Summary: As cryptocurrency venture capital experiences a significant downturn in Q2 2025, mining sector valuations are defying trends with record-breaking investments. This comprehensive analysis explores where capital is flowing, why mining hardware remains attractive, and what it means for miners navigating today’s dynamic market.

The Current State of Crypto Venture Capital

The cryptocurrency venture capital landscape has undergone a dramatic transformation in 2025. According to Galaxy Digital’s Q2 2025 report, crypto VC investment reached just $1.97 billion across 378 deals—representing a 59% quarter-over-quarter decline and marking the second-smallest quarter since Q4 2020.

This decline signals a fundamental shift in investor sentiment. While Bitcoin prices have shown resilience, traditional VC interest has waned due to multiple factors: competition from AI startups for capital, diminished enthusiasm for previously hot narratives like NFTs and Web3 gaming, and the emergence of alternative investment vehicles such as spot ETFs and digital asset treasury companies (DATCOs).

Breaking Down Investment Patterns

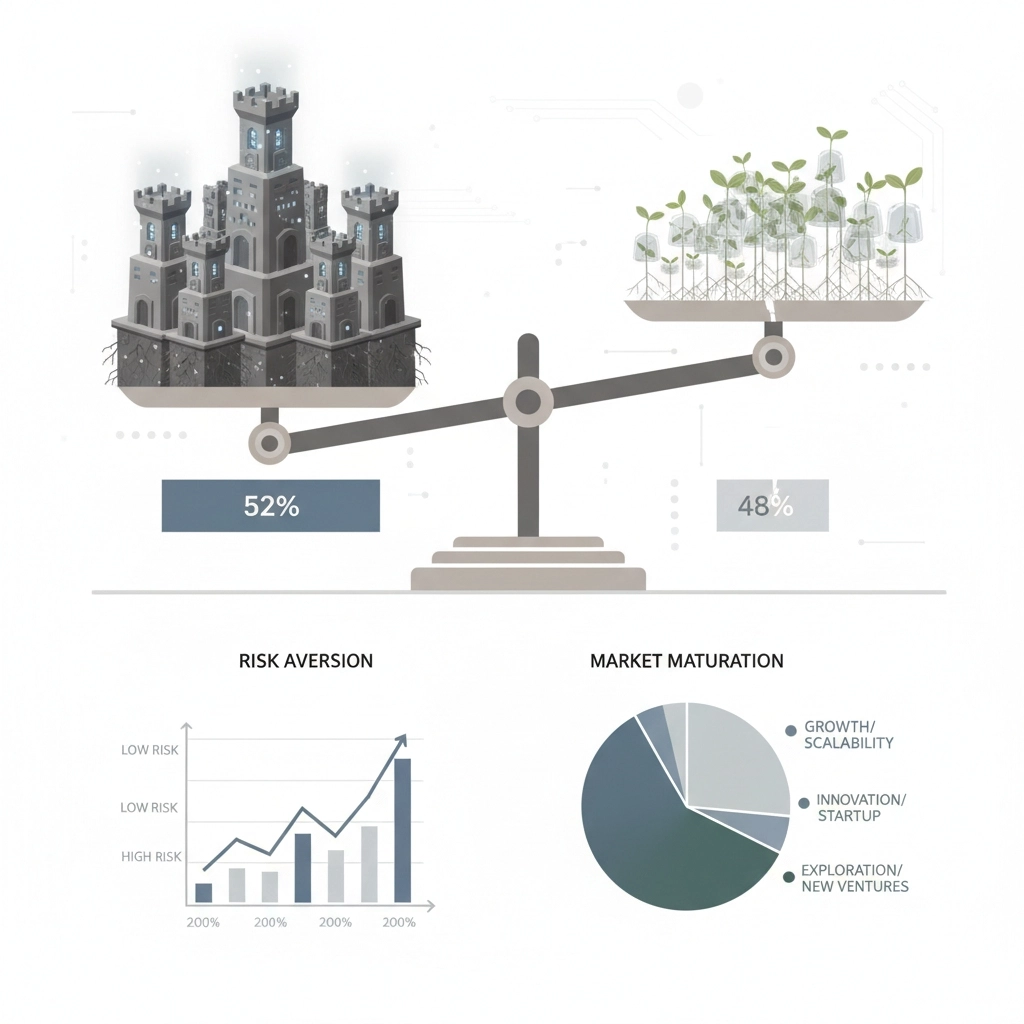

Later-stage companies captured 52% of capital invested in Q2 2025, while earlier-stage ventures received 48%. This marks only the second time since Q1 2021 that late-stage investment has exceeded early-stage funding—a clear indicator of market maturation and investor risk aversion in uncertain conditions.

Mining Sector: The Unexpected Champion

Despite broader VC contraction, the mining category emerged as Q2 2025’s surprise leader, attracting over $500 million in investment—the largest amount for this sector in years. This unprecedented capital flow was primarily driven by a single $300 million investment in cloud-mining operator XY Miners, led by Sequoia Capital.

Why Mining Attracts Capital

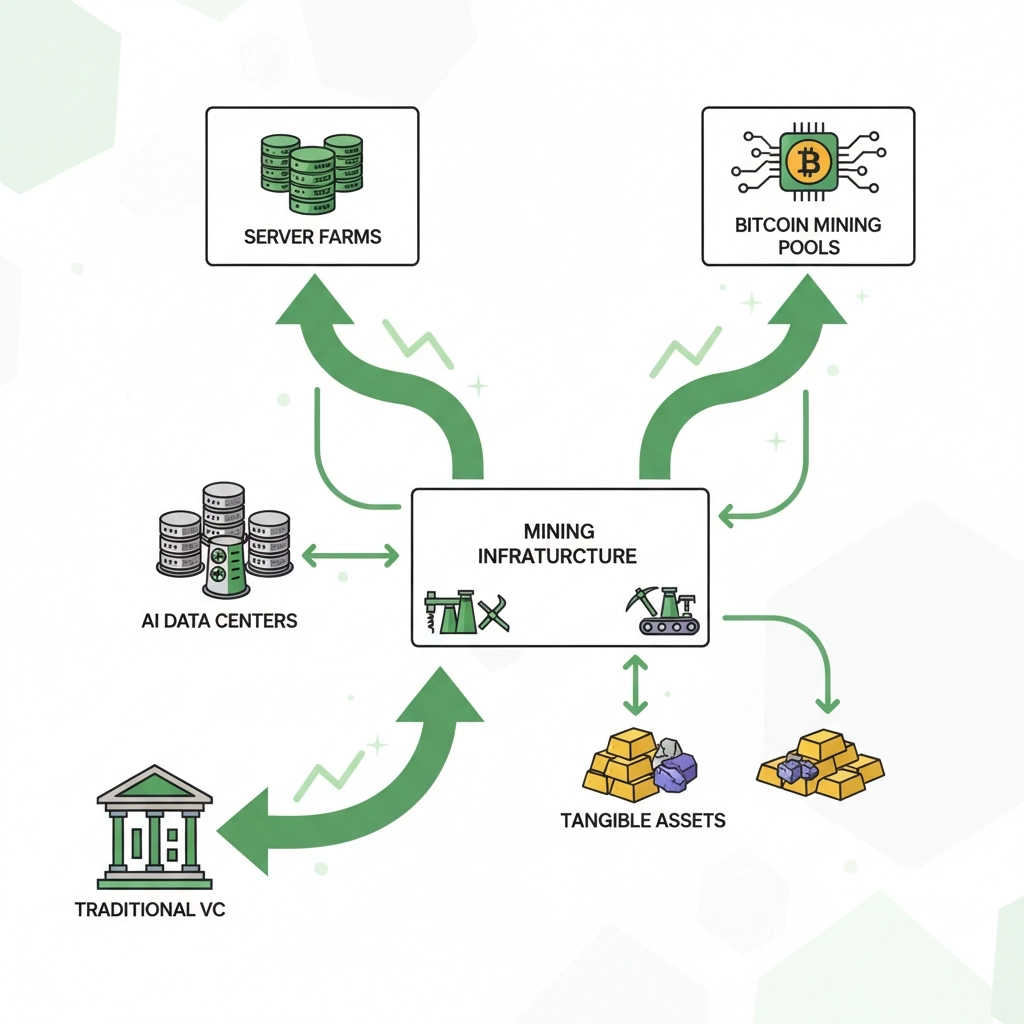

The surge in mining investments isn’t coincidental—it reflects strategic shifts in how institutional investors view crypto infrastructure:

AI Compute Demand: The explosive growth in artificial intelligence has created insatiable demand for computing resources. Mining facilities with their existing data center infrastructure and power management expertise are uniquely positioned to serve this dual market.

Tangible Asset Base: Unlike speculative DeFi protocols or metaverse projects, mining operations possess physical hardware with calculable ROI. This tangibility appeals to traditional investors seeking measurable value propositions.

Revenue Predictability: While cryptocurrency prices fluctuate, mining operations generate consistent hashrate-based revenues. This predictability contrasts sharply with the uncertain monetization paths of many crypto startups.

Mining Category Investment Breakdown

| Investment Category | Q2 2025 Capital | % of Total VC | Notable Deals |

|---|---|---|---|

| Mining | $500M+ | 20%+ | XY Miners ($300M) |

| Privacy/Security | $200M+ | 10%+ | Multiple rounds |

| Infrastructure | $200M+ | 10%+ | Blockchain scaling |

| Trading/Exchange | $150M+ | 8%+ | Institutional platforms |

| DeFi | $100M+ | 5%+ | Lending protocols |

For the first time in tracked history, mining captured over 20% of all crypto VC capital—a remarkable achievement that underscores the sector’s newfound prominence among institutional allocators.

Geographic Trends: US Dominance Persists

The United States reclaimed its position as the dominant force in crypto VC, with 47.8% of capital and 41.2% of deals. This resurgence follows Q1 2025’s anomaly when MGX’s $2 billion investment in Binance temporarily pushed Malta to the top spot.

Regional Capital Distribution

The geographic concentration reflects regulatory clarity emerging in certain jurisdictions. The US pro-crypto policy shift under the current administration has created favorable conditions for mining operations and blockchain infrastructure companies. The United Kingdom secured second place with 22.9% of capital, while Japan and Singapore rounded out the top four with 4.3% and 3.6% respectively.

Policy Impact on Investment

Recent US regulatory developments—including discussions around stablecoin frameworks and market structure legislation—are expected to further consolidate American dominance. These policy changes particularly benefit infrastructure-heavy sectors like mining, where regulatory certainty directly impacts large capital deployment decisions.

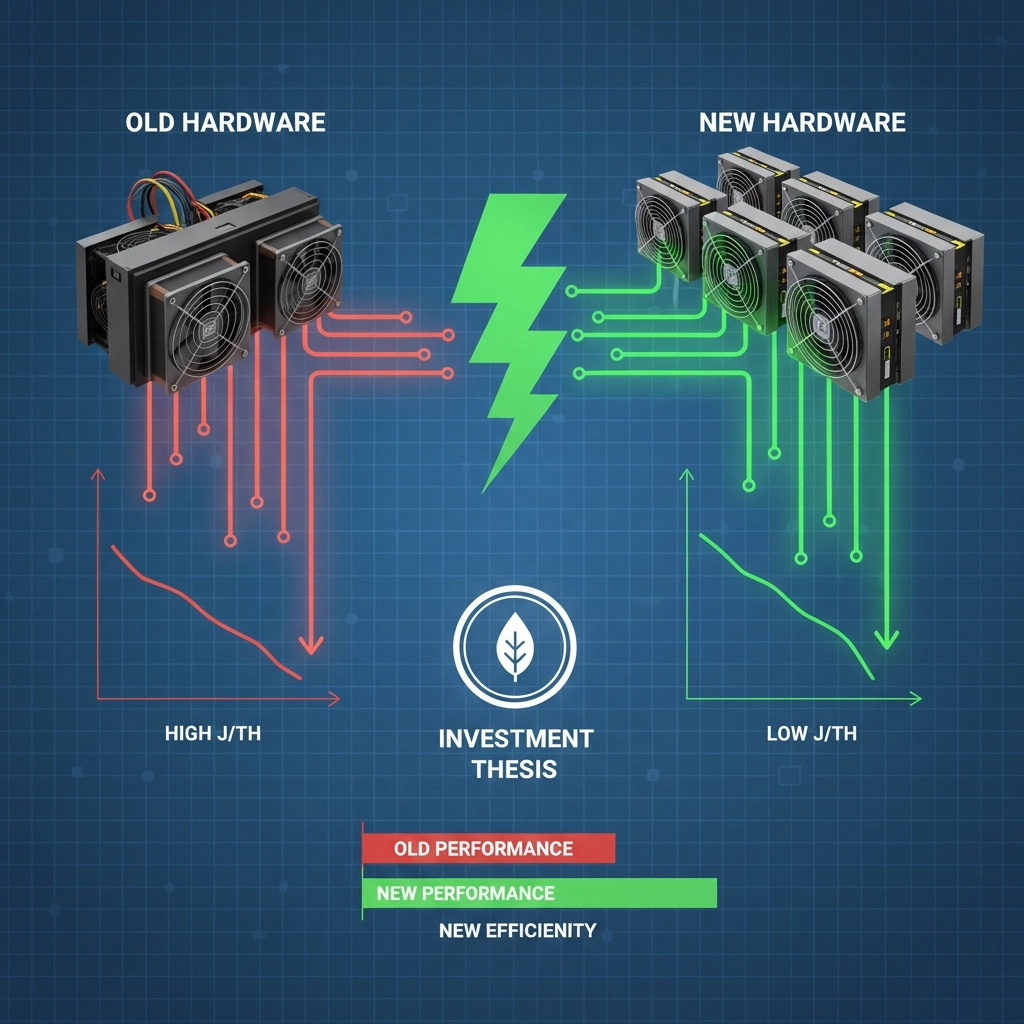

Hardware Efficiency: The New Investment Thesis

As VC capital gravitates toward mining, hardware efficiency has become the critical factor determining which operations attract investment and achieve profitability. The market has shifted from a focus on total hashrate to an emphasis on energy efficiency measured in joules per terahash (J/TH).

Leading Hardware in 2025

Bitmain Antminer S21 Series: The flagship Antminer S21 continues to dominate professional mining operations with its balance of hashrate and power efficiency. The S21+ variant offers even better performance for operators prioritizing efficiency over upfront costs.

MicroBT Whatsminer M60 Series: Competing directly with Bitmain’s offerings, the M60 series delivers comparable efficiency with slightly different power profiles, making it ideal for operations with specific infrastructure constraints.

Specialized Altcoin Miners: The Antminer L9 for Dogecoin/Litecoin mining and other specialized ASICs continue to find niches as investors diversify beyond Bitcoin-only strategies.

Efficiency Impact on ROI

Current market conditions make efficiency paramount. With electricity costs representing 60-70% of operational expenses for most mining operations, a 10% improvement in J/TH can translate to 15-20% better profit margins. This efficiency premium directly correlates with which mining companies attract venture funding.

Top Mining Hardware Comparison 2025

| Hardware Model | Hashrate | Power Consumption | Efficiency (J/TH) | Typical ROI Period |

|---|---|---|---|---|

| Antminer S21+ | 216 TH/s | 3,645W | ~17 J/TH | 12-18 months |

| Whatsminer M60 | 172 TH/s | 3,344W | ~19.4 J/TH | 14-20 months |

| Antminer L9 | 17.6 GH/s | 3,570W | Scrypt optimized | 10-15 months |

| Canaan Avalon Q | 90 TH/s | 1,674W | ~18.6 J/TH | 15-22 months |

| Elphapex DG2+ | 20.5 GH/s | 3,900W | Dual-algorithm | 12-18 months |

ROI periods assume $0.10/kWh electricity and current network difficulty levels

Valuation Metrics: What VCs Look For

Understanding how venture capitalists evaluate mining investments provides critical insight for operators seeking capital or assessing their own operations’ market position.

Key Performance Indicators

Power Purchase Agreements (PPAs): Long-term electricity contracts at competitive rates (ideally below $0.06/kWh) significantly enhance valuation multiples. Operations with PPAs typically command 30-40% higher valuations than those relying on spot electricity markets.

Fleet Efficiency: The weighted average J/TH across an operation’s entire hardware fleet determines competitiveness. VCs favor operations actively upgrading to latest-generation ASICs, as evidenced by capital flowing toward companies with S21 series or equivalent hardware.

Uptime and Reliability: Demonstrated operational excellence with 98%+ uptime commands premium valuations. This metric reflects management quality and infrastructure robustness—factors that directly impact returns.

Scalability: Access to additional power capacity and facility space allows for growth without proportional cost increases. Scalable operations attract significantly more VC interest.

Valuation Calculation Framework

Mining operation valuations typically follow an EBITDA multiple approach, with adjustments for:

- Hardware age and efficiency

- Power cost advantages

- Geographic risk factors

- Management team experience

- Regulatory environment stability

Current multiples for well-run mining operations range from 8-12x EBITDA, compared to 3-5x during the 2022-2023 bear market period.

Market Outlook: Navigating Current Conditions

The cryptocurrency market in 2025 presents a complex landscape that defies simple characterization. While avoiding terms like “bull market” or “bear market,” we observe distinct patterns shaping investment decisions.

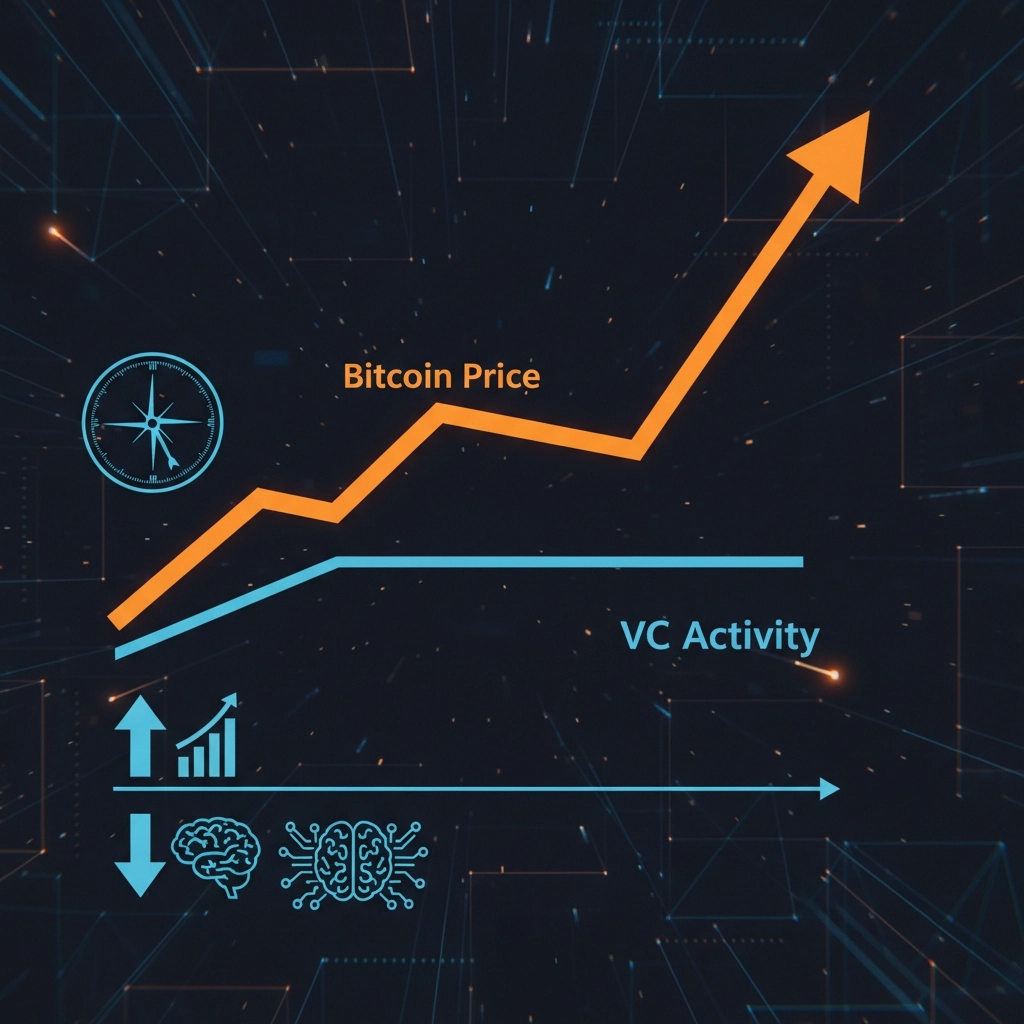

Bitcoin Price Decoupling

An intriguing phenomenon has emerged: Bitcoin’s price performance and VC investment activity have diverged significantly since early 2023. While BTC has appreciated substantially, VC activity remains subdued compared to 2021-2022 levels. This disconnect stems from:

Alternative Investment Vehicles: Spot Bitcoin ETFs now provide institutional exposure without the illiquidity and risk profile of venture investments.

Narrative Shift: The market has consolidated around Bitcoin and proven layer-1 blockchains, reducing opportunities for early-stage venture bets.

AI Competition: Artificial intelligence startups compete directly for the same institutional capital pools that previously flowed heavily into crypto ventures.

Mining Profitability Dynamics

Current mining profitability reflects multiple competing factors. Network hashrate continues growing as efficient hardware deployment expands. Bitcoin’s halving in April 2024 reduced block rewards to 3.125 BTC, increasing operational pressure. However, improved hardware efficiency and strategic power sourcing have kept well-run operations profitable.

Miners using latest-generation equipment like the Antminer S21 series maintain healthy margins, while operators relying on older hardware face increasing pressure to upgrade or exit.

Strategic Considerations for Mining Operations

For mining operations seeking to position themselves advantageously in the current capital environment, several strategic imperatives emerge.

Hardware Refresh Cycles

Maintaining fleet efficiency requires proactive hardware management. The typical economic life of mining ASICs has shortened to 18-24 months, down from 3-4 years in previous cycles. This acceleration reflects rapid technological improvements and increasing network competition.

Operations should plan systematic refreshes, retiring hardware as it approaches 30-35 J/TH efficiency thresholds. At Miners1688, we offer trade-in programs that help operators upgrade economically while maintaining operational continuity.

Diversification Strategies

While Bitcoin mining remains the primary focus for most operations, strategic diversification into select altcoins provides hedge benefits. The Antminer L9 enables dual Dogecoin/Litecoin mining, offering revenue diversification with proven hardware.

Similarly, specialized miners like the GoldShell AE Max II for Aleo mining allow operators to capture emerging opportunities in privacy-focused blockchain networks.

Power Strategy Optimization

Given that electricity represents the largest operational expense, power strategy directly determines competitiveness. Successful approaches include:

Curtailment Agreements: Partnering with utilities to provide demand response services generates additional revenue while securing favorable power rates.

Renewable Integration: While often motivated by ESG considerations, renewable power sources increasingly offer cost advantages, particularly in regions with abundant wind or solar resources.

Load Balancing: Operating flexibly to take advantage of time-of-use pricing and grid incentives can reduce effective power costs by 15-30%.

Hardware Selection Guide for 2025

Choosing the right mining hardware in 2025’s competitive environment requires careful analysis of multiple factors beyond simple hashrate specifications.

Bitcoin Mining Hardware

Large-Scale Operations (1+ MW): The Bitmain Antminer S21+ represents the optimal balance of efficiency, reliability, and availability. Its proven track record and Bitmain’s established support network make it ideal for institutional deployments.

Mid-Scale Operations (100kW – 1MW): A mix of S21 standard and Plus models provides flexibility while maintaining efficiency. This approach allows operators to balance capital deployment with performance optimization.

Entry-Level Operations (< 100kW): The Canaan Avalon Q offers competitive efficiency at lower initial investment, making it suitable for operators starting their mining journey or testing facility infrastructure.

Altcoin Mining Opportunities

Litecoin/Dogecoin: The Antminer L9 delivers exceptional performance for Scrypt algorithm mining. With Dogecoin maintaining strong community support and Litecoin’s established position, this dual-mining capability provides meaningful diversification.

Dual-Algorithm Options: The Elphapex DG2+ offers flexibility for operations seeking to optimize between multiple coins based on real-time profitability.

Emerging Networks: Specialized miners for privacy-focused chains and new consensus mechanisms, like the GoldShell AE Max II, allow early-mover advantages in emerging networks with potentially higher rewards.

Procurement Considerations

When sourcing mining hardware, several factors beyond price merit consideration:

Supply Chain Reliability: Working with established suppliers like Miners1688 ensures genuine equipment with manufacturer warranties. Our seven years in the industry and direct manufacturer relationships provide supply chain security critical for operational planning.

After-Sales Support: Mining operations cannot afford extended downtime. Our technical support team provides remote guidance and coordinates maintenance services to minimize operational disruptions.

Logistics Expertise: International shipping of mining equipment involves complex customs and documentation requirements. Our partnerships with DHL, UPS, and FedEx, plus specialized routes to key regions, ensure timely delivery with proper handling.

Risk Management in Current Environment

Operating mining infrastructure in 2025’s dynamic environment requires sophisticated risk management across multiple dimensions.

Market Risk Mitigation

Dollar Cost Averaging Hodlings: Rather than selling all mined cryptocurrency immediately, strategic operators retain portions of production to capture potential appreciation while maintaining operational liquidity.

Hedging Strategies: Futures and options markets provide tools to lock in revenue certainty for a portion of production, stabilizing cash flows for operational expenses and debt service.

Treasury Management: Maintaining adequate cash reserves (typically 3-6 months of operational expenses) provides resilience during hashrate spikes or difficulty adjustments that temporarily reduce profitability.

Operational Risk Controls

Redundancy Planning: Critical infrastructure components require redundancy. Power distribution, cooling systems, and network connectivity should have backup systems to maintain uptime.

Preventive Maintenance: Regular maintenance schedules extend hardware life and prevent unexpected failures. Well-maintained S21 miners consistently deliver 98%+ uptime compared to 90-92% for poorly maintained equivalent hardware.

Monitoring Systems: Real-time monitoring of temperature, hashrate, power consumption, and network connectivity enables rapid response to emerging issues before they impact production.

Regulatory and Political Risk

Mining operations must consider regulatory environments carefully. Jurisdictions with clear, stable frameworks for cryptocurrency mining provide the certainty necessary for long-term capital investment. Recent US policy developments exemplify how regulatory clarity catalyzes investment, as evidenced by America’s increased share of global hashrate and VC capital.

Frequently Asked Questions

Why is mining attracting more VC investment than other crypto sectors in 2025?

Mining investments appeal to VCs because they involve tangible assets with calculable returns, provide exposure to both cryptocurrency and AI compute markets, and generate predictable revenue streams. Unlike speculative protocol investments, mining operations have established business models with clear path to profitability, making them more attractive in the current risk-averse capital environment.

What hardware efficiency level should miners target to remain competitive?

Operations should target hardware with efficiency below 20 J/TH to maintain competitiveness in 2025. The most competitive operations are deploying equipment in the 15-18 J/TH range, such as the Antminer S21 series. Hardware exceeding 30 J/TH faces increasing profitability challenges and should be prioritized for replacement.

How do current mining profitability margins compare to previous years?

Well-run operations with efficient hardware and competitive power costs (< $0.08/kWh) maintain margins of 30-50%, comparable to 2021 levels despite the 2024 halving. However, operations using older equipment or paying higher electricity rates face significantly compressed margins of 10-20% or less, creating strong incentive for hardware upgrades.

What electricity cost is necessary for profitable mining in 2025?

Competitive mining operations target electricity costs below $0.06/kWh, with world-class operations achieving $0.03-0.04/kWh through renewable energy integration or special utility agreements. Operations paying $0.10/kWh or more can remain profitable with latest-generation hardware but have limited margin for network difficulty increases or price volatility.

Should miners focus exclusively on Bitcoin or diversify into altcoins?

While Bitcoin should comprise the majority of most mining operations (70-90%), strategic diversification into established altcoins like Litecoin/Dogecoin via Antminer L9 or emerging networks provides hedge benefits without significantly increasing operational complexity. The key is selecting coins with genuine utility and established networks rather than speculative tokens.

How important is hardware manufacturer choice?

Manufacturer selection significantly impacts operational success. Established manufacturers like Bitmain and MicroBT offer proven reliability, available spare parts, and comprehensive support networks. When sourcing equipment, working with experienced suppliers like Miners1688 ensures genuine products with proper warranties and support, avoiding counterfeit hardware that plagues some distribution channels.

What ROI timeline should miners expect with current hardware?

With latest-generation hardware like the Antminer S21+, operators with competitive electricity rates can expect 12-18 month ROI periods under current market conditions. However, ROI varies significantly based on power costs, operational efficiency, and cryptocurrency prices. Conservative operators should plan for 18-24 month payback periods to account for difficulty increases and market volatility.

Related Resources: