Bitcoin has entered one of its quietest trading periods in recent months, with price action compressed within a tight $85,000-$90,000 corridor for over two weeks. This consolidation has triggered a technical phenomenon known as a Bollinger Band Squeeze, historically a precursor to significant price volatility. For miners navigating network difficulty at all-time highs of 148.2T, understanding this pattern’s implications extends beyond simple price speculation—it directly impacts operational profitability, equipment investment timing, and strategic positioning for 2026.

The cryptocurrency market currently finds itself at a critical inflection point. While traders focus on directional breakout potential, mining operations face a unique calculus: profit margins compressed by rising difficulty, capital allocation decisions for next-generation hardware, and the persistent question of whether current price levels justify continued expansion. This analysis examines the Bollinger Squeeze through a mining-centric lens, connecting technical price patterns to operational realities facing the industry as we transition into the new year.

Understanding the Current Bitcoin Bollinger Band Squeeze

The Bollinger Band Squeeze represents one of technical analysis’s most reliable volatility indicators. Bitcoin’s current configuration shows the gap between upper and lower bands narrowing to less than $3,500, matching compression levels last observed in July 2025. This tightening occurs when price volatility drops substantially, with standard deviation bands converging around the 20-day simple moving average.

Legendary trader John Bollinger himself recently highlighted Bitcoin’s current setup as a “near perfect base” with textbook squeeze characteristics. The two-week consolidation between $85,000 and $90,000 has allowed the bands to contract significantly, creating what technical analysts call “energy accumulation” before an eventual explosive move. Historical data confirms that similar squeezes have consistently preceded 15-20% price swings within 2-4 weeks following the initial breakout.

The current squeeze’s significance lies in its timing and context. Unlike mid-2025 squeezes that occurred during trending markets, this consolidation happens as Bitcoin attempts to establish a stable base after considerable price discovery. Volume profiles show balanced accumulation, with neither bulls nor bears gaining definitive control. This equilibrium state, while frustrating for short-term traders, creates optimal conditions for algorithmic mining operations to reassess profitability forecasts and adjust operational strategies before the next volatility cycle begins.

For mining operations, this period of reduced volatility offers a strategic window. Price stability allows more accurate revenue projections, facilitating better decision-making around hardware purchases, energy contract negotiations, and capacity planning. Miners deploying capital during squeeze phases have historically achieved better unit economics compared to those investing during peak volatility periods.

Historical Patterns What Previous Squeezes Tell Us

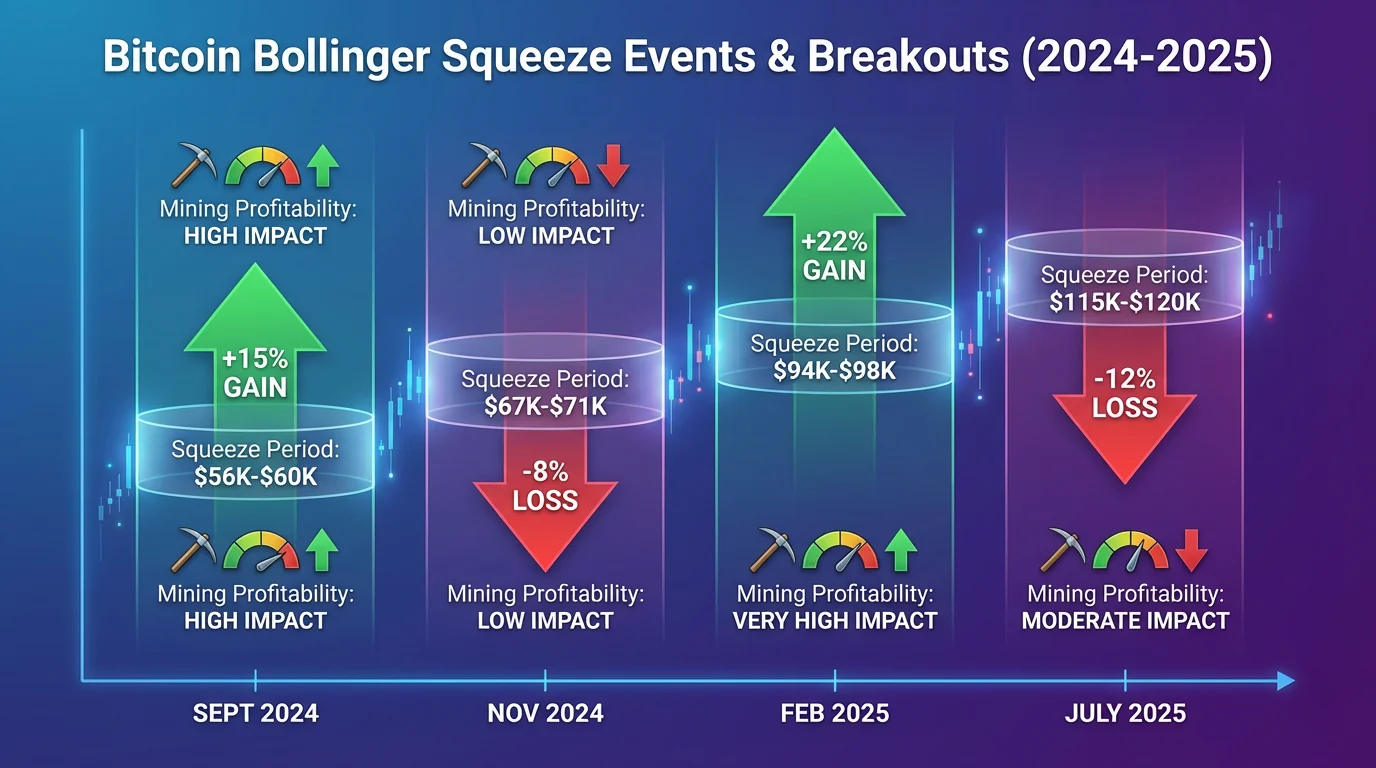

Examining Bitcoin’s price behavior following previous Bollinger Squeezes reveals consistent patterns with direct mining implications. The July 2025 squeeze, which occurred within a $115,000-$120,000 range, preceded a three-month expansion phase where Bitcoin swung between $100,000 and $126,000. This 26% range created substantial profit margin variance for miners, with operations locked into fixed electricity costs experiencing monthly profitability swings exceeding 40%.

The February 2025 squeeze presented a contrasting scenario. After compressing between $94,000 and $98,000, Bitcoin broke downward to $80,000 by month-end—a 17% decline that pushed many inefficient mining operations into negative cash flow territory. Machines with efficiency ratios above 20 J/TH became unprofitable at typical North American electricity rates of $0.06-$0.08/kWh. This historical episode underscores squeeze breakouts’ directional uncertainty and the importance of operational flexibility.

Data extending back to 2018 shows Bollinger Squeezes have accurately signaled volatility expansions with approximately 87% reliability. However, the direction of breakout remains roughly evenly distributed, with 52% resolving upward and 48% downward across the sample set. This statistical reality requires miners to develop scenario-based operational plans rather than betting on a single directional outcome.

The table below synthesizes key historical squeeze events and their mining profitability impacts:

| Squeeze Period | Range | Breakout Direction | Price Swing | Mining Profitability Impact |

|---|---|---|---|---|

| July 2025 | $115K-$120K | Bidirectional expansion | $100K-$126K (26%) | +40-60% variance in monthly margins |

| February 2025 | $94K-$98K | Downward | Declined to $80K (-17%) | Machines >20 J/TH became unprofitable |

| November 2024 | $67K-$71K | Upward | Rallied to $89K (+28%) | Doubled profitability for efficient operations |

| September 2024 | $56K-$60K | Downward | Dropped to $49K (-15%) | 30% of global hashrate temporarily offline |

Current squeeze conditions most closely resemble the July 2025 scenario in terms of absolute price level and market structure. However, network difficulty has increased by 35% since January 2025, fundamentally altering the profitability equation. Miners must now achieve higher BTC prices or improved operational efficiency to maintain equivalent profit margins from earlier periods.

Mining Profitability in the $85K-$90K Range

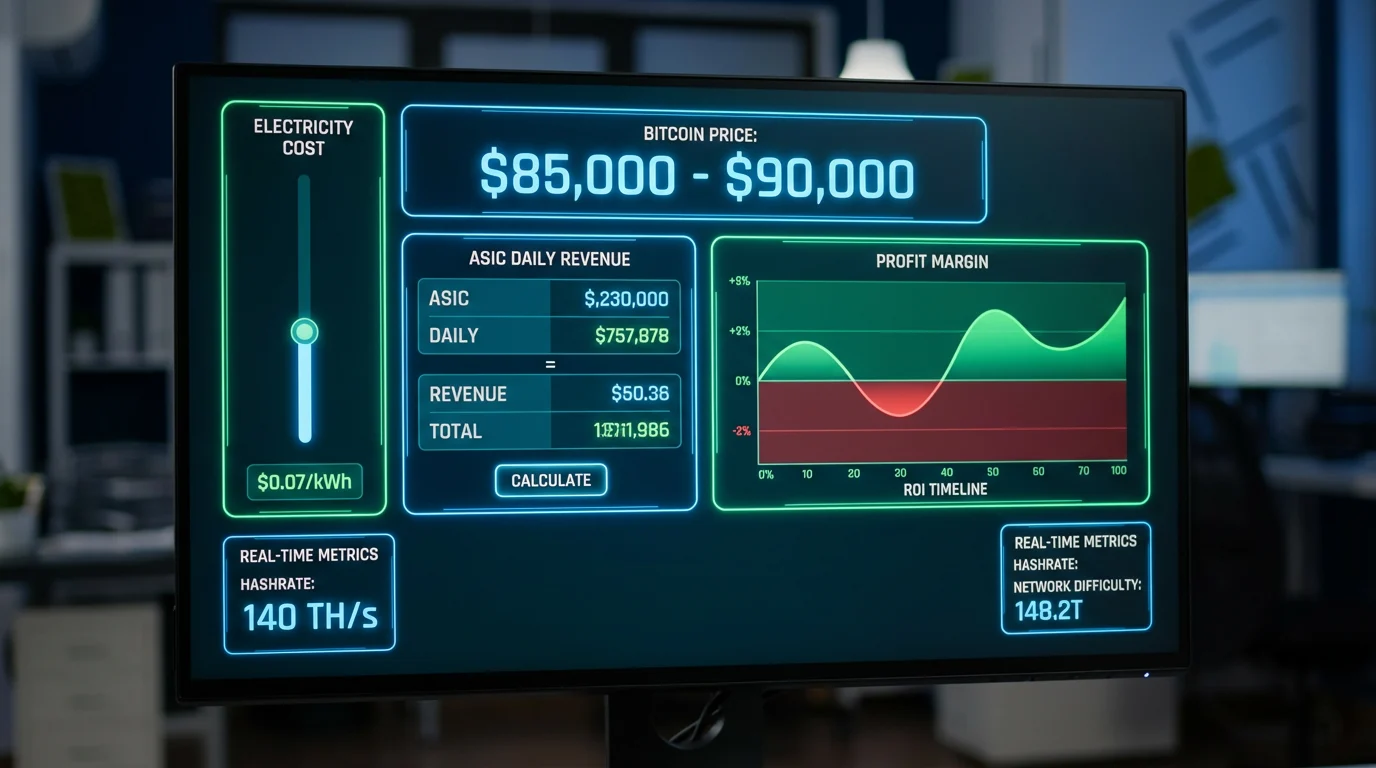

Bitcoin’s current trading range of $85,000-$90,000 presents a complex profitability landscape for mining operations. At the midpoint of $87,500, top-tier ASIC miners like the Antminer S21 XP (270 TH/s, 3,600W) generate approximately $8.50-$9.50 per day at $0.07/kWh electricity costs. This translates to monthly gross revenue of $255-$285 per unit before operational overhead, facility costs, and capital depreciation.

The profit margin compression becomes evident when examining year-over-year comparisons. In January 2025, the same Bitcoin price level ($87,500) yielded approximately $12-$14 daily revenue per S21 XP unit due to network difficulty of 109.8T. Current difficulty of 148.2T represents a 35% increase, directly reducing per-machine profitability by roughly the same percentage. This difficulty inflation has effectively erased profit gains that would otherwise result from Bitcoin’s price appreciation throughout 2025.

Different miner models demonstrate vastly different profitability profiles in this price range. The table below compares leading ASIC miners at current network conditions:

| Miner Model | Hashrate | Power | Efficiency | Daily Revenue | Daily Profit ($0.07/kWh) | ROI Period |

|---|---|---|---|---|---|---|

| Antminer S21 XP | 270 TH/s | 3,600W | 13.3 J/TH | $9.20 | $3.22 | 12-14 months |

| Antminer S21 Pro | 234 TH/s | 3,510W | 15.0 J/TH | $8.00 | $2.11 | 15-18 months |

| WhatsMiner M60S | 186 TH/s | 3,370W | 18.1 J/TH | $6.35 | $0.71 | 22-26 months |

| Antminer S19 XP | 140 TH/s | 3,010W | 21.5 J/TH | $4.78 | -$0.22 | Unprofitable |

The data reveals a clear efficiency threshold: machines exceeding approximately 20 J/TH struggle to maintain positive cash flow at current Bitcoin prices and typical North American electricity rates. This explains the ongoing market consolidation, with older-generation equipment being phased out while operators upgrade to next-generation units like the S21 series.

Electricity cost remains the dominant variable determining mining viability. Operations with access to sub-$0.05/kWh power maintain healthy margins even with mid-tier equipment, while those paying above $0.08/kWh face compressed profits even with the most efficient machines. This cost structure advantage has driven geographic concentration of mining operations toward regions with stranded energy resources, hydroelectric power, and favorable regulatory environments.

The Bollinger Squeeze’s resolution will dramatically impact these profitability calculations. An upward breakout toward $100,000-$107,000 would restore robust margins across most equipment classes, potentially justifying accelerated fleet expansion. Conversely, a breakdown below $80,000 could force marginal operations offline, reducing network hashrate and triggering a difficulty adjustment that would stabilize remaining miners’ profitability—albeit at lower absolute revenue levels.

Network Difficulty Reaches 148T Impact on Mining Operations

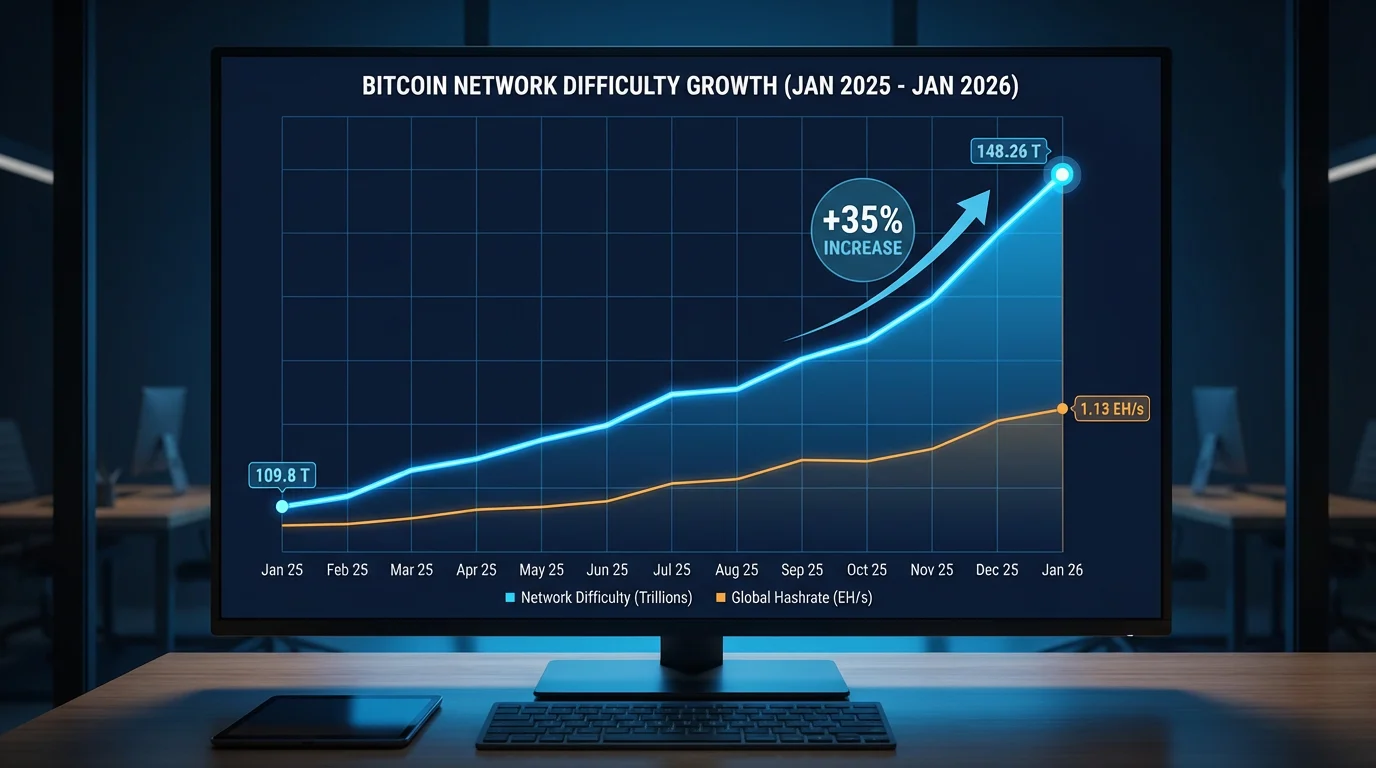

Bitcoin’s network difficulty closed 2025 at 148.26 trillion, representing a 35.1% increase from the 109.8 trillion recorded on January 1, 2025. This relentless upward trajectory reflects continued global hashrate expansion despite price volatility and margin compression throughout the year. The network’s computational power now exceeds 1.1 exahash per second (EH/s), a psychological milestone that underscores Bitcoin’s security but simultaneously intensifies competition among mining operations.

The difficulty adjustment mechanism’s impact on operational planning cannot be overstated. Bitcoin’s protocol recalibrates mining difficulty approximately every two weeks (2,016 blocks) to maintain a consistent 10-minute average block time. The next adjustment, projected for January 8, 2026, forecasts another 1.5-2.0% increase based on current hashrate trends. This means miners acquiring equipment today face an even more challenging competitive landscape within days of deployment.

Hashrate growth has outpaced Bitcoin price appreciation throughout 2025, creating a profitability squeeze. While Bitcoin traded near $87,500 in both January 2025 and January 2026, the 35% difficulty increase means each terahash of mining capacity now generates 26% less revenue than it did twelve months ago. This dynamic forces continuous operational optimization and equipment upgrades merely to maintain existing profit levels, let alone grow margins.

Several factors drive persistent difficulty increases despite margin compression:

Institutional mining expansion: Publicly traded mining companies raised over $4.2 billion in capital throughout 2025, largely deployed toward fleet expansion and next-generation equipment acquisition. Companies like Marathon Digital and Riot Platforms added tens of thousands of next-generation ASIC miners, contributing significantly to global hashrate growth.

Geographic diversification: Mining operations expanded into emerging markets with favorable energy costs and regulatory environments. Regions including Paraguay, Argentina, and the Middle East saw substantial hashrate additions, diversifying Bitcoin’s security model while increasing global competition for block rewards.

Equipment efficiency improvements: The transition from 20-25 J/TH machines (S19 generation) to 13-18 J/TH units (S21 generation) allows miners to deploy more hashrate per unit of electrical infrastructure. This efficiency gain enables capacity expansion without proportional facility upgrades, accelerating network difficulty growth.

Halving adjustment period: The April 2024 halving reduced block rewards from 6.25 BTC to 3.125 BTC, initially causing hashrate decline as marginal operations became unprofitable. However, Bitcoin’s subsequent price appreciation to the $85,000-$95,000 range restored profitability, triggering renewed investment and hashrate recovery that ultimately pushed difficulty to new highs.

The interaction between difficulty and the current Bollinger Squeeze creates a particularly complex strategic environment. If Bitcoin breaks upward toward $100,000+, current difficulty levels become highly profitable, justifying aggressive capacity expansion. However, if price breaks downward toward $75,000-$80,000, difficulty at 148T+ would force significant hashrate offline, potentially triggering the first meaningful difficulty decrease since the 2022 bear market.

Mining operations with strong balance sheets and access to low-cost power can leverage this uncertainty strategically. Acquiring equipment during periods of uncertainty often yields superior unit economics compared to purchasing during obvious market strength when equipment prices inflate and delivery timelines extend. The current squeeze environment presents such an opportunity for well-capitalized miners with conviction in Bitcoin’s long-term trajectory.

Best ASIC Miners for Current Market Conditions

Navigating the current mining landscape requires careful equipment selection aligned with operational objectives, electricity costs, and capital availability. The market for Bitcoin mining hardware has matured significantly, with clear performance tiers emerging that dictate profitability potential under various scenarios.

Top-Tier Efficiency Leaders

The Bitmain Antminer S21 XP (270 TH/s, 3,600W, 13.3 J/TH) currently represents the gold standard for air-cooled Bitcoin mining equipment. Its exceptional efficiency of 13.3 joules per terahash enables profitability across a wide range of electricity costs and Bitcoin price scenarios. At $87,500 BTC and $0.07/kWh power costs, the S21 XP generates approximately $3.20 daily profit, yielding a 12-14 month ROI at current market pricing of $3,600-$4,200 per unit.

For operations with hydro-cooling infrastructure, the S21 XP Hydro variant (473 TH/s, 6,200W, 13.1 J/TH) offers even superior performance. The hydro-cooling system enables higher operational frequencies while maintaining efficiency, resulting in 75% more hashrate per unit. However, the $12,000-$14,000 unit cost and specialized cooling requirements make this option viable primarily for large-scale operations with existing liquid cooling infrastructure.

Mid-Tier Value Propositions

The Bitmain Antminer S21 Pro (234 TH/s, 3,510W, 15.0 J/TH) offers a compelling balance between performance and capital efficiency. While slightly less efficient than the S21 XP, its lower acquisition cost ($2,800-$3,400) results in comparable ROI timelines of 15-18 months. For operations prioritizing capital preservation or those uncertain about the breakout direction, the S21 Pro’s lower initial investment reduces downside risk if Bitcoin trends toward the lower end of projections.

Alternative manufacturers provide competitive options worth considering. The WhatsMiner M60S (186 TH/s, 3,370W, 18.1 J/TH) serves as a budget-friendly entry point at $2,200-$2,600 per unit. While less efficient than Bitmain’s offerings, its lower capital requirement enables faster deployment of megawatt-scale operations. At electricity costs below $0.06/kWh, the M60S maintains adequate profit margins, though its viability decreases rapidly at higher power costs.

Obsolescence Thresholds

Older-generation equipment faces increasing viability challenges at current difficulty levels. The Antminer S19 XP (140 TH/s, 3,010W, 21.5 J/TH), previously a workhorse of the mining industry, now struggles to maintain profitability at typical North American electricity rates. At $87,500 BTC and $0.07/kWh, the S19 XP generates negative cash flow, making it suitable only for operations with access to extremely cheap power (sub-$0.04/kWh) or those anticipating significant Bitcoin price appreciation.

The efficiency threshold separating viable from obsolete equipment currently sits around 19-20 J/TH at $87,500 Bitcoin prices. This threshold shifts dynamically with both price movement and difficulty adjustments. An upward breakout to $100,000+ would extend the viability of 20-22 J/TH machines, while a breakdown below $80,000 would render even some 18 J/TH equipment unprofitable at average electricity costs.

Strategic Equipment Selection Considerations

For new mining operations or those planning expansion, several factors should guide equipment selection beyond simple efficiency metrics:

Capital efficiency: Lower-cost machines enable faster deployment of total megawatts when capital availability constrains growth. A $1 million budget deploys 238 units of S21 Pro (54.8 PH/s) versus 250 units of S21 XP (67.5 PH/s), representing meaningful hashrate differences but also different ROI profiles.

Electricity cost environment: Operations with power costs below $0.05/kWh can consider mid-tier equipment like the M60S profitably, while those paying $0.07-$0.08/kWh must prioritize top-tier efficiency to maintain margins. The efficiency premium becomes exponentially more valuable as electricity costs increase.

Market timing: Current Bollinger Squeeze uncertainty creates equipment pricing volatility. Manufacturers and resellers often offer discounts during periods of market uncertainty, making the current environment potentially attractive for strategic equipment acquisitions. Conversely, waiting for breakout confirmation risks equipment price increases and extended delivery timelines as demand surges.

Warranty and support: Miners1688 provides comprehensive technical support and after-sales service for all equipment sold through our platform, including remote troubleshooting and maintenance coordination. This support infrastructure becomes critical for operations without in-house technical expertise, potentially justifying modest price premiums for equipment purchased through established channels rather than gray-market sources.

The current market conditions favor a barbell approach: prioritizing top-tier efficiency equipment for core operations while selectively acquiring mid-tier machines where electricity costs and capital availability justify the efficiency trade-off. This diversified strategy provides resilience across various price scenarios while maintaining operational flexibility.

Strategic Positioning for the Breakout

The current Bollinger Squeeze creates a unique decision window for mining operations across the business lifecycle spectrum—from established operators considering expansion to prospective miners evaluating market entry. Historical patterns suggest the squeeze will resolve within 2-4 weeks, making immediate strategic positioning critical for capturing optimal outcomes.

Scenario Planning Framework

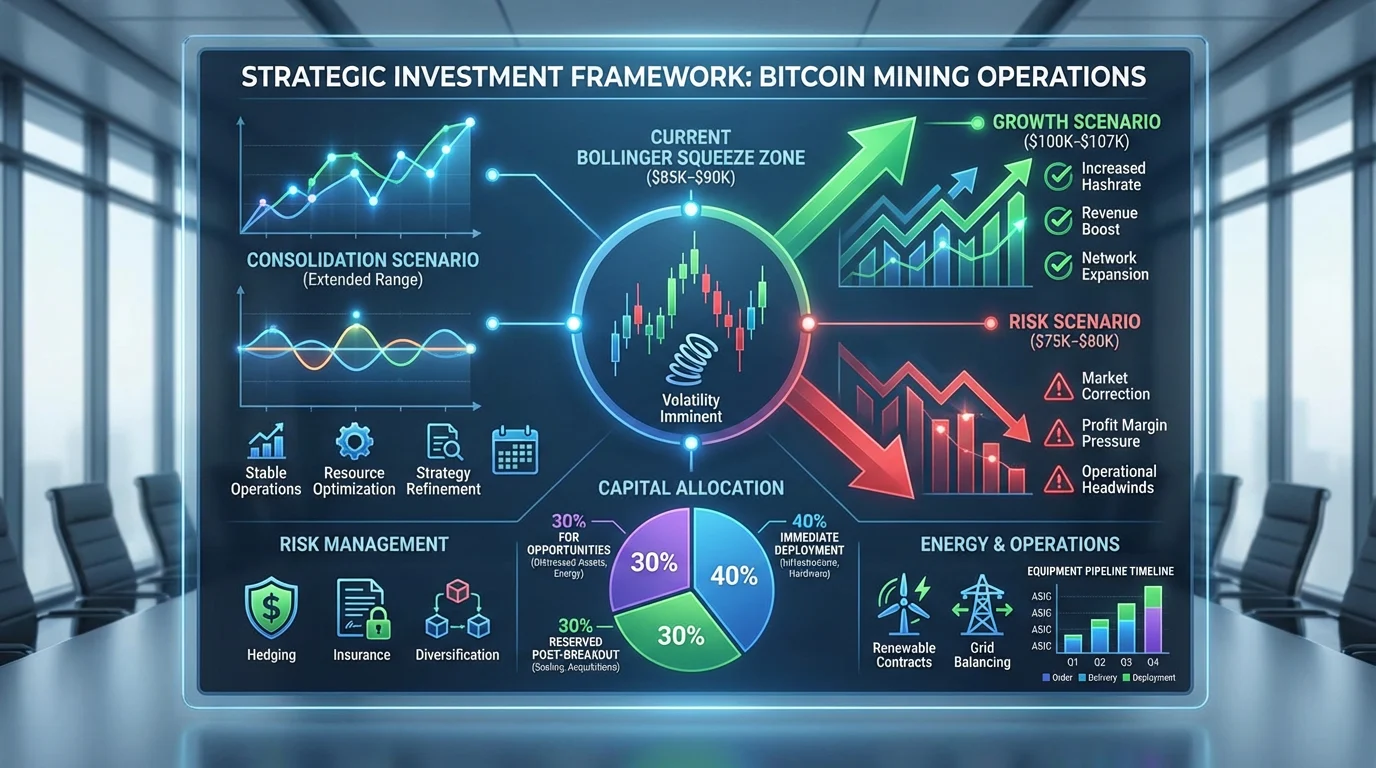

Sophisticated mining operations approach the current environment through multi-scenario planning rather than single-point forecasts. This framework involves developing operational responses for three primary breakout scenarios:

Upside breakout ($100,000-$107,000): Bitcoin breaking above $95,000 with sustained momentum would restore robust profit margins across all equipment classes. Operations should position for this scenario through secured equipment orders with staggered delivery timelines, ensuring capacity comes online as price strength confirms. Pre-negotiated equipment purchases with delivery flexibility allow participation in the upside while minimizing downside if the breakout fails.

Downside breakdown ($75,000-$80,000): A break below $85,000 would compress margins significantly, potentially forcing 15-20% of global hashrate offline as marginal operations become unprofitable. This scenario paradoxically creates opportunity for well-capitalized miners through two mechanisms: discounted equipment acquisition as financially stressed competitors liquidate, and difficulty adjustments that improve per-unit profitability for surviving operations.

Extended consolidation ($85,000-$95,000): Continued range-bound trading extends the current profitability environment, favoring efficient operations while attriting marginal miners through sustained low margins. This scenario supports gradual, consistent capacity expansion while avoiding aggressive capital deployment that assumes specific directional outcomes.

Capital Allocation Strategies

Current market conditions favor staged capital deployment over all-or-nothing commitments. A typical strategic approach might allocate 40% of available expansion capital immediately toward high-efficiency equipment, 30% reserved for opportunistic deployment following breakout confirmation, and 30% held for distressed equipment acquisitions if downside scenarios materialize.

This staged approach provides exposure to upside scenarios while maintaining flexibility to exploit downside opportunities. Mining operations that deployed 100% of available capital during the $115,000-$120,000 consolidation period in mid-2025 subsequently faced months of compressed margins without reserves to acquire equipment at more favorable pricing when Bitcoin retreated.

Energy Contract Optimization

The squeeze period offers an ideal environment for energy contract renegotiation and optimization. Electricity suppliers frequently offer improved terms during periods of reduced mining industry expansion, making the current consolidation window strategically valuable for locking in favorable long-term power costs. Operations that secured sub-$0.05/kWh power contracts during previous consolidation periods achieved sustained competitive advantages that persisted through multiple market cycles.

Some operations are exploring creative power procurement strategies including curtailment credits, where miners receive compensation for voluntarily reducing consumption during grid stress periods. These programs, increasingly common in Texas and other mining-heavy regions, can reduce effective electricity costs by 10-20% while providing grid stabilization services. The value of such programs increases during volatile price environments where operational flexibility becomes more valuable than maximum uptime.

Equipment Pipeline Management

Experienced mining operations maintain diversified equipment pipelines rather than single large orders. The current environment favors placing orders with multiple manufacturers and delivery timelines, reducing exposure to single-vendor risks including delivery delays, specification changes, or quality issues. Diversified pipelines also create negotiating leverage, as manufacturers compete for large-scale orders during periods of reduced industry-wide demand.

Direct relationships with suppliers like Miners1688 provide advantages during uncertain market conditions. Established supply relationships often yield preferential pricing, flexible payment terms, and priority allocation of limited supply during high-demand periods. These relationships take years to develop, making the current relatively slow period ideal for establishing or strengthening supplier partnerships that will prove valuable during the next expansion cycle.

Risk Management Through Hedging

While spot mining—simply holding mined Bitcoin without hedging—remains the most common approach, sophisticated operations increasingly employ hedging strategies during high-uncertainty periods like the current squeeze. Options contracts allow miners to establish price floors that guarantee minimum profitability while maintaining upside participation. For example, purchasing $85,000 put options ensures profitability even if the squeeze resolves downward, while still capturing gains if Bitcoin breaks toward $100,000+.

Hashprice derivatives, an emerging market innovation, allow miners to hedge their effective hashrate revenue rather than Bitcoin price directly. These instruments account for both price and difficulty, providing more precise risk management aligned with actual mining economics. While still relatively illiquid compared to Bitcoin price derivatives, hashprice markets have matured significantly throughout 2025.

Operational Efficiency Initiatives

Consolidation periods offer ideal environments for implementing operational efficiency improvements that become overwhelmed during rapid expansion phases. Current conditions support:

Facility optimization: Reviewing cooling system efficiency, power distribution upgrades, and layout optimization to reduce overhead costs per unit of hashrate deployed.

Monitoring infrastructure: Implementing comprehensive monitoring systems that provide real-time visibility into per-machine performance, enabling rapid identification and remediation of underperforming units.

Maintenance protocols: Developing systematic maintenance schedules that maximize equipment uptime and lifespan, reducing total cost of ownership across the fleet lifecycle.

Team development: Investing in technical training and process documentation during slower periods ensures operational readiness when rapid expansion resumes following the breakout.

Operations that prioritize infrastructure and operational improvements during consolidation periods consistently outperform competitors that focus exclusively on hashrate growth during favorable markets. The current squeeze environment represents such a strategic window for forward-thinking mining operations.

FAQ: Bitcoin Bollinger Squeeze and Mining Strategy

What does a Bollinger Band Squeeze mean for Bitcoin price?

A Bollinger Band Squeeze indicates extremely low volatility with bands compressed to multi-month lows. Historically, these patterns precede significant price movements (15-20% swings) within 2-4 weeks, though direction remains uncertain. Bitcoin’s current squeeze between $85,000-$90,000 matches compression levels last seen in July 2025, which preceded a three-month expansion phase with prices ranging between $100,000-$126,000.

How does Bitcoin’s current price range affect mining profitability?

At Bitcoin prices between $85,000-$90,000, profitability varies dramatically by equipment efficiency and electricity costs. Top-tier machines like the Antminer S21 XP (13.3 J/TH) generate approximately $3-$4 daily profit at $0.07/kWh power costs, maintaining 12-14 month ROI timelines. However, older-generation equipment exceeding 20 J/TH efficiency struggles to maintain positive cash flow at typical North American electricity rates. The 35% network difficulty increase since January 2025 has effectively reduced per-machine revenue by a similar percentage despite stable Bitcoin prices.

What is Bitcoin’s current network difficulty and why does it matter?

Bitcoin network difficulty reached 148.26 trillion at the end of 2025, representing a 35.1% increase from January 2025’s 109.8 trillion. Difficulty directly determines how much revenue each unit of hashrate generates—higher difficulty means each mining machine competes with more global computational power for the same block rewards. The next difficulty adjustment projected for January 8, 2026 forecasts another 1.5-2.0% increase, further compressing profit margins unless Bitcoin price appreciates proportionally.

Which ASIC miners are most profitable in current market conditions?

The Bitmain Antminer S21 XP (270 TH/s, 13.3 J/TH) leads profitability rankings for air-cooled equipment, generating positive cash flow across various electricity cost scenarios. The S21 Pro (234 TH/s, 15.0 J/TH) offers compelling value with lower acquisition costs ($2,800-$3,400) and acceptable efficiency. Machines exceeding 19-20 J/TH efficiency approach obsolescence at current Bitcoin prices and difficulty levels, remaining viable only for operations with extremely cheap electricity (below $0.04-$0.05/kWh).

Should miners buy equipment now or wait for the breakout?

Current market uncertainty creates both opportunity and risk. Staged capital deployment—allocating 40-50% of expansion budget immediately toward high-efficiency equipment while reserving capital for post-breakout opportunities—balances participation in upside scenarios with flexibility for downside. Equipment manufacturers and resellers often offer favorable pricing during consolidation periods, making strategic acquisitions potentially attractive despite directional uncertainty. Miners1688 provides comprehensive technical support and flexible purchasing arrangements that reduce timing risk for well-planned acquisitions.

How can mining operations prepare for volatility following the squeeze?

Sophisticated operations employ multi-scenario planning: securing equipment orders with flexible delivery for upside scenarios, maintaining capital reserves for distressed equipment acquisitions if downside materializes, and optimizing operational efficiency during the consolidation period. Energy contract renegotiation, facility optimization, and monitoring infrastructure improvements implemented during low-volatility windows provide competitive advantages when rapid market expansion resumes. Relationships with established suppliers like Miners1688 ensure access to equipment and technical support regardless of which breakout scenario ultimately unfolds.

References & Related Resources: