Summary: Ethereum tumbled over 8% as spot ETF outflows reached $1.4 billion over three weeks, with long-term holders accelerating sell-offs. Mining profitability faces new challenges amid declining on-chain activity and shifting market dynamics in late 2025.

Ethereum’s Sharp Decline: Analyzing the November 2025 Correction

The cryptocurrency market witnessed significant turbulence in November 2025, with Ethereum bearing the brunt of institutional selling pressure. ETH plunged from $3,565 to below $3,100 within 48 hours, marking an 8% decline that caught many investors off guard. This dramatic price action coincided with Bitcoin’s struggle to maintain the psychological $100,000 level, signaling broader market weakness.

The selloff wasn’t isolated to retail traders. Institutional outflows from U.S.-listed spot Ethereum ETFs reached $1.4 billion since late October, following Federal Reserve Chairman Jerome Powell’s comments dampening expectations for December rate cuts. Thursday’s single-day outflow of $260 million represented the largest exodus in over a month, underscoring waning institutional confidence.

Source: Spot Ethereum ETFs Record Monthly Outflows

For crypto miners operating in 2025, this market volatility presents both challenges and opportunities. While Ethereum mining ceased after The Merge in September 2022, the broader implications for proof-of-work mining profitability across Bitcoin, Litecoin, and emerging altcoins remain significant.

On-Chain Metrics Reveal Weakening Network Fundamentals

Transaction Activity Hits Multi-Month Lows

Ethereum’s on-chain metrics paint a concerning picture for network health. Monthly active addresses declined to 8.2 million in November 2025, down from over 9 million in September—a 9% drop that signals reduced user engagement. More alarming is the 42% collapse in transaction fees to just $27 million over the past month, according to Token Terminal data.

This fee reduction, while beneficial for users, indicates diminished network utilization. For miners considering alternative proof-of-work chains, these metrics suggest that network congestion and fee markets remain unpredictable revenue sources in the current environment.

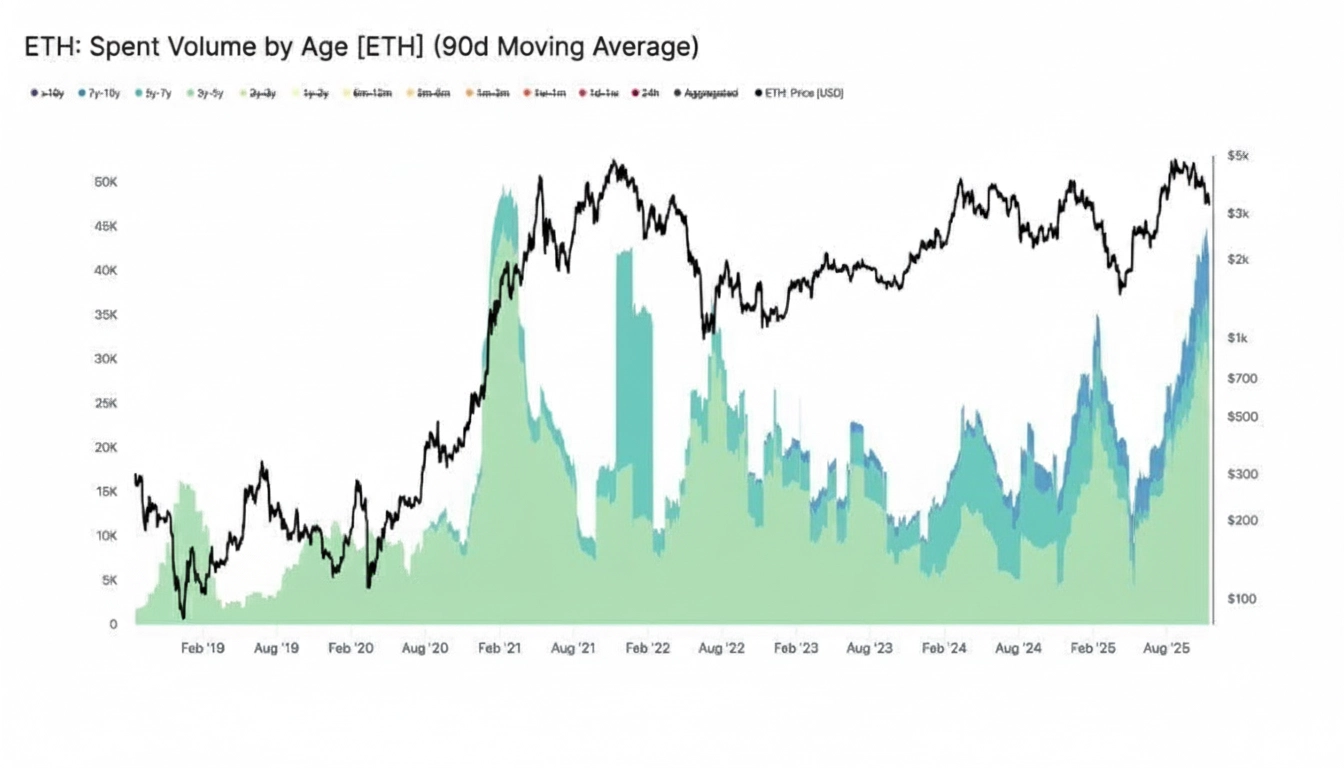

Long-Term Holders Accelerate Distribution

Glassnode’s blockchain analytics revealed that long-term ETH holders (3-10 years) accelerated selling to approximately 45,000 ETH daily on a 90-day moving average—roughly $140 million at current prices. This represents the highest distribution pace since February 2021, suggesting that even conviction holders are reassessing their positions amid macroeconomic uncertainty.

Source: CoinDesk Market Analysis

Layer-2 Scaling Impact on Miner Economics

The migration of transactions to Layer-2 solutions like Arbitrum and Optimism continues reshaping Ethereum’s economic model. While beneficial for scalability, this shift reduced mainnet transaction fees by 40-60%, fundamentally altering the revenue model that once made GPU mining highly profitable before The Merge.

Technical Analysis: Critical Support Levels and Trading Ranges

ETH shattered the critical $3,325 support level, establishing a clear bearish trend with consecutive lower highs. CoinDesk Research’s technical analysis identified key levels for miners and traders monitoring market conditions:

Support Levels:

- Primary: $3,080

- Secondary: $3,050 and $2,880

Resistance Levels:

- Immediate: $3,330 (former support turned resistance)

- Major: $3,500 (main pivot point)

- Extended: $3,650 (descending channel highs)

Volume analysis showed selling peaked at 641,103 during the $3,325 breakdown—71% above 24-hour averages. Subsequent volume declined to 80% of 7-day norms, potentially indicating seller exhaustion. However, breaking below $3,050 would expose downside targets near $2,880, while reclaiming $3,563 is essential for renewed bullish momentum.

Ethereum Post-Merge: Mining Alternatives for 2025

| Comparison Factor | Ethereum (Pre-Merge) | Bitcoin Mining | Litecoin/Dogecoin | Kaspa (KAS) |

|---|---|---|---|---|

| Consensus Mechanism | Proof-of-Work (ended 2022) | Proof-of-Work | Proof-of-Work | Proof-of-Work |

| Mining Equipment | GPU (obsolete) | ASIC (Antminer S21+) | ASIC (Antminer L9) | ASIC (KS3) |

| Algorithm | Ethash | SHA-256 | Scrypt | kHeavyHash |

| Current Profitability | N/A (staking only) | Moderate-High | Moderate | Emerging |

| Market Cap Rank | #2 | #1 | #10/#20 | #35 |

| Investment Stability | High | Very High | Medium-High | Medium |

Table compares mining alternatives after Ethereum’s transition to Proof-of-Stake in September 2022

Since Ethereum’s transition to Proof-of-Stake, GPU miners faced a critical decision: pivot to alternative proof-of-work chains or exit mining entirely. The most viable options in December 2025 include:

Bitcoin Mining: The gold standard for ASIC mining remains Bitcoin. The Bitmain Antminer S21+ delivers 216 TH/s with 16.5 J/TH efficiency, providing stable returns despite market volatility. With Bitcoin’s institutional adoption and proven track record, BTC mining represents the lowest-risk proof-of-work option.

Litecoin/Dogecoin Merged Mining: The Bitmain Antminer L9 enables simultaneous mining of Litecoin and Dogecoin through Scrypt algorithm merged mining. This dual-revenue stream provides hedging against single-coin volatility, particularly valuable during uncertain market conditions.

Alternative Networks: Kaspa (KAS), Ethereum Classic (ETC), and Ravencoin (RVN) offer opportunities for miners with existing GPU infrastructure or specialized ASICs, though with higher risk profiles than established networks.

December 2025 Market Outlook: Volatility and Opportunity

Macroeconomic Headwinds Persist

The cryptocurrency market enters December 2025 facing significant macroeconomic pressures. Bitcoin’s realized volatility fell from 84% to approximately 43% over recent months, indicating deeper institutional liquidity but also reflecting reduced speculative fervor. The Federal Reserve’s stance on maintaining higher rates through year-end dampens risk appetite across all asset classes.

Government liquidity concerns, highlighted by the recent U.S. government shutdown (now resolved), created additional uncertainty. These factors combine to create a challenging environment for crypto miners dependent on favorable token prices for profitability calculations.

Institutional Sentiment Shifts

The $1.4 billion in Ethereum ETF outflows since late October reflects institutional reassessment of crypto exposure. However, this shouldn’t be interpreted solely as bearish sentiment. Many analysts view the current correction as a “mid-cycle reset” rather than the onset of prolonged crypto winter, according to Glassnode’s latest research.

Source: Binance Square Market Analysis

Mining Profitability Considerations

For mining operations evaluating expansion or equipment purchases in December 2025, several factors warrant consideration:

- Electricity Costs: Remain the primary determinant of profitability, particularly with BTC mining difficulty at record highs

- Equipment Efficiency: Newer models like the S21 series offer significant efficiency gains over older hardware

- Market Timing: Current price volatility may present acquisition opportunities for discounted mining equipment

- Diversification: Multi-coin mining strategies reduce dependence on single-asset price movements

Recommended Mining Equipment for Current Market Conditions

| Miner Model | Algorithm | Hashrate | Power | Efficiency | Best For | ROI Timeline |

|---|---|---|---|---|---|---|

| Antminer S21+ | SHA-256 (BTC) | 216 TH/s | 3564W | 16.5 J/TH | Established miners | 12-18 months |

| Antminer L9 | Scrypt (LTC/DOGE) | 16 GH/s | 3360W | 210 J/MH | Diversification | 14-20 months |

| Goldshell KS3 | kHeavyHash (KAS) | 8.3 TH/s | 3188W | 384 J/TH | High-risk growth | Variable |

| Whatsminer M60 | SHA-256 (BTC) | 186 TH/s | 3344W | 18 J/TH | Budget entry | 15-22 months |

| Elphapex DG2+ | Scrypt (LTC/DOGE) | 20.5 GH/s | 3900W | 190 J/MH | Maximum hashrate | 12-18 months |

ROI timelines calculated at $0.08/kWh electricity cost and December 2025 market prices. Actual returns vary with market conditions.

Navigating ETF Flows: What Miners Need to Know

The relationship between ETF flows and mining profitability isn’t immediately obvious, but institutional capital movements significantly impact miners’ business models. Large ETF outflows typically precede or accompany price declines, compressing mining margins. Conversely, sustained inflows often correlate with price appreciation that improves profitability calculations.

Ethereum’s $1.4 billion outflow over three weeks represents approximately 0.47 million ETH in institutional selling pressure. For comparison, Bitcoin ETFs experienced similar volatility during November 2025, with net outflows exceeding $3.48 billion for the month, according to Incrypted’s analysis.

Modern ASIC miners like the Antminer S21+ represent significant capital investments requiring careful ROI analysis

Mining operations should monitor ETF flow data as a leading indicator of institutional sentiment. Tools like Farside Investors’ ETF tracker provide daily updates on inflows and outflows across all spot crypto ETF products, enabling data-driven operational decisions.

Risk Management Strategies for Crypto Miners in 2025

Diversification Across Multiple Chains

The collapse of Ethereum GPU mining after The Merge demonstrated the risks of single-chain dependence. Modern mining operations should consider:

- Primary allocation: 60-70% to established networks (Bitcoin)

- Secondary allocation: 20-30% to proven alternatives (Litecoin/Dogecoin merged mining)

- Speculative allocation: 10-20% to emerging networks with growth potential (Kaspa, Alephium)

Hedging Strategies

Miners can employ several hedging techniques to protect against price volatility:

- Forward selling: Lock in future revenue through derivatives markets

- Options collars: Purchase puts while selling calls to limit downside while capping upside

- Stablecoin conversion: Regular conversion of mined coins to USDT/USDC to preserve capital

- Hardware diversification: Maintain flexibility to pivot between profitable coins

Operational Efficiency Focus

During periods of compressed margins, operational excellence becomes paramount:

- Negotiate long-term electricity contracts to stabilize costs

- Implement monitoring systems to maximize uptime (target >98%)

- Optimize cooling and infrastructure to reduce energy waste

- Consider renewable energy sources to reduce both costs and regulatory risk

The Ethereum Staking Alternative: Comparative Analysis

While traditional Ethereum mining ended in 2022, staking offers an alternative revenue stream for those holding ETH. Current staking yields stabilized around 3.5-4.2% APY in early 2025, according to OKX analysis. However, this represents significantly lower returns compared to historical GPU mining profitability during Ethereum’s proof-of-work era.

Staking Advantages:

- No hardware depreciation or electricity costs

- Passive income without active management

- Supports network security and decentralization

- Lower operational complexity

Staking Disadvantages:

- Much lower yields (3-4% vs. historical 50-200% mining APY)

- Requires minimum 32 ETH ($100,000+ capital requirement)

- Tokens remain locked with withdrawal limitations

- No equipment ownership or potential resale value

For miners accustomed to proof-of-work economics, staking represents a fundamentally different business model with lower returns but dramatically reduced operational risk and capital requirements (excluding the ETH purchase itself).

Where to Source Reliable Mining Equipment

Acquiring genuine, warranty-backed mining equipment remains crucial for operational success. Miners1688 specializes in supplying top-tier ASIC miners directly from manufacturers including Bitmain, Whatsminer, IceRiver, Avalon, and Goldshell.

Key advantages of working with established suppliers:

- Manufacturer Direct Sourcing: Competitive pricing and guaranteed authenticity

- Professional Logistics: Partnerships with DHL, UPS, FedEx for reliable global shipping

- Technical Support: Remote guidance and troubleshooting assistance

- After-Sales Service: Warranty support and maintenance services

- Market Expertise: 7+ years of industry experience and market insights

Miners1688 offers comprehensive mining solutions from equipment to technical support

During volatile market conditions, choosing reputable suppliers becomes even more critical. Equipment failures or counterfeit hardware can devastate mining operations when margins are already compressed.

Future Outlook: Ethereum’s Fusaka Upgrade and Market Implications

Looking ahead to 2025’s second half, Ethereum’s upcoming Fusaka upgrade promises significant improvements to Layer-2 efficiency. Expected benefits include:

- 40-60% reduction in Layer-2 transaction costs

- Improved rollup throughput and data availability

- Enhanced smart contract functionality

While these improvements strengthen Ethereum’s technical position, they further reduce mainnet transaction fees—solidifying the post-Merge economic model that makes traditional mining impossible. Miners should view Ethereum developments through the lens of broader market sentiment rather than direct operational impact.

The divergence between Ethereum’s strong technical roadmap and current price weakness, coupled with ETF outflows, creates an interesting paradox. Some analysts believe this disconnect represents an opportunity, while others see fundamental shifts in institutional crypto allocation strategies.

Frequently Asked Questions

Q: Can you still mine Ethereum in December 2025?

A: No, Ethereum mining became impossible after The Merge in September 2022, when the network transitioned from Proof-of-Work to Proof-of-Stake. Miners can only stake ETH (requiring minimum 32 ETH) or mine alternative cryptocurrencies using their hardware.

Q: How do ETF outflows affect mining profitability?

A: ETF outflows typically correlate with price declines, which directly reduce mining revenue. A $1.4 billion outflow like Ethereum experienced creates selling pressure that can drop prices 5-10%, significantly impacting profit margins for all proof-of-work miners across the crypto ecosystem.

Q: What’s the most profitable cryptocurrency to mine right now?

A: Bitcoin mining with efficient ASICs like the Antminer S21+ generally offers the best risk-adjusted returns in December 2025. Litecoin/Dogecoin merged mining provides diversification, while Kaspa offers higher-risk growth potential. Profitability depends heavily on electricity costs and equipment efficiency.

Q: Should I buy mining equipment during the current market decline?

A: Market corrections can present equipment acquisition opportunities, as both hardware prices and difficulty may decline. However, ensure thorough ROI calculations assuming conservative price scenarios. Focus on efficient models with proven manufacturer support, and never invest more capital than you can afford to lose.

Q: How long until ETH prices recover?

A: Price predictions remain speculative, but historical patterns suggest major cryptocurrencies typically experience 30-60% corrections during bull market cycles before resuming upward trends. The current decline may represent a “mid-cycle reset” rather than prolonged bear market, according to Glassnode research. Miners should plan for 12-24 month ROI timelines regardless of short-term volatility.

Q: What’s the difference between on-chain activity and price?

A: On-chain activity (active addresses, transaction volume, fees) measures actual network usage, while price reflects market sentiment and speculation. The current divergence—where ETH price declines despite ongoing development—suggests temporary fear-driven selling rather than fundamental deterioration. However, declining active addresses (8.2M vs. 9M) do indicate reduced user engagement requiring monitoring.

Conclusion: Adapting Mining Strategies to New Market Realities

Ethereum’s $1.4 billion ETF outflow over three weeks, coupled with accelerating long-term holder distribution, signals significant institutional repositioning. For crypto miners operating in December 2025, these developments underscore the importance of diversification, operational efficiency, and evidence-based decision-making.

While Ethereum mining ceased in 2022, the lessons from current market dynamics apply broadly across proof-of-work networks. Bitcoin, Litecoin, Dogecoin, and emerging altcoins continue offering mining opportunities for operations with:

- Competitive electricity costs (ideally below $0.06/kWh)

- Efficient modern equipment (latest-generation ASICs)

- Strong risk management practices

- Sufficient capital reserves for market volatility

The current market period—characterized by volatility, institutional uncertainty, and technical evolution—separates sustainable mining operations from undercapitalized ventures. By focusing on fundamentals, maintaining diversified exposure, and sourcing reliable equipment from established suppliers like Miners1688, miners can position themselves to capture opportunities as the market stabilizes.

The divergence between on-chain activity and price action won’t persist indefinitely. Whether Ethereum rebounds quickly or enters an extended consolidation period, miners focused on proof-of-work alternatives must maintain operational discipline, monitor institutional flows as leading indicators, and remain prepared to adapt strategies as market conditions evolve.

Related Resources: