Summary: Bitcoin mining companies are undergoing a fundamental valuation shift in 2025. Once viewed purely as high-beta Bitcoin proxies, public miners now face differentiated market assessment based on operational efficiency, infrastructure monetization, and treasury strategies. The April 2024 halving reduced block rewards to 3.125 BTC, forcing companies to evolve beyond simple Bitcoin exposure toward diversified business models spanning AI data centers, HPC infrastructure, and strategic capital deployment.

The Death of the “Bitcoin Proxy” Investment Thesis

For years, institutional investors treated public mining stocks as leveraged plays on Bitcoin price movements. Marathon Digital, Riot Platforms, and CleanSpark delivered 3-5x Bitcoin’s volatility during bull markets. However, 2025 data reveals a critical decoupling. While Bitcoin trades around $96,000 (November 2025), mining stocks have experienced independent valuation pressures driven by hash rate competition, energy costs, and capital efficiency metrics.

Understanding the Valuation Disconnect

The traditional correlation between Bitcoin price and miner stock performance has weakened significantly. According to Houlihan Lokey’s Digital Assets Market Update, large-cap miners now face scrutiny on: operational hash rate efficiency (TH/s per dollar invested), power purchase agreement structures, debt-to-equity ratios affecting expansion capacity, and diversification into AI/HPC revenue streams.

Post-Halving Economic Reality

The April 2024 halving slashed mining rewards from 6.25 BTC to 3.125 BTC per block. Combined with network difficulty reaching 123 trillion, hash prices dropped to $0.049 per terahash—the lowest in mining history. This structural shift means only operators with sub-$0.05/kWh energy costs and latest-generation ASICs remain profitable at current Bitcoin prices.

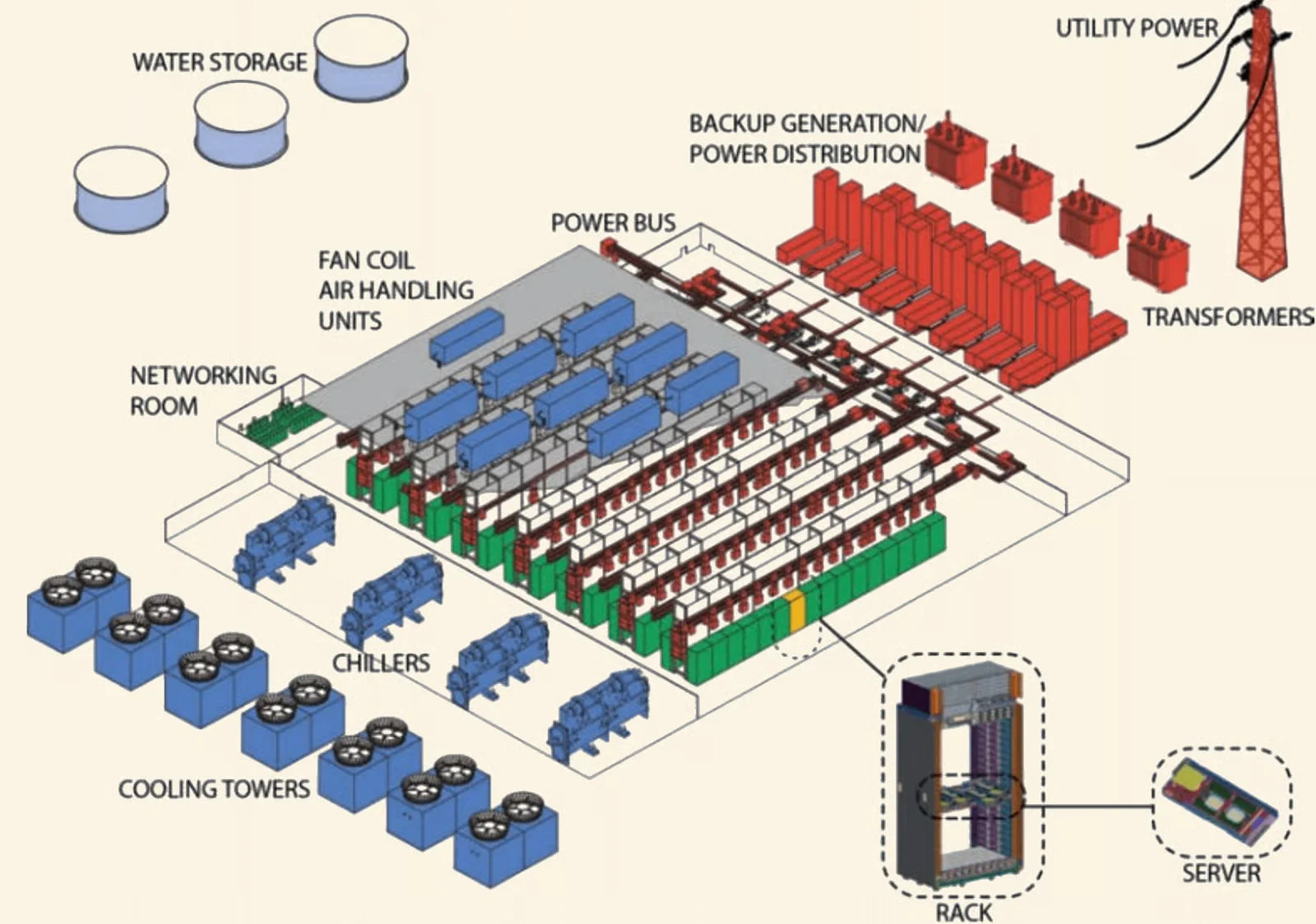

Infrastructure Monetization: The New Revenue Pillar

Leading mining companies are pivoting physical infrastructure toward high-margin AI and HPC workloads. CleanSpark announced $1.15B capital raise specifically targeting dual-purpose data centers. Hut 8 completed strategic merger with US Data Mining Group, creating hybrid facilities generating 40% revenue from non-Bitcoin computing tasks.

Why Infrastructure Matters for Valuation

Traditional mining operations generated single revenue stream from block rewards plus transaction fees. New hybrid model creates: AI training/inference computing contracts (30-40% gross margins), grid stabilization demand response payments, surplus energy arbitrage opportunities, and colocation services for third-party miners. These diversified cash flows reduce Bitcoin price sensitivity, attracting institutional investors seeking lower-volatility digital asset exposure.

Real-World Diversification Examples

Marathon Digital Holdings secured 200 MW Texas facility with explicit AI co-location design. TeraWulf operates 50 MW nuclear-powered site offering zero-carbon computing, attracting ESG-focused AI firms. These infrastructure plays fundamentally change valuation models—analysts now apply DCF methodologies incorporating multiple revenue streams rather than simple Bitcoin price correlation.

Consolidation Wave Reshapes Competitive Landscape

| Acquirer | Target | Strategic Rationale | Transaction Value |

|---|---|---|---|

| Marathon Digital | Stronghold Digital Mining | Geographic expansion + energy arbitrage | $155M |

| Riot Platforms | Bitfarms (attempted) | Hash rate consolidation + Canadian hydro power access | $215M proposed |

| CleanSpark | Multiple small operators | Economies of scale for next-gen ASIC deployment | $185M cumulative |

| Hut 8 | US Data Mining Group | Vertical integration: mining + AI infrastructure | Undisclosed |

Post-halving economics force consolidation among public miners. Companies with $2B+ market caps acquire distressed operators, gaining strategic assets at 40-60% discounts to replacement cost. This M&A activity signals market maturation—investors reward platforms with operational scale over speculative early-stage miners.

Survival of the Efficient

Smaller public miners without access to sub-$0.04/kWh power or capital for latest ASICs face existential threats. Hash rate concentration among top 5 companies increased from 35% (2023) to 52% (2025). This consolidation creates “blue-chip” mining category—firms with fortress balance sheets, diversified energy sources, and institutional-grade reporting.

Valuation Multiples Diverge Dramatically

Leading miners trade at 8-12x forward EBITDA despite Bitcoin volatility. Mid-tier operators stuck at 3-5x multiples reflect market skepticism about post-halving survival. Smallest public miners approach liquidation valuations, with market caps below tangible book value. This dispersion proves investors now differentiate based on operational excellence rather than treating sector as monolithic Bitcoin play.

Treasury Strategy: From Optional to Essential

Public miners increasingly adopt Strategy’s (formerly MicroStrategy) playbook—holding mined Bitcoin rather than immediately liquidating for operational expenses. Marathon Digital holds 35,000+ BTC ($3.4B at current prices), creating secondary valuation driver beyond mining operations. This treasury strategy attracts crypto-native investors willing to pay premiums for indirect Bitcoin exposure within regulated equity vehicles.

Treasury Holdings Impact Share Price

Companies with significant BTC treasuries trade at premiums to net asset value (NAV). Marathon’s treasury represents 55% of market cap, creating bitcoin-backed equity instrument appealing to investors unable to hold direct crypto exposure. However, this strategy introduces accounting volatility—quarterly impairment charges reduce reported earnings during Bitcoin corrections despite long-term holding strategy.

Capital Allocation Debates

Mining community debates optimal treasury strategy. Conservative operators like Riot Platforms maintain minimal BTC holdings, immediately converting rewards to fund expansion. Aggressive accumulators like Marathon and CleanSpark leverage debt financing to avoid selling mined Bitcoin. Each approach attracts different investor profiles—growth-focused hedge funds prefer treasury builders while risk-averse institutions favor cash-generative models.

Energy Cost Arbitrage: The Ultimate Competitive Moat

| Energy Source | Typical Cost ($/kWh) | Availability | Strategic Advantage |

|---|---|---|---|

| Stranded Natural Gas | $0.02-$0.03 | Moderate | Lowest variable cost for remote operations |

| Hydroelectric (Run-of-river) | $0.03-$0.04 | High | Renewable + grid stabilization revenue |

| Nuclear (Curtailed Hours) | $0.03-$0.05 | Limited | Zero-carbon certification premium |

| Wind/Solar (Over-generation) | $0.01-$0.03 | High variability | Demand response payments available |

| Grid Power (Industrial Rate) | $0.07-$0.12 | Universal | Baseline cost for urban data centers |

Post-halving environment makes energy cost THE critical valuation factor. Miners with multi-year power purchase agreements below $0.04/kWh possess structural advantages competitors cannot replicate. TeraWulf’s nuclear-powered facility delivers 99.9% uptime at $0.03/kWh—impossible to match without similar infrastructure access.

Geographic Energy Arbitrage

Texas ERCOT grid offers unique mining economics. Miners receive payments for voluntary curtailment during peak demand, creating negative effective energy costs during 15-20% of operating hours. Riot Platforms generated $31M in 2024 from curtailment credits alone—revenue stream independent of Bitcoin price or hash rate.

Renewable Energy Premium

ESG-conscious institutional investors pay valuation premiums for carbon-neutral mining operations. CleanSpark’s 95% renewable energy mix commands 25-30% higher EBITDA multiple versus coal-powered competitors. This green premium grows as European and North American pension funds increase digital asset allocations with sustainability mandates.

Next-Generation ASIC Economics Transform Profitability

Latest mining hardware fundamentally alters competitive dynamics. Bitmain’s Antminer S21 series delivers 17-20 J/TH efficiency versus 30-35 J/TH for prior generation equipment. This 40-50% efficiency improvement means operators with legacy ASICs face profitability crisis even at current Bitcoin prices.

