Summary: Bitcoin spot ETFs experienced $869 million in outflows on November 14, 2025—the second-largest on record. With $2.64 billion withdrawn over three weeks and BTC falling below $100,000, miners face unprecedented pressure as hashprice hits five-year lows while network difficulty reaches all-time highs.

Understanding the Historic ETF Outflow Event

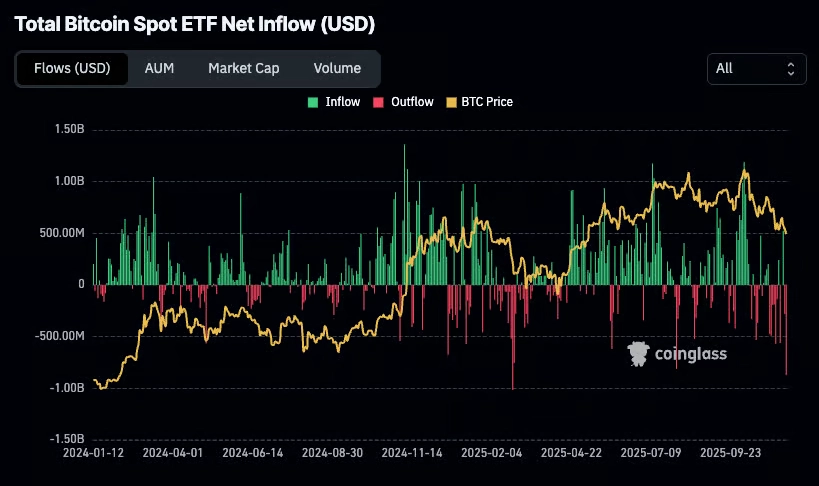

The Bitcoin spot ETF market witnessed a seismic shift when U.S.-listed products collectively hemorrhaged $869.86 million in a single day on November 14, 2025. This marked the second-highest outflow on record, signaling a dramatic reversal in institutional sentiment that had propelled BTC toward six-figure territory just weeks earlier.

Over a three-week period, investors withdrew $2.64 billion from these instruments, creating substantial selling pressure that coincided with Bitcoin’s retreat below the psychologically critical $100,000 support level. The outflows accelerated as BTC declined to $97,500, representing a 5% drop in 24 hours and an 11% monthly decline.

How ETF Flows Directly Influence Bitcoin Price Dynamics

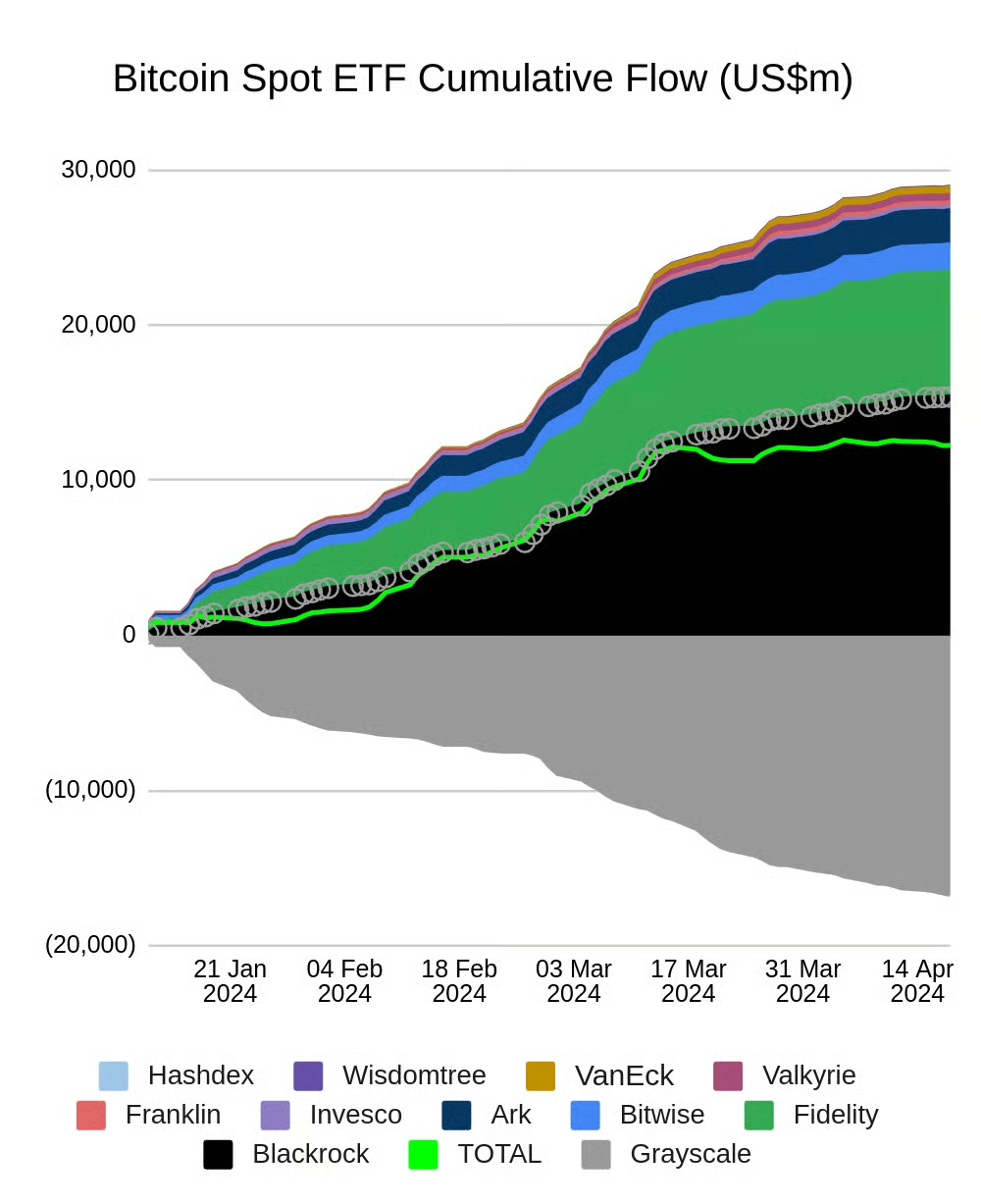

Exchange-traded funds have fundamentally altered Bitcoin’s market microstructure since their January 2024 approval. Net inflows necessitate corresponding spot market purchases by fund managers to maintain proper backing, creating direct demand-side pressure. Conversely, sustained outflows force liquidation of underlying holdings, amplifying downward price momentum.

Research indicates that positive ETF flow shocks generate persistent effects on Bitcoin prices, typically peaking around days 3-4 following the initial capital movement. This lag reflects the time required for market makers to adjust positions and for price discovery to occur across fragmented liquidity pools.

The November outflow period demonstrates this mechanism in reverse: as institutional capital fled, Bitcoin’s price elasticity—its sensitivity to supply-demand imbalances—diminished significantly. Reduced bid-side liquidity meant larger price movements resulted from equivalent selling volumes compared to periods of robust ETF inflows.

Critical Support Levels: Where Does Bitcoin Find Its Floor?

| Price Level | Technical Significance | Historical Context | Current Status |

|---|---|---|---|

| $100,000 | Psychological barrier & institutional profit-taking zone | First breached Oct 2025 | Broken support |

| $97,500 | Current trading range & 50-day MA convergence | Mid-term consolidation area | Active testing |

| $92,000-$95,000 | Major demand zone from previous accumulation | July-August 2025 base | Next support target |

| $87,000 | 200-day moving average & institutional cost basis | Post-halving recovery level | Strong support if tested |

Bitcoin’s descent below $100,000 eliminated what many analysts considered the most critical support level for maintaining momentum. The cryptocurrency now trades in a precarious zone where diminished ETF flows have reduced natural buying pressure that previously absorbed sell-side activity.

The $92,000-$95,000 range represents the next significant demand zone, characterized by substantial accumulation during the summer consolidation period. Should Bitcoin fail to stabilize above $97,500, accelerated testing of this lower range appears inevitable, particularly if ETF outflows persist.

