Summary: As Bitcoin mining profitability faces mounting pressure from rising network difficulty and electricity costs, demand response curtailment programs have emerged as a crucial revenue diversification strategy. This analysis explores how miners can leverage power market participation to offset declining margins during BTC price volatility in 2025.

Understanding Curtailment Credits in Bitcoin Mining Operations

Curtailment credits represent payment incentives that electricity grid operators provide to large-scale energy consumers—including Bitcoin miners—for voluntarily reducing power consumption during peak demand periods. In 2025, this demand-response mechanism has evolved into a critical profit center for mining operations facing compressed margins.

How Curtailment Programs Generate Revenue

Bitcoin mining facilities possess unique flexibility: they can power down operations within minutes without damaging equipment or disrupting production schedules. This characteristic makes them ideal participants in grid stabilization programs.

When grid operators face stress—such as extreme weather events, supply shortages, or unexpected demand spikes—they compensate miners for shutting down operations. Major mining companies like Riot Platforms reported curtailment credits exceeding $8.3 million in Q2 2025 alone, effectively reducing their cost-per-bitcoin by double-digit percentages.

The Economics of Strategic Shutdowns

Consider a hypothetical 50 MW mining facility operating during a 4-hour grid emergency:

- Curtailment payment: 50 MW × 4 hours × $2,000/MWh = $400,000

- Electricity cost savings: $16,000 (avoided consumption)

- Lost mining revenue: ~$35,000-50,000 (depending on BTC price)

- Net benefit: $365,000-380,000 for just 4 hours

This demonstrates how curtailment can generate revenues that significantly exceed normal mining operations, particularly when hashprice (mining profitability per unit of hashrate) remains suppressed.

Current Mining Margins: The 2025 Profitability Landscape

The Bitcoin mining industry in November 2025 operates under increasingly challenging conditions. Network difficulty reached 152.27 T following a modest 2.37% decrease on November 12, while the seven-day average hashrate declined from 1.124 ZH/s to approximately 1.06 ZH/s.

Hashprice at Historic Lows

Bitcoin’s hashprice—the daily revenue miners earn per petahash of computing power—dropped to $38.2 PH/s in mid-November 2025, marking a five-year low. This metric directly impacts operational profitability across all mining equipment generations.

For context, miners operating Bitmain Antminer S21 units (200 TH/s at 3,500W) at $0.08/kWh electricity costs face these economics:

- Daily revenue: ~$10.50-12.00 (at current hashprice)

- Daily electricity cost: ~$6.72

- Daily profit margin: $3.78-5.28 (before other operational expenses)

This translates to roughly 30-40% profit margins for efficient operations—a significant compression from the 50-60% margins experienced during more favorable market conditions.

Equipment Efficiency Matters More Than Ever

The profitability divide between old-generation and current-generation mining equipment has widened dramatically. Miners still operating older units like the Antminer S19 series (95 TH/s at 34.5 J/TH efficiency) are approaching break-even or operating at losses at many electricity price points.

Meanwhile, operators deploying next-generation equipment such as the Antminer S21 Pro (234 TH/s at 15 J/TH) or the S21+ Hyd maintain healthy margins even in challenging conditions.

H2:Curtailment as a Hedge Against BTC Price Volatility

Table 1: Revenue Comparison – Mining vs. Curtailment Scenarios

| Scenario | Mining Revenue (24h) | Curtailment Payment (4h event) | Electricity Saved | Net Outcome |

|---|---|---|---|---|

| Normal Operations | $525 (50 MW facility) | $0 | $0 | +$525 |

| High-Price Curtailment | $481 (20h mining) | $400,000 | $16,000 | +$416,481 |

| BTC Correction (-15%) | $446 (24h mining) | $0 | $0 | +$446 |

| BTC Correction + Curtailment | $401 (20h mining) | $400,000 | $16,000 | +$416,401 |

As illustrated, curtailment revenues remain stable regardless of Bitcoin price fluctuations, providing crucial income diversification during market downturns.

Strategic Participation in Demand Response Markets

Forward-thinking mining operations are now structuring their business models around grid participation. This includes:

1. Contractual Arrangements: Securing long-term agreements with grid operators that guarantee minimum curtailment compensation regardless of activation frequency.

2. Geographic Optimization: Positioning mining facilities in regions with high curtailment payment rates. Texas ERCOT market, for example, regularly offers $2,000-9,000/MWh during scarcity pricing events.

3. Infrastructure Investment: Implementing rapid-response systems that can curtail operations within 60 seconds of receiving grid signals, maximizing program participation opportunities.

Real-World Performance Data

Mining companies publishing financial results in Q3 2025 demonstrate the material impact of curtailment:

- Riot Platforms: Power curtailment credits of $8.3 million offset 6.4% of total mining costs

- LM Funding America: Mining margin improved from 41.0% to 49.0% quarter-over-quarter, partially attributed to eliminating hosting costs and optimizing curtailment opportunities

- Industry Average: Miners participating in demand response programs reported 15-25% lower effective electricity costs compared to non-participants

Grid Participation Models for Mining Operations

Bitcoin miners can engage with power markets through several distinct program structures, each offering different risk-reward profiles.

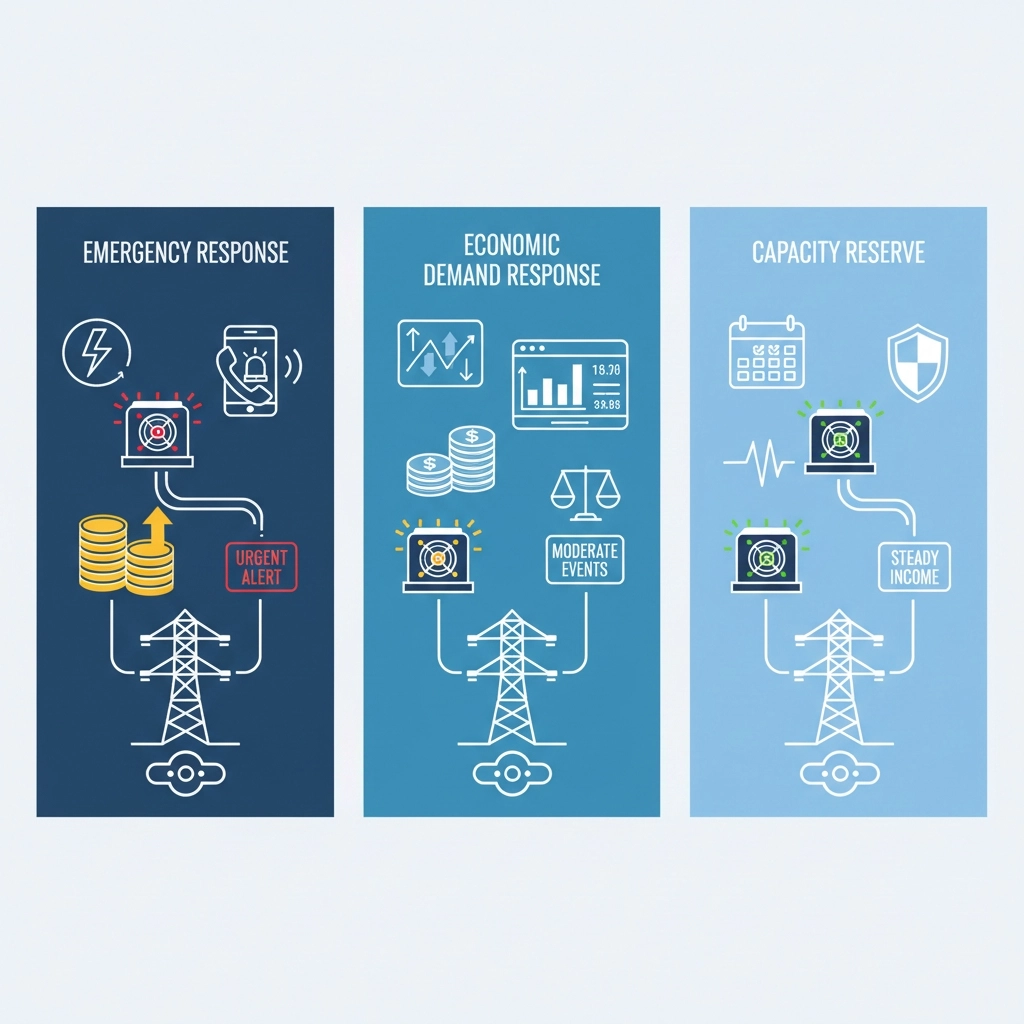

Emergency Response Programs

These programs activate during genuine grid emergencies—typically 5-20 events per year. Compensation rates are highest ($1,500-5,000/MWh) but predictability is lowest. Miners must respond within 10-30 minutes of notification.

Best suited for: Large-scale operations (>20 MW) with automated curtailment systems and sufficient profit margins to absorb occasional forced shutdowns.

Economic Demand Response

Miners voluntarily bid to curtail operations when wholesale electricity prices exceed predetermined thresholds. This provides more frequent participation opportunities (30-100+ events annually) at moderate compensation rates ($200-1,000/MWh).

Best suited for: Mid-sized operations (5-50 MW) with flexible operational strategies and real-time pricing exposure.

Capacity Reserve Markets

Operators commit to maintaining curtailment capacity year-round in exchange for monthly capacity payments, plus additional energy payments during activation events. This provides steady, predictable income streams.

Best suited for: Operations prioritizing revenue stability and willing to guarantee response capability, particularly valuable for securing project financing.

Equipment Selection for Curtailment-Optimized Operations

Not all mining hardware performs equally in curtailment-focused business models. Equipment selection should prioritize rapid restart capabilities, thermal cycling tolerance, and overall efficiency.

Recommended ASIC Miners for 2025 Operations

Tier 1: Premium Efficiency Class

- Bitmain Antminer S21 XP Hyd (500 TH/s, 11 J/TH): Industry-leading efficiency with excellent thermal management for frequent start-stop cycles

- WhatsMiner M60S++ (412 TH/s, 13.5 J/TH): Robust design optimized for variable-load operations

Tier 2: High-Performance Value

- Bitmain Antminer S21 Pro (234 TH/s, 15 J/TH): Excellent balance of capital cost and operational efficiency

- Canaan Avalon Made A1566 (185 TH/s, 18 J/TH): Lower upfront investment with acceptable efficiency for moderate electricity costs

Tier 3: Strategic Budget Options

- Bitmain Antminer S21 (200 TH/s, 17.5 J/TH): Competitive pricing with proven reliability

- Used S19 XP Units (140 TH/s, 21.5 J/TH): Secondary market value plays for operations with <$0.05/kWh electricity

Diversification Beyond Bitcoin

Some mining operations are hedging market volatility by deploying multi-algorithm capabilities:

Litecoin/Dogecoin Mining:

- Bitmain Antminer L9 (16 GH/s Scrypt): Provides diversification into proven alternative proof-of-work networks

- Elphapex DG2+ (20.5 GH/s): Higher throughput for dedicated LTC/DOGE operations

Emerging Networks:

- Goldshell AE Max II (Aleo mining): Exposure to privacy-focused blockchain infrastructure with growing adoption

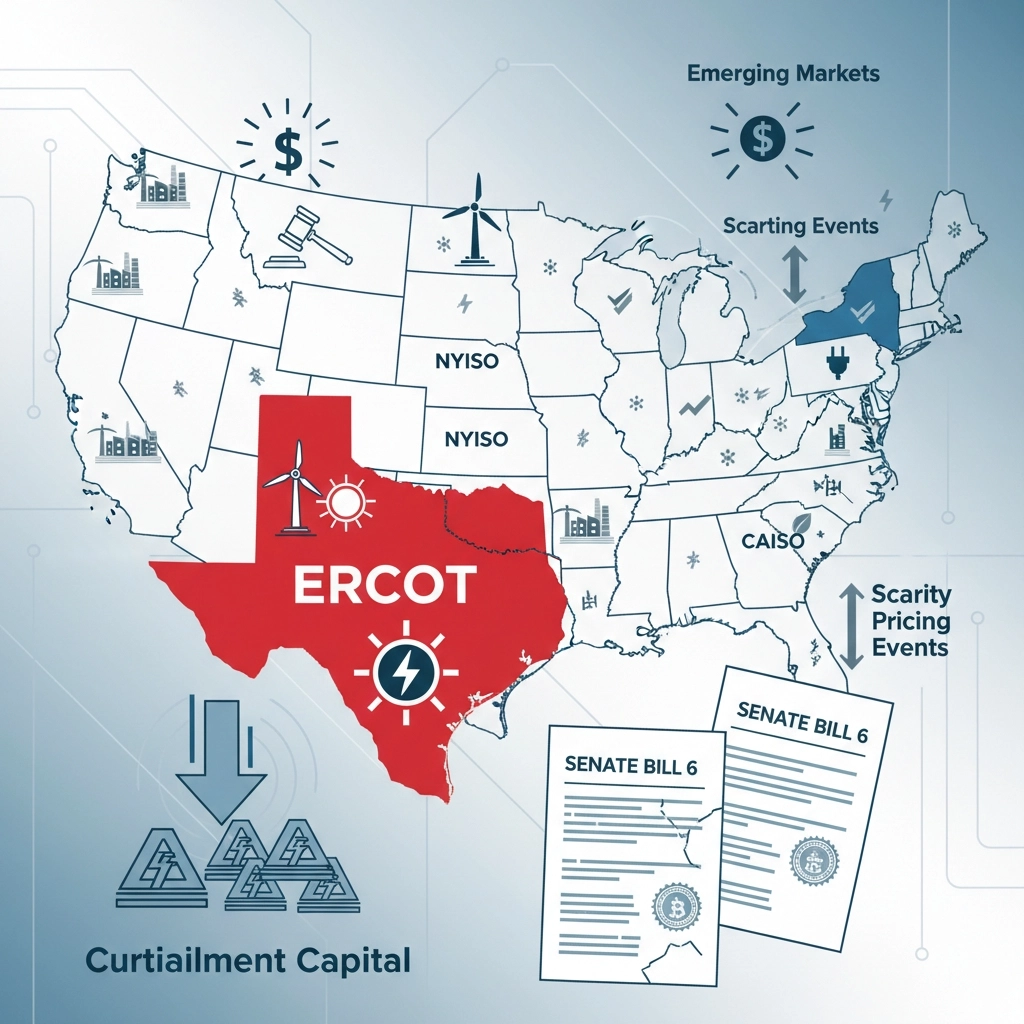

Regulatory Developments Shaping Curtailment Markets

Table 2: Major Regulatory Frameworks Impacting Mining Operations (2025)

| Jurisdiction | Key Regulation | Mining Impact | Curtailment Opportunities |

|---|---|---|---|

| Texas (ERCOT) | Senate Bill 6 (2025) | Mandates interconnection transparency and curtailment participation | High – frequent scarcity pricing events |

| PJM Interconnection | Economic DR Guidelines | Prohibits participation during “normal curtailment operations” | Moderate – strict eligibility requirements |

| NYISO | Bitcoin Mining Load Management | Requires demonstration of demand flexibility | Moderate – seasonal opportunities |

| California (CAISO) | Load Flexibility Standards | Incentivizes flexible consumption profiles | Low-Moderate – limited mining presence |

Texas as the Curtailment Capital

Texas represents the most mature market for mining curtailment participation. The ERCOT grid’s energy-only market design—with no capacity market—creates frequent price spikes during tight supply-demand conditions.

During summer 2025, ERCOT experienced 23 separate scarcity pricing events where wholesale electricity exceeded $1,000/MWh. Mining operations strategically located within ERCOT captured substantial curtailment revenues during these periods, with some facilities reporting that curtailment income exceeded mining revenues for July-August combined.

Texas Senate Bill 6, enacted in 2025, further codifies miner participation requirements while providing regulatory clarity that has encouraged additional mining investment in the state.

Emerging Markets and Opportunities

Beyond established markets, several regions are developing mining-friendly curtailment frameworks:

Upstate New York: Hydroelectric-heavy regions offering seasonal curtailment programs during spring snowmelt periods when generation exceeds transmission capacity.

Pacific Northwest: Similar hydroelectric dynamics, plus growing data center competition driving higher power prices and curtailment compensation.

Wyoming: Abundant wind resources creating intermittency management needs that mining flexibility can address.

Operational Strategies for Maximizing Curtailment Revenue

Successful curtailment participation requires more than simply having the ability to shut down—it demands sophisticated operational planning and technical infrastructure.

Building Automated Response Systems

Modern mining operations deploy real-time monitoring and control systems that:

- Monitor Grid Conditions: Continuously track wholesale electricity prices, frequency deviations, and grid operator signals

- Execute Automated Curtailment: Respond to curtailment requests within 60 seconds without human intervention

- Optimize Restart Sequencing: Systematically power up equipment to avoid inrush current issues and maximize availability

- Document Performance: Maintain audit trails proving curtailment compliance for payment verification

Leading mining operators are implementing SCADA (Supervisory Control and Data Acquisition) systems traditionally used in industrial facilities, adapted for mining-specific requirements.

Financial Modeling and Decision Frameworks

Operators must determine curtailment participation thresholds—the minimum compensation rate that justifies shutting down mining operations.

Basic Formula:

Minimum Curtailment Rate = (Lost Mining Revenue + Restart Costs + Risk Premium) / Megawatts Curtailed

For a facility mining at current 2025 margins:

- Lost mining revenue: $40-50/MWh equivalent

- Restart costs: $5-10/MWh (wear, personnel, verification)

- Risk premium: $10-20/MWh (opportunity cost, uncertainty)

- Minimum acceptable rate: $55-80/MWh premium above normal electricity costs

This calculation varies significantly based on Bitcoin price, hashprice, equipment efficiency, and electricity costs. Operators using the latest-generation ASICs like the S21 series have higher curtailment thresholds since their mining profitability is stronger.

Seasonal and Temporal Optimization

Smart operators adjust mining intensity and curtailment participation based on seasonal patterns:

Summer Strategy (High Demand Season):

- Increase curtailment participation during afternoon peak hours (2-7 PM)

- Shift mining intensity to nighttime and early morning periods

- Target 15-25% of total potential runtime for curtailment availability

Winter Strategy (Moderate Demand Season):

- Maximize mining uptime during most hours

- Selective participation only during extreme weather events

- Focus on economic demand response rather than emergency programs

Spring/Fall Strategy (Shoulder Season):

- Minimize curtailment commitment

- Maximize mining production during lowest electricity price periods

- Perform equipment maintenance during periods of moderate profitability

Risk Management and Curtailment Limitations

While curtailment credits offer attractive revenue diversification, operators must understand inherent limitations and risks.

Key Risk Factors

1. Payment Uncertainty: Curtailment events are unpredictable. A mild summer with ample generation capacity may result in zero curtailment opportunities despite infrastructure investments.

2. Regulatory Changes: Program rules, compensation rates, and eligibility requirements can change annually, affecting business model viability.

3. Equipment Wear: Frequent thermal cycling from start-stop operations may accelerate hardware degradation, though modern ASICs are generally designed to handle this stress.

4. Opportunity Costs: Curtailing during a sustained Bitcoin price rally means permanently forfeiting mining rewards that could have exceeded curtailment payments.

Balancing Mining and Grid Services

The optimal strategy involves portfolio allocation across multiple revenue streams:

- 70-80% of operational focus: Traditional Bitcoin mining during periods of acceptable profitability

- 15-25% of capacity: Reserved for curtailment participation during favorable compensation events

- 5-10% of strategy: Exploring adjacent opportunities (heat reuse, excess capacity sales, alternative cryptocurrencies)

This balanced approach ensures operators capture upside from Bitcoin price appreciation while maintaining downside protection through grid services revenue.

Contractual Considerations

Miners entering curtailment agreements should carefully evaluate:

- Minimum call frequency requirements: Some programs require availability for X events per year

- Performance penalties: Failure to curtail when called may result in fines or program expulsion

- Payment timing: Understanding cash flow implications of quarterly or annual payment schedules

- Force majeure provisions: Protecting against penalties during equipment failures or natural disasters

Future Outlook: Evolution of Mining Economics

The Bitcoin mining industry in 2025 stands at an inflection point where operational sophistication matters more than ever.

Long-Term Viability of Curtailment Revenue

As mining becomes increasingly integrated with electrical grid operations, several trends will shape future economics:

Grid Operator Perspective: Utilities are recognizing that large, flexible loads like Bitcoin mining provide valuable grid stabilization services that reduce the need for expensive peaker plants and battery storage investments.

Competition and Compensation: As more miners participate in curtailment programs, compensation rates may moderate. However, growing electricity demand from AI/data centers is simultaneously creating more frequent curtailment opportunities.

Technology Evolution: Smart grid technologies, real-time pricing APIs, and automated bidding systems will make curtailment participation more efficient and accessible to smaller mining operations.

Bitcoin Network Dynamics

Network difficulty and hashrate will continue influencing curtailment economics. The next Bitcoin halving (expected 2028) will further compress mining margins, making auxiliary revenue streams even more critical.

In the near term, with difficulty at 152.27 T and potentially declining further, miners with efficient equipment and low electricity costs maintain healthy profitability. However, marginal operators face increasing pressure to diversify revenue sources or exit the market.

Geographic Shifts and Infrastructure Development

Mining operations are increasingly locating near:

- Renewable energy sources: Wind and solar farms with frequent curtailment needs

- Stranded energy: Remote natural gas or hydroelectric resources lacking transmission infrastructure

- Grid bottlenecks: Regions where local generation exceeds transmission capacity

These strategic locations maximize both low electricity costs and high curtailment compensation opportunities.

Frequently Asked Questions (FAQ)

Q1: What is curtailment in Bitcoin mining? Curtailment refers to voluntarily shutting down mining operations in exchange for compensation from electrical grid operators. Miners participate in demand response programs that help balance electricity supply and demand during peak periods or grid emergencies.

Q2: How much can miners earn from curtailment credits? Earnings vary significantly based on location, program type, and grid conditions. In Texas ERCOT markets during 2025, miners typically earn $200-2,000 per megawatt-hour curtailed during standard events, with some emergency situations reaching $5,000-9,000/MWh. A 50 MW facility might generate $300,000-500,000 from a single 4-hour curtailment event.

Q3: Does curtailment damage mining equipment? Modern ASIC miners like the Antminer S21 series are designed to handle frequent power cycling. While any thermal cycling creates minor wear, the impact is negligible compared to the revenue benefits. Manufacturers typically warrant equipment for thousands of power cycles.

Q4: What mining equipment is most profitable in 2025? Equipment with efficiency below 20 J/TH remains competitive. Top performers include the Antminer S21 Pro (15 J/TH), S21 XP Hyd (11 J/TH), and WhatsMiner M60S++ (13.5 J/TH). Older generation equipment like S19 models are only profitable with electricity costs below $0.05/kWh.

Q5: Can small mining operations participate in curtailment programs? Most utility-scale curtailment programs require minimum participation levels of 1-5 MW. However, aggregator services are emerging that pool smaller miners together to meet minimum thresholds. Home miners (under 100 kW) generally cannot access curtailment revenues directly.

Q6: How does curtailment revenue compare to mining revenue? During favorable grid conditions, a single 4-hour curtailment event can generate more revenue than 24-48 hours of continuous mining. However, curtailment opportunities are unpredictable and may only occur 10-50 times annually depending on location and grid conditions.

Q7: What electricity price makes Bitcoin mining unprofitable? Profitability thresholds vary by equipment efficiency and Bitcoin price. With BTC at $88,000 (November 2025 levels), miners using S21-generation equipment remain profitable up to approximately $0.12-0.15/kWh. Older equipment becomes unprofitable above $0.08-0.10/kWh.

Q8: Is Bitcoin mining in a bull or bear market in 2025? The Bitcoin market in late 2025 is characterized by volatility and consolidation following earlier price peaks. Rather than definitive bull or bear categorization, the market exhibits dynamic price discovery with significant support around $85,000-90,000 ranges. Miners should focus on operational efficiency and revenue diversification rather than timing market cycles.

Conclusion: Building Resilient Mining Operations

Bitcoin mining in 2025 requires sophisticated operational strategies that extend beyond simply running hardware. Curtailment credits and demand response participation have transitioned from opportunistic revenue supplements to core business model components for successful operations.

Miners who strategically integrate grid services while maintaining focus on equipment efficiency, electricity procurement, and cost management position themselves to weather Bitcoin price volatility and competitive intensity. The combination of next-generation ASICs like those available through Miners1688, strategic site selection, and active curtailment participation creates the foundation for sustainable profitability.

As the industry continues maturing, the distinction between successful and struggling operations will increasingly depend on operational sophistication rather than simply Bitcoin price exposure. Curtailment revenues represent one powerful tool in building resilient, diversified mining businesses capable of thriving across multiple market conditions.