ASIC Refresh Cycle Acceleration

Pre-halving, miners operated ASICs 3-4 years before obsolescence. Post-halving economics compress refresh cycles to 18-24 months. Public companies with strong balance sheets access manufacturer pre-orders for next-generation chips—creating temporary hash rate advantages worth millions in incremental revenue.

Efficiency Determines Survival

At $96,000 Bitcoin and $0.049 hash price, only ASICs achieving <20 J/TH remain profitable with $0.05/kWh energy costs. This harsh reality forces operators without capital for equipment upgrades toward distressed sale or bankruptcy. The market now values public miners primarily on: current ASIC generation mix, scheduled delivery of next-gen equipment, and capital reserves for continuous upgrades.

Mining Hardware Supply Chain Dynamics

Bitmain and MicroBT dominate ASIC manufacturing with 85%+ market share. This oligopoly creates strategic advantages for public miners maintaining direct manufacturer relationships and multi-million dollar pre-order agreements. Companies like Marathon Digital prioritize exclusive supply agreements, ensuring priority access during chip shortages—strategic moat difficult for smaller competitors to replicate.

Regulatory Clarity Unlocks Institutional Capital

Bitcoin ETF approvals and evolving regulatory framework dramatically improve public miner access to traditional capital markets. Firms like CleanSpark and Riot Platforms now issue investment-grade debt at 6-8% interest rates—previously impossible without mainstream financial acceptance.

Institutional Ownership Surges

BlackRock, Vanguard, and State Street collectively hold 12-18% of major public mining companies—representing $4.5B institutional capital influx since 2024. This ownership shift brings: enhanced corporate governance standards, quarterly earnings call discipline, and ESG reporting requirements. While adding compliance costs, institutional ownership reduces cost of capital and valuation volatility.

The GENIUS Act Impact

U.S. stablecoin legislation and Bitcoin infrastructure recognition as “digital commodity” removes regulatory overhang that suppressed mining stock valuations 2022-2023. Public companies now confidently deploy growth capital, knowing operating licenses and power agreements carry reduced regulatory risk.

Valuation Frameworks: New Metrics for New Era

Traditional mining stock analysis focused exclusively on: Bitcoin price sensitivity (beta), total hash rate capacity, and all-in sustaining costs per Bitcoin mined. These metrics remain relevant but insufficient for 2025 valuation.

Multi-Factor Valuation Model Components

Modern mining analyst models incorporate: core mining EBITDA at various Bitcoin price scenarios, infrastructure monetization revenue (AI/HPC), treasury Bitcoin holdings at market value, energy cost structure and PPA duration, ASIC efficiency and refresh schedule, and grid services / demand response income.

From High-Beta to Multi-Business Conglomerate

Leading public miners now resemble diversified infrastructure companies rather than speculative commodity plays. This evolution attracts different investor base—infrastructure funds, renewable energy investors, and AI technology buyers replace crypto-native hedge funds as primary shareholders.

Comparative Valuation Analysis

Best-in-class miners trade at 10-15x forward EBITDA, 3-5x price-to-book, and 1.5-2.0x price-to-sales. These multiples approach traditional data center operators, reflecting market recognition of business model evolution. Conversely, pure-play Bitcoin mining operations without diversification trade at 50-60% discounts to diversified peers—quantifying the “infrastructure premium.”

Strategic Implications for Mining Equipment Buyers

Understanding public company valuation shifts provides actionable insights for mining equipment procurement decisions:

Equipment Selection Philosophy

Public miners demonstrate that equipment efficiency trumps absolute hash rate. Rather than maximizing TH/s, focus on J/TH efficiency matching your specific energy costs. Latest Antminer S21+ models deliver 15.5 J/TH efficiency, making them viable with $0.05-0.06/kWh power costs that render older equipment unprofitable.

Diversification Strategy Application

While individual miners cannot pivot to AI infrastructure like public companies, equipment portfolio diversification reduces risk. Consider allocating 70-80% capacity to Bitcoin mining with latest ASICs, while deploying 20-30% toward alternative proof-of-work coins with different difficulty cycles and reward structures.

Procurement Timing Lessons

Public company purchasing patterns provide market signals. Major miners pre-order next-generation ASICs 6-9 months ahead of general availability. Monitoring their equipment deployment announcements (disclosed in quarterly filings) offers advance warning of hash rate increases and difficulty adjustments affecting home/small commercial mining profitability.

For customers seeking reliable equipment suppliers, Miners1688 offers direct manufacturer relationships similar to public mining companies—ensuring access to latest-generation hardware including Bitmain Antminer L9 for Litecoin/Dogecoin mining and IceRiver KAS miners for Kaspa network participation.

The Path Forward: 2026 and Beyond

Public mining sector continues evolving beyond simple Bitcoin exposure. Expect further consolidation eliminating marginal operators, increased institutional ownership driving governance improvements, and hybrid infrastructure models becoming industry standard rather than innovation.

Next Halving Considerations

2028 halving will reduce block rewards to 1.5625 BTC, requiring ASIC efficiency improvements to <12 J/TH for profitability at today’s energy costs. Public companies investing in R&D partnerships with chip manufacturers position themselves for this inevitable efficiency requirement.

Macro Environment Influence

Traditional equity market conditions increasingly affect mining stocks as institutional ownership grows. During 2025 market volatility, mining stocks correlated 0.65 with S&P 500 versus 0.35 in 2023—demonstrating evolution toward mainstream technology stock behavior.

Frequently Asked Questions

Q: Are public mining stocks still good Bitcoin exposure vehicles?

A: They provide indirect exposure but with different risk/return profile than direct Bitcoin ownership. Stocks offer operational leverage during bull markets but suffer from company-specific risks (energy costs, equipment failures, debt levels) absent from pure Bitcoin holdings. Best used as portfolio diversification alongside direct crypto holdings.

Q: What Bitcoin price makes mining profitable post-halving?

A: With latest-generation ASICs (<20 J/TH efficiency) and energy costs under $0.05/kWh, mining remains profitable at $40,000-50,000 Bitcoin. However, profit margins remain thin until prices exceed $70,000. Current $96,000 prices provide comfortable margins for efficient operators.

Q: Should I invest in mining stocks or buy my own equipment?

A: Depends on scale and expertise. Home mining with 1-5 ASICs requires electrical infrastructure, cooling systems, and noise tolerance. Equipment investment breaks even at 12-18 months under optimal conditions. Mining stocks offer simpler exposure without operational hassles but include management risk and market volatility.

Q: How do I evaluate mining hardware purchases in 2025?

A: Calculate payback period: (Equipment Cost + Installation) / (Daily Mining Revenue – Daily Electricity Cost). Target <18 month payback given rapid ASIC obsolescence. Prioritize J/TH efficiency over absolute hash rate. Purchase from established suppliers like Miners1688 offering manufacturer warranties and technical support.

Q: What’s the biggest risk for public mining companies now?

A: Energy cost inflation. Fixed-rate power purchase agreements protect against electricity price spikes, but companies without long-term PPAs face profit margin compression if utility rates increase. Second major risk: debt burdens from aggressive expansion limiting flexibility during Bitcoin downturns.

Q: Will mining companies completely transition away from Bitcoin?

A: No. Bitcoin mining remains core business generating 60-80% of revenue for diversified operators. AI/HPC infrastructure provides stability during crypto market downturns but lacks Bitcoin mining’s upside during bull markets. Optimal strategy balances both revenue streams.

Q: How important are latest-generation ASICs for profitability?

A: Critical. At current network difficulty, ASICs older than 2 years struggle to break even with $0.05/kWh energy costs. Equipment efficiency determines whether operations generate profit or losses independent of Bitcoin price. Upgrade cycles now essential rather than optional for long-term mining viability.