revenue alongside staking rewards. Sustained low fees pressure validator economics and reduce the incentive for securing the network, potentially creating long-term stability concerns if the trend continues.

Implications for Miners and Stakers

While Ethereum no longer uses proof-of-work mining after “The Merge,” these metrics matter for crypto miners focused on other chains. Lower ETH prices and reduced network activity often correlate with broader market weakness, affecting profitability across all mineable cryptocurrencies. Miners should monitor these indicators as leading signals for adjusting operations and hedging strategies.

Mining Strategy in Volatile Markets

Diversification Remains Key

During periods of heightened volatility, miners benefit from hardware diversification across multiple algorithms. While Ethereum mining ended with The Merge, profitable alternatives like Bitcoin (SHA-256), Litecoin/Dogecoin (Scrypt), and other proof-of-work chains continue offering opportunities. Allocating hashpower across multiple networks reduces exposure to single-coin price fluctuations.

Cost Efficiency Prioritization

In challenging market conditions, operational efficiency becomes paramount. Focus on miners with optimal efficiency ratios (hashrate per watt) to minimize electricity costs. The Bitmain Antminer S21+ delivers industry-leading performance for Bitcoin mining, while the Elphapex DG2+ offers strong returns for Litecoin/Dogecoin operations. Calculate break-even electricity costs before deploying capital.

Strategic Accumulation Timing

Market downturns present accumulation opportunities for miners with strong balance sheets. Hardware prices often decline during bearish phases as overleveraged operations liquidate equipment. Patient buyers can acquire mining rigs at significant discounts, positioning for profitability when markets recover. However, avoid catching falling knives—wait for stabilization signals before committing large capital.

Table 2: Recommended Mining Hardware for Current Market

| Model | Algorithm | Hashrate | Power | Efficiency | Best For |

|---|---|---|---|---|---|

| Bitmain Antminer S21+ | SHA-256 | 216 TH/s | 3,500W | 16.2 J/TH | Bitcoin mining; strong ROI |

| Bitmain Antminer L9 | Scrypt | 16 GH/s | 3,360W | 210 J/MH | LTC/DOGE; proven reliability |

| Elphapex DG2+ | Scrypt | 20.5 GH/s | 3,900W | 190 J/MH | High-efficiency Scrypt mining |

| Canaan Avalon Q | SHA-256 | 90 TH/s | 1,674W | 18.6 J/TH | Budget-friendly Bitcoin option |

| Goldshell AE Max II | zkSNARK | 540 MH/s | 3,200W | 5.9 W/MH | Aleo mining; emerging network |

Broader Market Context and Federal Reserve Impact

Monetary Policy Headwinds

The Federal Reserve’s stance on interest rates continues casting a shadow over risk assets including cryptocurrencies. Powell’s October 2025 comments effectively ruling out December rate cuts triggered the initial ETF outflow wave. Higher-for-longer interest rates increase the opportunity cost of holding non-yielding assets like Bitcoin and Ethereum, pressuring prices as investors rotate toward bonds and dividend-paying equities.

Liquidity Conditions Tighten

November’s brief U.S. government shutdown exacerbated liquidity conditions, amplifying volatility across markets. Crypto assets, as highly liquid 24/7 instruments, often absorb outsized selling pressure during liquidity crunches as traders raise cash to meet margin calls elsewhere. This dynamic explains the correlation between traditional market stress and crypto selloffs, even when fundamental blockchain metrics remain stable.

December FOMC Meeting Outlook

Market participants now assign elevated probability to the Federal Reserve maintaining current rates through December 2025. If realized, this outcome could extend crypto market consolidation through year-end. However, any surprise dovish pivot could trigger sharp recovery rallies. Miners should prepare contingency plans for both scenarios—extended weakness requiring cost reduction, or sudden rallies enabling equipment expansion.

Risk Management for Mining Operations

Hedging Strategies

Sophisticated mining operations employ derivatives to hedge price risk. Consider selling futures contracts covering 30-50% of expected production to lock in profit margins regardless of spot price movements. While this caps upside potential, it ensures operational viability during extended downturns. CME Bitcoin and Ethereum futures offer institutional-grade hedging tools with deep liquidity.

Operational Flexibility

Maintain flexibility to quickly pivot between coins and adjust hashpower allocation based on real-time profitability. Multi-algorithm operations weather volatility better than single-coin focus. If hosting mining equipment at third-party facilities, negotiate contracts with electricity price caps and early termination clauses to preserve optionality during extreme market moves.

Capital Preservation

Avoid excessive leverage when financing mining operations. While debt can amplify returns during bull markets, it destroys businesses during bear markets when equipment values and coin prices collapse simultaneously. Maintain adequate liquid reserves to cover 6-12 months of operating expenses, ensuring survival through extended market downturns.

Frequently Asked Questions

Q1: Should I stop mining during market downturns like this ETH decline?

It depends on your cost structure. Calculate your break-even electricity cost—if mining remains profitable after power expenses, continue operations. Many successful miners accumulated coins during 2018-2019 bear market at low costs, reaping rewards during subsequent rallies. However, if operating at a loss, consider temporarily shutting down less efficient equipment while maintaining your most efficient rigs.

Q2: Are Ethereum ETF outflows a signal to avoid all cryptocurrency mining?

No. ETH ETF outflows reflect institutional sentiment toward Ethereum specifically, not the entire crypto mining sector. Bitcoin mining, Litecoin/Dogecoin Scrypt mining, and other proof-of-work networks operate independently with different fundamentals. Diversified mining operations actually benefit from multiple revenue streams during single-coin weakness.

Q3: What’s the best mining hardware to buy during this market volatility?

Focus on proven, efficient models from reputable manufacturers. The Bitmain Antminer S21 series offers excellent Bitcoin mining efficiency, while the Antminer L9 delivers strong Scrypt performance. Avoid experimental hardware or unproven manufacturers during uncertain markets—reliability matters most when margins compress.

Q4: How do technical support levels like $3,080 affect mining profitability?

While miners primarily care about the coins they mine (Bitcoin, Litecoin, etc.), broader market sentiment driven by ETH price action affects all cryptocurrencies. Major support breaks often trigger sympathy selling across markets, temporarily reducing profitability. Monitor key levels as leading indicators for adjusting hedging strategies.

Q5: Should I wait for lower prices before buying mining equipment?

Hardware prices often lag crypto price movements by 1-2 months. Current market weakness may create equipment buying opportunities in coming weeks as some operators liquidate. However, prioritize purchasing from established suppliers like Miners1688 with warranty support and verified manufacturer relationships—avoid gray market deals that may lack after-sales service.

Q6: How does Federal Reserve policy impact mining operations?

Higher interest rates increase capital costs for financing equipment and raise opportunity costs for holding mined coins instead of interest-bearing assets. This typically pressures crypto prices, reducing mining profitability. However, patient miners with strong balance sheets can accumulate coins during these periods for long-term gains.

Conclusion: Navigating Uncertainty with Strategic Planning

The confluence of $1.4 billion ETH ETF outflows, technical support breaches, and deteriorating network fundamentals presents near-term challenges for cryptocurrency markets. However, experienced miners understand that volatility creates opportunity. By maintaining operational efficiency, diversifying across multiple proof-of-work networks, and employing prudent risk management, mining operations can weather current turbulence and position for profitability when conditions improve.

The key lies in strategic hardware selection, cost discipline, and maintaining sufficient liquidity to survive extended downturns. Whether prices consolidate in the $3,080-$3,330 range or break toward $2,880 support, miners with efficient equipment and strong balance sheets will emerge stronger when the next bull cycle arrives.

Related Resources:

- Bitcoin Mining Hardware Guide – Explore top-tier ASIC miners

- Scrypt Mining Equipment – LTC/DOGE mining solutions

- CoinDesk Market Analysis – Latest crypto market insights

- ASIC Miner Profitability Calculators – Real-time mining profitability

Disclaimer: Cryptocurrency mining involves significant risks including hardware costs, electricity expenses, market volatility, and regulatory uncertainty. This article provides educational information and does not constitute financial advice. Always conduct thorough research and consult qualified professionals before making mining investment decisions.

About Miners1688: As one of China’s top three ASIC miner suppliers with 7 years industry experience, Miners1688 specializes in supplying mining hardware directly from manufacturers including Bitmain, WhatsMiner, IceRiver, Avalon, and Goldshell. We offer competitive pricing, professional DHL/UPS/FedEx logistics, specialized transportation routes to Russia, Middle East, and North America, plus excellent after-sales technical support.