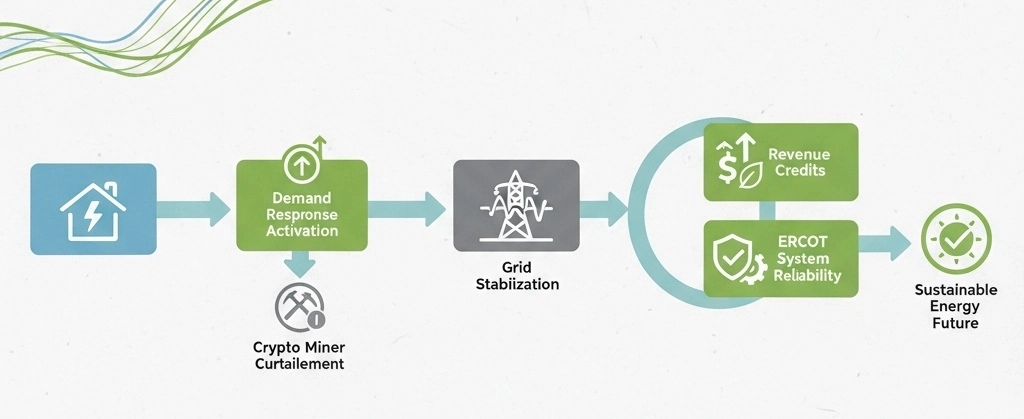

Summary: Bitcoin miners in Texas are revolutionizing their business model by participating in ERCOT’s demand response programs, earning millions in curtailment credits while supporting grid stability. Learn how strategic “peak shaving” transforms mining operations from pure computational ventures into sophisticated energy trading enterprises.

Understanding ERCOT’s Demand Response Programs for Crypto Mining

The Electric Reliability Council of Texas (ERCOT) manages the power grid for approximately 90% of Texas’s electric load, serving over 27 million customers. As Bitcoin mining operations have exploded across the Lone Star State, they’ve become key players in a sophisticated grid balancing act that benefits both miners and the broader energy ecosystem.

ERCOT’s demand response programs incentivize large flexible loads—including Bitcoin mining facilities—to temporarily reduce electricity consumption during peak demand periods. These programs create a win-win scenario: the grid gains stability during stress events, and miners earn substantial curtailment credits that can significantly boost their bottom line. According to Riot Platforms’ Q3 2025 financial results, power curtailment credits reached $30.6 million in Q3 2025 alone—a 147% increase compared to Q3 2024.

The Business Case for Curtailment Participation

Modern mining operations recognize that their true business isn’t just mining Bitcoin—it’s optimizing energy arbitrage opportunities. When ERCOT wholesale prices spike during extreme weather events or grid stress, miners can earn more by selling their contracted power capacity back to the grid than by continuing mining operations.

Consider Riot Platforms’ average cost to mine one Bitcoin in Q3 2025: $46,324 excluding depreciation. However, with strategic curtailment participation reducing effective power costs, their net mining cost becomes significantly more competitive. The math becomes compelling when electricity prices surge from typical rates of $0.03-0.05/kWh to $5.00/kWh or higher during peak events.

Peak Shaving Strategies: Timing Is Everything

Successful curtailment strategies require sophisticated monitoring and rapid response capabilities. ERCOT issues various alert levels—from Conservation Alerts to Energy Emergency Alerts (EEA Levels 1-3)—each signaling different levels of grid stress and corresponding price volatility.

Optimal curtailment windows typically occur during:

- Summer afternoon peaks (2 PM – 7 PM): When air conditioning demand maxes out across Texas

- Winter storm events: Rare but extreme pricing opportunities, as seen in previous winter storms

- ERCOT’s 4 Coincident Peak (4CP) intervals: Four critical hours during June-September that determine the following year’s transmission charges

Strategic miners don’t curtail randomly—they employ predictive analytics, weather forecasting, and real-time price monitoring to identify the 15-20 annual events where curtailment credits dwarf potential mining revenue. For a 50 MW mining facility, these strategic shutdowns can generate $2-5 million annually in additional revenue, according to industry analysis from Miners1688’s research.

Implementing Automated Curtailment Systems

Leading mining operations have invested in automated curtailment response systems that can power down operations within 60 seconds of receiving ERCOT signals. These systems typically include:

- Real-time ERCOT price monitoring via API integrations

- Automated shutdown sequences that safely power down mining hardware

- Predictive algorithms that forecast high-price events 2-4 hours in advance

- Load balancing software that can curtail partial operations rather than full facility shutdowns

The key advantage of Bitcoin mining as a flexible load is its interruptibility—unlike data centers running critical applications, mining operations can start and stop with minimal consequence beyond temporarily reduced hash rate contribution.