Mining Economics Under Pressure: Hashprice at Five-Year Lows

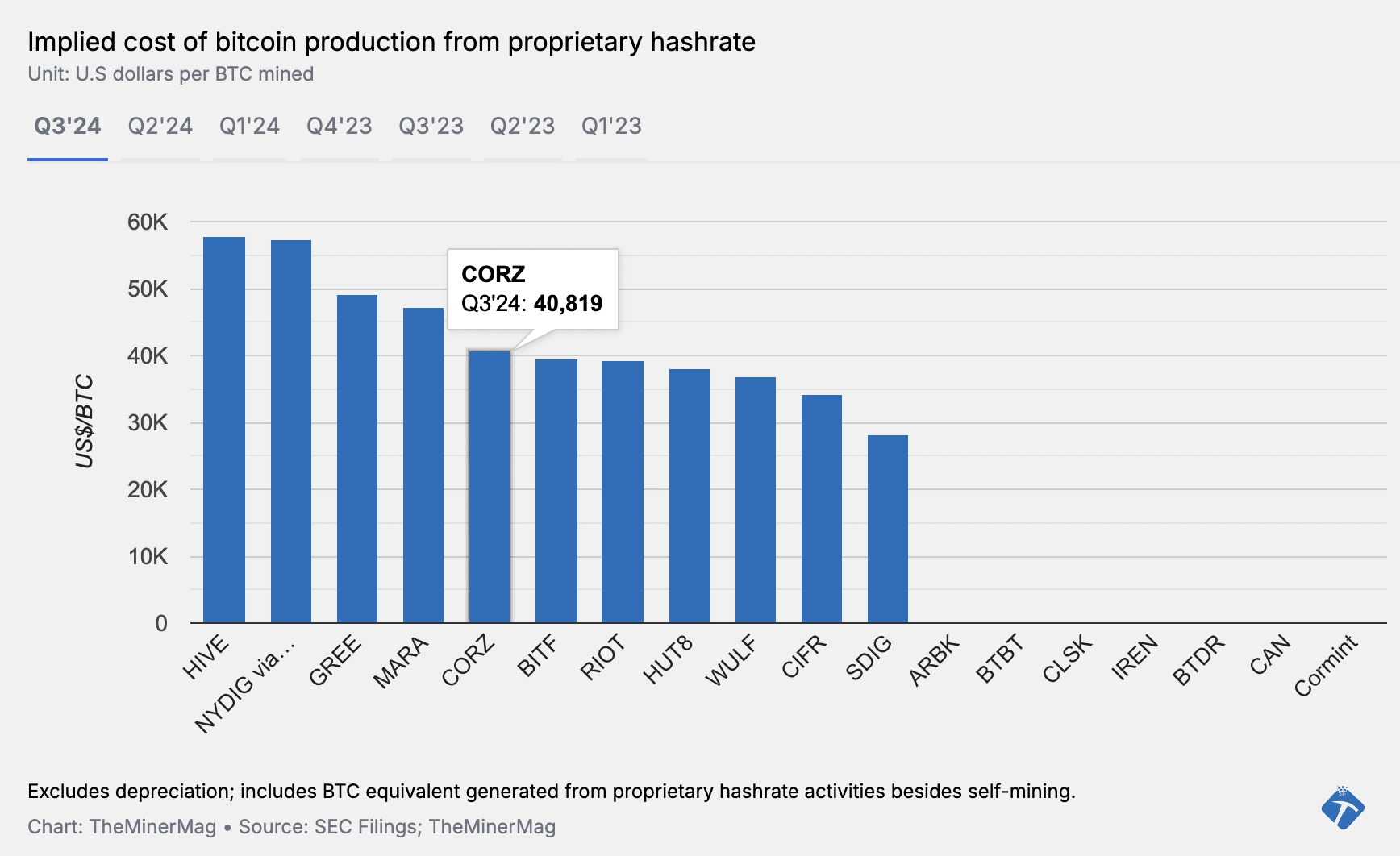

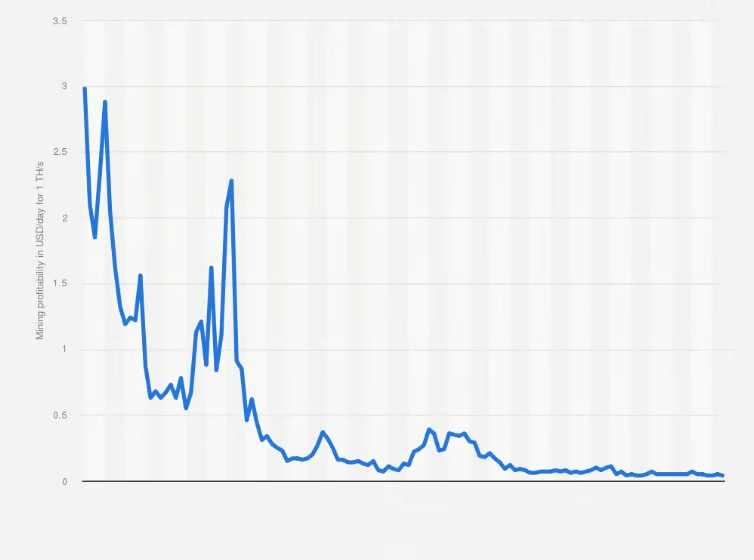

Bitcoin miners face their most challenging operational environment in over five years as hashprice—the daily revenue per petahash of mining power—plummeted to $38.2 PH/s. This represents the lowest level since September 2020, creating acute profitability pressures across the industry despite Bitcoin trading near $97,000.

The hashprice collapse stems from the convergence of three negative factors: Bitcoin’s price retreat from all-time highs, network difficulty reaching unprecedented levels above 152 trillion, and post-halving block reward reductions to 3.125 BTC per block. Collectively, these dynamics have compressed margins to levels that render older mining equipment unprofitable.

Publicly traded mining companies have seen their stock prices decline sharply, though losses often reflect broader market reassessment of AI infrastructure initiatives many miners have pursued as diversification strategies. The operational reality remains stark: without significant Bitcoin price recovery or difficulty adjustments, marginal miners face existential challenges.

Current State of Mining Hardware: Which Machines Remain Viable?

| Miner Model | Hashrate | Power Consumption | Efficiency | Daily Profit @ $0.08/kWh | Viability Rating |

|---|---|---|---|---|---|

| Bitmain Antminer S21 Pro | 234 TH/s | 3,510W | 15.0 J/TH | $9.60 | Excellent |

| Antminer S21 XP Hyd | 430 TH/s | 5,590W | 13.0 J/TH | $4.18 | Very Good |

| Whatsminer M66S++ | 356 TH/s | 5,518W | 15.5 J/TH | $3.85 | Good |

| Antminer S21 (Standard) | 200 TH/s | 3,500W | 17.5 J/TH | $2.10 | Marginal |

| Antminer S19j Pro | 104 TH/s | 3,068W | 29.5 J/TH | -$1.20 | Unprofitable |

