Bitcoin’s unusual strength during U.S. trading hours in early 2026 signals a potential shift from the downward American session pattern observed throughout late 2025, raising new questions about institutional behavior and mining profitability as network difficulty approaches 148T.

Rare US Session Strength Breaks Multi-Week Pattern

Bitcoin pushed above $90,000 during the first official trading session of 2026, marking a notable departure from the persistent weakness observed during U.S. market hours throughout December 2025. According to CoinDesk, BTC climbed roughly 2.5% in the 24 hours following the New Year weekend, with the majority of gains materializing during American trading hours rather than during Asian or European sessions.

Traditional Session Pattern Background

For over six weeks leading into 2026, Bitcoin exhibited a pronounced tendency to retreat during U.S. trading sessions. Gains accumulated during overnight Asian trading and European morning hours would systematically erode once American markets opened. This pattern created frustration among Western traders and raised questions about the role of institutional flows, ETF redemptions, and macro positioning.

Early 2026 Behavior Shift

The first week of 2026 witnessed an interruption of this pattern. Bitcoin not only maintained gains through American hours but actually strengthened during U.S. sessions on January 2nd and 3rd. This reversal suggests potential changes in institutional positioning, renewed spot ETF inflows, or shifts in derivative market structure. However, by January 6th, signs emerged that the old pattern might reassert itself as BTC pulled back toward $92,000 during U.S. hours.

Institutional Flows and ETF Dynamics Drive Session Behavior

Understanding the shift in Bitcoin’s intraday patterns requires examining the mechanics of institutional participation and spot ETF flows during different global trading sessions.

Spot Bitcoin ETF Activity

U.S.-listed spot Bitcoin ETFs have become dominant liquidity vectors for institutional capital since their January 2024 launch. December 2025 witnessed sustained net outflows from these products, contributing to downward pressure during American trading hours. Early January data suggests this trend may be stabilizing or reversing, though comprehensive flow data remains limited as of this writing.

Global Liquidity Distribution

Bitcoin’s 24-hour trading structure means liquidity concentrates differently across time zones. Asian sessions typically feature lower aggregate volume but higher volatility, while European hours see moderate activity. U.S. sessions traditionally command the deepest liquidity and tightest spreads, making American hours particularly influential for price discovery.

Derivative Market Positioning

CME Bitcoin futures and options contracts settle during U.S. hours, creating natural pressure points. December 2025 saw elevated short interest and put positioning ahead of year-end, potentially contributing to systematic selling pressure during American sessions. Early 2026 derivatives data indicates some unwinding of bearish positions, which may explain improved U.S. session performance.

Mining Profitability Under Current Market Conditions

Table: Top Performing Bitcoin Miners – January 2026

| Model | Hashrate | Power Consumption | Daily Profit (@ $0.07/kWh) | Efficiency (W/TH) |

|---|---|---|---|---|

| Antminer S23 Hyd | 580 TH/s | 5,510W | $22.00 | 9.50 |

| Antminer S21 XP | 473 TH/s | 5,000W | $18.50 | 10.57 |

| Antminer S21 Pro | 234 TH/s | 3,510W | $9.85 | 15.00 |

| Antminer S21 Hyd | 335 TH/s | 5,360W | $12.92 | 16.00 |

Profitability calculated at BTC = $90,000, network difficulty = 148.26T

Bitcoin miners face a complex profitability landscape as 2026 begins. Network difficulty reached 148.26 trillion in late December 2025 and shows signs of continued upward pressure. The next difficulty adjustment, scheduled for January 8, 2026, projects a modest decrease to approximately 146.31T due to slight network hashrate reduction from 1,099 EH/s to 1,054 EH/s week-over-week.

Efficiency Requirements Tighten

At current difficulty levels and BTC prices hovering near $90,000, only the most efficient ASIC hardware maintains healthy profit margins. Legacy equipment like the Antminer S19 series struggles to remain profitable at electricity costs above $0.05/kWh. Meanwhile, latest-generation hydro-cooled models like the S23 Hyd and S21 XP command premium economics.

Electricity Cost Sensitivity

With BTC price consolidating rather than rallying strongly through $100,000 as some analysts predicted, miners face increased sensitivity to power costs. Operations with access to sub-$0.05/kWh electricity maintain comfortable margins, while those paying retail rates encounter break-even scenarios unless hash price improves materially.

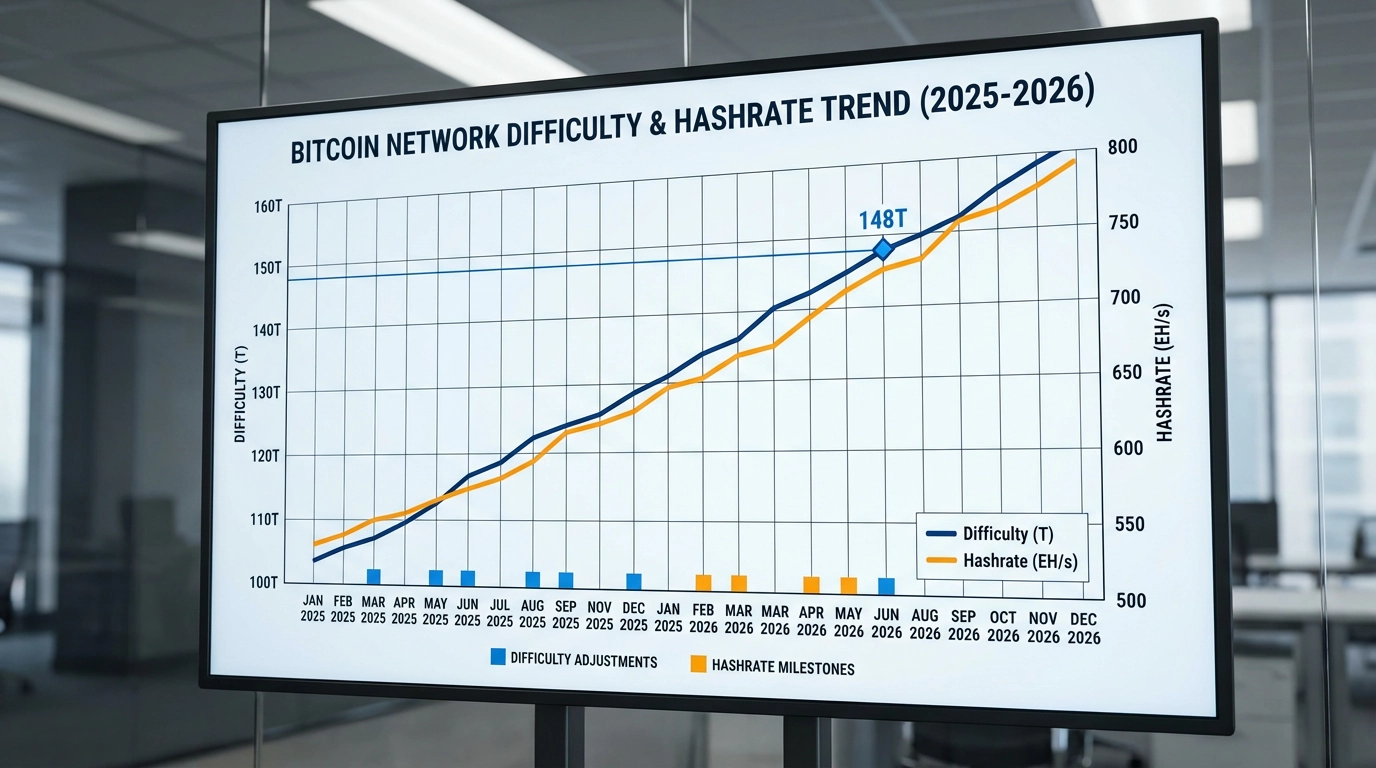

Network Difficulty Trajectory and Hashrate Dynamics

Bitcoin’s mining difficulty adjustment mechanism ensures blocks maintain ~10-minute intervals regardless of total network hashrate. As 2026 begins, this self-regulating system faces interesting dynamics from new ASIC deployments, miner capitulations, and institutional mining expansion.

Recent Difficulty Movements

Mining difficulty climbed throughout 2025, peaking near all-time highs in December before stabilizing around 148T. This represents approximately 36.5% growth year-over-year, reflecting massive hardware deployments despite the April 2024 halving reducing block rewards to 3.125 BTC.

Hashrate Distribution

Global hashrate distribution continues shifting toward North American operations with access to stranded energy and favorable regulatory environments. However, significant capacity remains in Kazakhstan, Russia, and strategic Middle Eastern jurisdictions. Network hashrate volatility decreased compared to 2024, suggesting maturing operational stability.

Forward Difficulty Projections

If BTC price maintains current levels or improves toward $95,000-$100,000, mining difficulty likely resumes upward trajectory through Q1 2026. Conversely, sustained price weakness toward $80,000 would trigger meaningful hashrate attrition from marginal operators, allowing difficulty to decline 5-8% over subsequent adjustment periods.

Strategic Implications for Mining Operations

Table: Break-Even Analysis by Hardware Generation

| Miner Model | Break-Even BTC Price (@ $0.07/kWh) | Current Margin | Recommended Action |

|---|---|---|---|

| S23 Hyd | $62,000 | Strong | Continue operation |

| S21 XP | $67,000 | Healthy | Continue operation |

| S21 Pro | $73,000 | Moderate | Monitor closely |

| S19 XP | $85,000 | Minimal | Consider upgrade |

| S19 Pro | $92,000 | Negative | Decommission or upgrade |

Analysis based on network difficulty = 148T, electricity = $0.07/kWh

Mining operations face critical strategic decisions as market conditions evolve. The shift in U.S. session trading patterns, while potentially positive for overall price stability, introduces new volatility considerations for treasury management and hedging strategies.

Hardware Upgrade Economics

With latest-generation ASICs delivering 9-11 W/TH efficiency compared to 25-30 W/TH for legacy equipment, the payback period for hardware upgrades compressed significantly. Operations running S19-era equipment should model replacement economics carefully, particularly if electricity costs exceed $0.06/kWh.

Treasury Management Considerations

The potential stabilization or improvement in U.S. session price behavior reduces some systematic selling pressure that miners faced when liquidating daily production. This could allow for more strategic treasury management rather than forced immediate sales to cover operating expenses.

Risk Mitigation Strategies

Given uncertainty around sustained pattern changes and ongoing difficulty increases, miners should consider multi-month forward sales via CME futures or structured OTC contracts to lock in current favorable hash price. Additionally, power procurement strategies should emphasize flexibility given the rapid pace of efficiency improvements in mining hardware.

Macro Context and 2026 Market Structure

Bitcoin’s early 2026 price action occurs within a complex macroeconomic context. U.S. monetary policy, global liquidity conditions, and cryptocurrency regulatory developments all influence trading patterns across different sessions.

Federal Reserve Policy Impact

The Federal Reserve’s stance on interest rates directly affects risk asset appetite during U.S. trading hours. Late 2025 saw renewed hawkish rhetoric, contributing to systematic selling pressure in crypto markets during American sessions. Early 2026 data suggests some softening in this tone, potentially explaining improved U.S. session behavior for Bitcoin.

Institutional Adoption Maturation

Spot ETF products reached a maturation phase where volatile flows from early adopters stabilized. BlackRock’s IBIT and Fidelity’s FBTC now hold combined assets exceeding $30 billion, representing significant structural demand. However, redemption patterns during late 2025 demonstrated that institutional holders maintain active portfolio management rather than pure “HODL” behavior.

Regulatory Clarity Developments

Improved regulatory clarity around cryptocurrency classification and custody requirements in major jurisdictions reduces compliance friction for institutional participation. This structural improvement may contribute to more stable trading behavior across all sessions, reducing the pronounced U.S. session weakness observed in late 2025.

Technical Analysis and Price Action Outlook

From a technical perspective, Bitcoin’s positioning near $90,000 represents a critical juncture for directional resolution in early 2026.

Support and Resistance Levels

Key support exists at $87,000-$88,000, representing the late 2025 consolidation range. Resistance clusters around $95,000-$97,000, with more significant overhead supply near $102,000-$105,000 from late 2024 distribution. A decisive break above $95,000 on sustained volume would target $110,000 over subsequent weeks.

Volume Profile Analysis

On-chain volume metrics indicate moderate conviction around current levels. Exchange inflows decreased during early January compared to December, suggesting reduced immediate selling pressure. However, significant whale accumulation remains absent compared to major bottom formations in previous cycles.

Volatility Considerations

Realized volatility compressed during late December before expanding slightly in early January. Implied volatility in options markets remains elevated in near-term tenors relative to longer-dated contracts, indicating uncertainty around immediate directional resolution despite potential longer-term optimism.

Mining Infrastructure and Energy Considerations

The relationship between Bitcoin mining profitability and energy market dynamics continues evolving as the industry matures and global energy landscapes shift.

Renewable Energy Integration

Mining operations increasingly leverage renewable energy sources and participate in grid balancing services. This integration provides revenue diversification beyond pure Bitcoin mining and improves public perception. Texas, Norway, and Iceland lead in hosting mining operations with high renewable penetration.

Heat Recovery Applications

Innovative miners deploy heat recovery systems to monetize thermal byproducts from ASIC operation. Applications include greenhouse heating, industrial process heat, and district heating integration. These secondary revenue streams improve overall operation economics by 5-15% depending on local heat market conditions.

Curtailment Response Programs

Participation in demand response and curtailment programs allows miners to earn credits for reducing load during peak demand periods. This flexibility serves grid operators while providing miners with additional income streams that buffer against short-term BTC price volatility. As demonstrated in recent industry analysis, power curtailment credits can shield margins during volatile markets.

FAQ: Understanding Bitcoin’s US Session Behavior and Mining Impact

Q: Why has Bitcoin traditionally weakened during U.S. trading hours?

A: Multiple factors contributed to this pattern, including spot ETF redemptions processing during American hours, CME futures settlement mechanics, and institutional portfolio rebalancing. Additionally, macro news flow during U.S. sessions often triggered risk-off behavior affecting all asset classes.

Q: Is the early 2026 pattern change sustainable?

A: Sustainability depends on whether institutional flows genuinely shifted or if early January simply represented temporary positioning adjustments. Monitoring spot ETF flows, CME open interest, and continued U.S. session price behavior over coming weeks will clarify whether this represents a durable change or temporary anomaly.

Q: What does this mean for Bitcoin mining profitability?

A: Improved price stability or strength during U.S. hours reduces systematic selling pressure that miners previously faced. This allows more flexibility in treasury management and timing of Bitcoin sales to cover operating expenses, potentially improving realized prices by 1-3% through strategic execution.

Q: Which mining hardware remains profitable at current conditions?

A: Latest-generation equipment like the Antminer S23 Hyd, Antminer S21 XP, and S21 Pro maintain healthy margins at electricity costs below $0.08/kWh. Legacy S19-series hardware struggles unless power costs remain under $0.05/kWh.

Q: Should miners upgrade equipment now or wait?

A: The decision depends on current hardware efficiency, electricity costs, and capital availability. Operations running equipment less efficient than 20 W/TH should prioritize upgrades if electricity exceeds $0.06/kWh. Those with access to very cheap power (<$0.04/kWh) can extend legacy hardware life while monitoring next-generation releases.

Q: How high might mining difficulty climb in early 2026?

A: Assuming BTC price remains above $85,000 and new hardware deployments continue at current pace, difficulty could reach 155-160T by end of Q1 2026. However, if price weakens toward $75,000, expect difficulty to stabilize or decrease as marginal operators shut down.

Q: What role do institutional investors play in session-based patterns?

A: Institutional investors predominantly trade during their local market hours, creating concentrated flow during specific sessions. U.S. institutional activity during American hours dramatically impacts intraday patterns due to the size and sophistication of these market participants.

Q: Can miners hedge against U.S. session volatility?

A: Yes, through multiple mechanisms including CME Bitcoin futures to lock in forward prices, options strategies to protect against downside, and participating in structured OTC products. Additionally, diversifying sale timing across multiple sessions reduces exposure to U.S.-hour specific weakness.

Conclusion: Monitoring Pattern Evolution Through Q1 2026

The rare strength Bitcoin exhibited during early 2026 U.S. trading sessions represents either a meaningful shift in market structure or a temporary aberration before previous patterns reassert. For Bitcoin miners, understanding these dynamics matters beyond pure academic interest—session-based price behavior directly impacts treasury management strategies and realized pricing for daily production.

As network difficulty hovers near all-time highs and latest-generation ASIC hardware sets new efficiency benchmarks, operations must balance immediate profitability with strategic positioning for an evolving market landscape. Whether the U.S. session pattern genuinely shifted or will revert to late-2025 behavior remains the critical question for Q1 2026.

Miners should focus on controllable factors: securing competitive electricity rates, upgrading to efficient hardware, implementing sophisticated treasury management, and participating in ancillary revenue programs like demand response. These fundamentals determine long-term success regardless of short-term session-based price volatility.

For more insights on navigating volatile mining conditions, explore our analysis of Bitcoin mining outlook as BTC hovers near $90K and discover how mining difficulty adjustments affect profitability.

References:

- CoinDesk: Bitcoin Pushes Above $90,000 as Traders Eye Change in Pattern

- Hashrate Index: Top 10 Bitcoin Mining ASIC Machines for 2026

- Miners1688: Bitcoin Mining Analysis and Market Insights