Revenue Optimization: Mining vs. Curtailment Credits

| Scenario | Mining Revenue (24h) | Curtailment Credits (24h) | Optimal Strategy |

|---|---|---|---|

| Normal Operations ($0.04/kWh) | $12,000 | $0 | Continue Mining |

| High Demand Alert ($0.50/kWh) | $12,000 | $18,000 | Curtail Operations |

| Emergency Alert ($2.00/kWh) | $12,000 | $72,000 | Full Curtailment |

| Winter Storm Peak ($5.00/kWh) | $12,000 | $180,000 | Extended Curtailment |

Table assumes 50 MW mining facility with average efficiency of 30 J/TH

This revenue comparison illustrates why sophisticated miners view their operations as “energy businesses with a Bitcoin mining component” rather than pure mining ventures. The strategic value lies in flexibility—the ability to pivot between mining during favorable conditions and grid services during peak pricing events.

Modern miners also participate in ERCOT’s ancillary services market, providing frequency regulation and responsive reserve services. These programs offer capacity payments simply for remaining on standby, creating additional revenue streams beyond mining and curtailment credits.

Hardware Considerations for Flexible Operations

Not all mining hardware handles frequent power cycling equally well. Miners optimizing for curtailment participation should consider equipment durability and rapid restart capabilities when selecting ASICs.

Top performers for curtailment-focused operations include:

- Bitmain Antminer S21 Series (available at Miners1688): Robust design withstands frequent cycling, 200 TH/s at 3500W

- MicroBT WhatsMiner M60 Series: Enterprise-grade reliability with fast restart protocols

- Canaan Avalon Made A1566: Cost-effective option with proven durability in demand response applications

The critical factor isn’t just hash rate or efficiency—it’s the ability to perform thousands of start-stop cycles without hardware degradation. Miners should avoid older equipment with known reliability issues, as frequent power cycling accelerates failure rates in marginal hardware.

Maintenance Protocols for Curtailment Operations

Frequent power cycling requires enhanced maintenance protocols:

- Thermal management: Rapid temperature changes stress components; allow gradual cool-down periods

- Electrical infrastructure: Invest in robust switching gear rated for frequent cycling

- Hash board monitoring: Track performance degradation metrics across power cycles

- Predictive maintenance: Replace fans, power supplies, and control boards proactively

Leading operators report that proper maintenance protocols extend hardware lifespan despite frequent curtailment, while the additional revenue more than justifies the incremental maintenance costs.

Current Market Conditions and Profitability Analysis

As of November 2025, Bitcoin mining profitability faces a complex landscape. Network hash rate has increased 52% year-over-year, while Bitcoin prices show continued volatility, currently trading around $114,000. This creates both challenges and opportunities for miners.

| Profitability Factor | Q3 2024 | Q3 2025 | Change |

|---|---|---|---|

| Average BTC Price | $61,131 | $114,361 | +87% |

| Global Network Hash Rate | 623 EH/s | 947 EH/s | +52% |

| Cost to Mine (excluding depreciation) | $35,376 | $46,324 | +31% |

| Curtailment Credits (Riot, quarterly) | $12.4M | $30.6M | +147% |

| Profitability Margin | 42% | 59% | +17% |

Data source: Riot Platforms Q3 2025 Financial Results

The substantial increase in curtailment credits demonstrates the growing sophistication of mining operations in monetizing grid participation. Companies like Riot Platforms have essentially created a dual revenue model where power market participation supplements and sometimes exceeds mining revenue during optimal conditions.

For operators in ERCOT territory, the economic equation increasingly favors flexible, grid-responsive operations over pure mining facilities locked into fixed operational models. The 2025 data clearly shows that miners who ignore demand response opportunities leave significant money on the table.

Regulatory Landscape and Future Outlook

ERCOT’s relationship with large flexible loads like Bitcoin miners continues evolving. In late 2024, ERCOT implemented new registration requirements for cryptocurrency mining operations exceeding 75 MW, aiming to improve grid visibility and planning accuracy.

The U.S. Energy Information Administration projects that crypto mining demand in ERCOT could reach 54 billion kWh in 2025—approximately 10% of total grid demand. This growing presence has sparked both opportunity and scrutiny.

Key regulatory developments include:

- Mandatory registration: Large mining facilities must register with ERCOT and report capacity

- Transmission charge reforms: The 4CP system may evolve to include monthly or real-time coincident peaks

- Expanded ancillary services: New programs specifically designed for flexible loads in development

- Environmental considerations: Increasing focus on renewable energy sources for mining operations

Forward-thinking miners are positioning themselves not as grid liabilities but as grid assets—flexible loads that enhance reliability while pursuing profitable operations. This strategic positioning provides regulatory advantages as policymakers evaluate the role of energy-intensive industries in Texas’s energy future.

Preparing for 2026 and Beyond

ERCOT’s long-term load forecast anticipates peak demand reaching 139 GW by 2030, driven by data centers, manufacturing growth, and electrification trends. This projected growth creates expanding opportunities for flexible load participation.

Miners investing in infrastructure today should consider:

- Scalable curtailment systems that can respond to evolving program requirements

- Hybrid renewable integration to hedge against grid power costs and enhance sustainability profiles

- Diversified revenue models beyond pure mining and curtailment (hosting, HPC, AI compute)

- Geographic diversification across ERCOT zones to optimize transmission costs and renewable access

FAQ: Curtailment Credits and ERCOT Mining Operations

Q: How much can Bitcoin miners earn from ERCOT curtailment credits?

A: Earnings vary significantly based on facility size, contract structure, and participation rates. Industry data shows that strategic curtailment during 15-20 peak events annually can generate $2-5 million additional revenue for a 50 MW facility. Riot Platforms earned $30.6 million in Q3 2025 alone from power curtailment credits, representing approximately 19% of their mining-related revenue.

Q: Does frequent power cycling damage mining hardware?

A: Modern enterprise-grade ASIC miners like the Antminer S21 series and WhatsMiner M60 series are designed to handle thousands of power cycles with proper protocols. The key is gradual thermal management, robust electrical infrastructure, and proactive maintenance. When properly managed, the revenue from curtailment significantly exceeds any incremental hardware wear costs.

Q: What’s the optimal curtailment strategy for maximizing profitability?

A: The most profitable approach combines predictive analytics with automated response systems. Monitor ERCOT real-time pricing, weather forecasts, and grid alert levels. Curtail during the top 15-20 highest-priced events annually while mining during normal conditions. Focus particularly on ERCOT’s 4CP intervals and extreme weather events when prices can spike 50-100x normal rates.

Q: Can small mining operations participate in demand response programs?

A: Yes, though minimum participation thresholds vary by program. Individual operators with facilities below ERCOT’s direct participation minimums can work through aggregators or Curtailment Service Providers (CSPs) who pool smaller loads to meet program requirements. Even 5-10 MW operations can generate six-figure annual curtailment revenue through aggregated participation.

Q: How does Bitcoin price volatility affect curtailment decisions?

A: When Bitcoin prices are high, the opportunity cost of curtailment increases, requiring higher electricity price thresholds before curtailment becomes profitable. When Bitcoin prices drop, curtailment becomes attractive at lower electricity price points. Sophisticated operators use dynamic curtailment algorithms that adjust response thresholds based on real-time Bitcoin prices, electricity costs, and grid conditions.

Q: What mining equipment is best suited for curtailment-focused operations?

A: Prioritize enterprise-grade hardware with proven durability and rapid restart capabilities. The Bitmain Antminer S21+, WhatsMiner M60S, and Canaan Avalon Q series offer excellent balance between efficiency, hash rate, and operational flexibility. Avoid older generation equipment (S19 series and earlier) for curtailment-heavy strategies due to higher failure rates under frequent cycling.

Conclusion: The Evolution of Bitcoin Mining Business Models

The Bitcoin mining industry in Texas has fundamentally evolved beyond simple computational speculation. Today’s successful operations function as sophisticated energy trading enterprises that happen to mine Bitcoin during favorable conditions and provide critical grid services during peak demand periods.

ERCOT’s demand response programs have created a powerful economic model where strategic curtailment can boost annual revenue by 15-25% or more. As Bitcoin network difficulty continues rising and mining margins compress, the ability to monetize grid participation may determine which operators thrive and which struggle to remain profitable.

For miners operating in ERCOT territory—or considering entry—the message is clear: develop robust curtailment capabilities, invest in automation and monitoring infrastructure, and view your operation as an integrated energy business. The era of “always-on” mining is giving way to strategic, grid-responsive operations that maximize returns across multiple revenue streams.

The miners who master this evolution won’t just survive the next market cycle—they’ll lead the industry’s transformation into a critical component of grid stability and renewable energy integration.