The current mining landscape demands next-generation efficiency to maintain profitability. Equipment with energy efficiency above 17 J/TH faces severe margin compression, while machines exceeding 25 J/TH have become unprofitable at typical industrial electricity rates.

The Bitmain Antminer S21 series represents the current sweet spot for mining operations, particularly the Pro and XP variants that combine robust hashrates with industry-leading efficiency metrics. These machines can sustain positive cash flow even with hashprice depression, providing operational runway through market volatility.

Older generation equipment like the S19 series, which dominated mining operations from 2020-2023, has largely been rendered obsolete by the combination of increased network difficulty and reduced block rewards. Operators still running this hardware face immediate upgrade imperatives or operational shutdown.

Risk Factors: What Could Amplify Further Downside Pressure?

Several interconnected risks threaten to intensify Bitcoin’s current weakness. Persistent ETF outflows indicate institutional investors are actively reducing exposure, potentially driven by profit-taking after the late-2024 rally or portfolio rebalancing ahead of year-end. Should this trend accelerate, liquidation pressure could overwhelm natural market demand.

Mining capitulation represents another critical risk factor. If hashprice remains suppressed, marginal miners will be forced offline, potentially triggering a cascade of Bitcoin sales as operations liquidate holdings to cover fixed costs and debt obligations. While difficulty adjustments should eventually compensate, the interim period could see significant supply pressure.

Broader macroeconomic headwinds, including elevated interest rates and risk-off sentiment in traditional markets, could further weaken Bitcoin’s correlation-driven flows. The cryptocurrency increasingly trades in tandem with technology stocks during stress periods, making it vulnerable to equity market corrections.

Conversely, several mitigating factors provide counterbalance: Bitcoin’s supply growth rate remains historically low post-halving, long-term holder cohorts show minimal distribution despite price weakness, and mining difficulty adjustments will improve economics for surviving operators over time.

Strategic Positioning for Mining Operations in Volatile Markets

Mining operations must adapt quickly to the compressed margin environment. Capital allocation should prioritize the most efficient available hardware, even if this requires taking on strategic debt or engaging in equipment sales to fund upgrades. The efficiency gap between current-generation and legacy equipment has widened to unprecedented levels.

Electricity cost optimization becomes paramount when hashprice declines. Operations should aggressively pursue power purchase agreement renegotiations, explore load curtailment programs that provide compensation for demand reduction, or consider geographic relocation to jurisdictions with lower industrial rates. Every cent per kilowatt-hour directly impacts operational viability.

Diversification strategies warrant serious consideration, particularly for operations with access to low-cost infrastructure. Some mining companies have successfully pivoted portions of their facilities toward AI compute workloads, high-performance computing contracts, or other energy-intensive processes that provide alternative revenue streams during Bitcoin market weakness.

Treasury management practices should emphasize sustainability over speculation. Rather than holding 100% of mined Bitcoin, operations might consider implementing systematic partial liquidation to cover fixed expenses, preserving cash runway through extended periods of margin compression. Financial resilience trumps absolute Bitcoin accumulation during survival phases.

Visit Miners1688 for competitive pricing on next-generation mining equipment with global shipping and comprehensive technical support.

FAQ: Understanding ETF Flows and Mining Impact

Q: How long do ETF outflows typically last before reversing? A: Historical patterns show ETF outflow periods ranging from 5-21 days, with reversals typically coinciding with Bitcoin establishing clear support levels. The current three-week outflow represents an extended period suggesting substantial repositioning rather than temporary profit-taking.

Q: Can Bitcoin recover while ETF outflows continue? A: Yes, but recovery would require offsetting demand from other sources—spot exchanges, corporate treasury purchases, or retail accumulation. ETFs represent significant but not dominant Bitcoin demand, comprising roughly 15-20% of daily trading volume.

Q: What electricity cost makes mining unprofitable at current hashprice? A: For standard efficiency equipment (15-17 J/TH), electricity costs above $0.09/kWh create marginal profitability. Older machines (>25 J/TH) are unprofitable above $0.06/kWh. Premium operations with sub-$0.05/kWh rates maintain healthy margins across most hardware.

Q: Should miners sell their Bitcoin holdings during price weakness? A: This depends on individual operational circumstances. Miners with low debt, strong cash reserves, and efficient equipment can often afford to hold through weakness. Highly leveraged operations or those running marginal hardware should prioritize operational survival over Bitcoin accumulation.

Q: What Bitcoin price would restore healthy mining profitability? A: At current difficulty levels, sustained prices above $105,000 would restore above-average profitability for most modern mining operations. The $110,000-$115,000 range would create conditions for aggressive capacity expansion and equipment upgrades.

Q: Are there alternative cryptocurrencies to mine instead of Bitcoin? A: While some alternatives like Litecoin/Dogecoin via Scrypt mining or newer proof-of-work coins offer opportunities, Bitcoin remains the most liquid and established option. SHA-256 miners have limited flexibility to switch algorithms without equipment replacement.

Key Takeaways and Market Outlook

The convergence of sustained ETF outflows and Bitcoin’s retreat below $100,000 has created a challenging environment characterized by reduced price elasticity and compressed support levels. The $92,000-$95,000 zone represents the next critical test for Bitcoin’s medium-term trajectory.

Mining operations face unprecedented margin pressure as hashprice reaches five-year lows despite Bitcoin trading near all-time high territory. Survival requires aggressive efficiency optimization, cost management, and strategic capital allocation toward next-generation hardware.

Market volatility creates both risks and opportunities. Well-capitalized operations with access to efficient equipment and low-cost power can use this period to consolidate competitive advantages, acquiring distressed assets and expanding capacity while marginal competitors exit.

The interplay between ETF flows, Bitcoin price action, and mining economics will likely determine market structure through early 2026. Investors and operators should monitor ETF flow data, network difficulty adjustments, and hashprice trends as leading indicators for potential turning points.

References & Related Resources: