The Resurgence of the Solo Miner: More Than Just a Lottery Ticket

Real-World Wins of 2025

In 2025, several solo miners defied astronomical odds. One famously solved block 903,883, earning the full reward of 3.125 BTC plus transaction fees, totaling over $350,000. These wins prove that with the right setup, solo success is still possible.

What is Solo Mining?

Solo mining is the act of attempting to validate a block on a blockchain independently, without joining a mining pool. If you succeed, you keep the entire block reward and all transaction fees, unlike pool mining where rewards are shared.

Understanding the Odds: Hashrate, Difficulty, and Your Chances

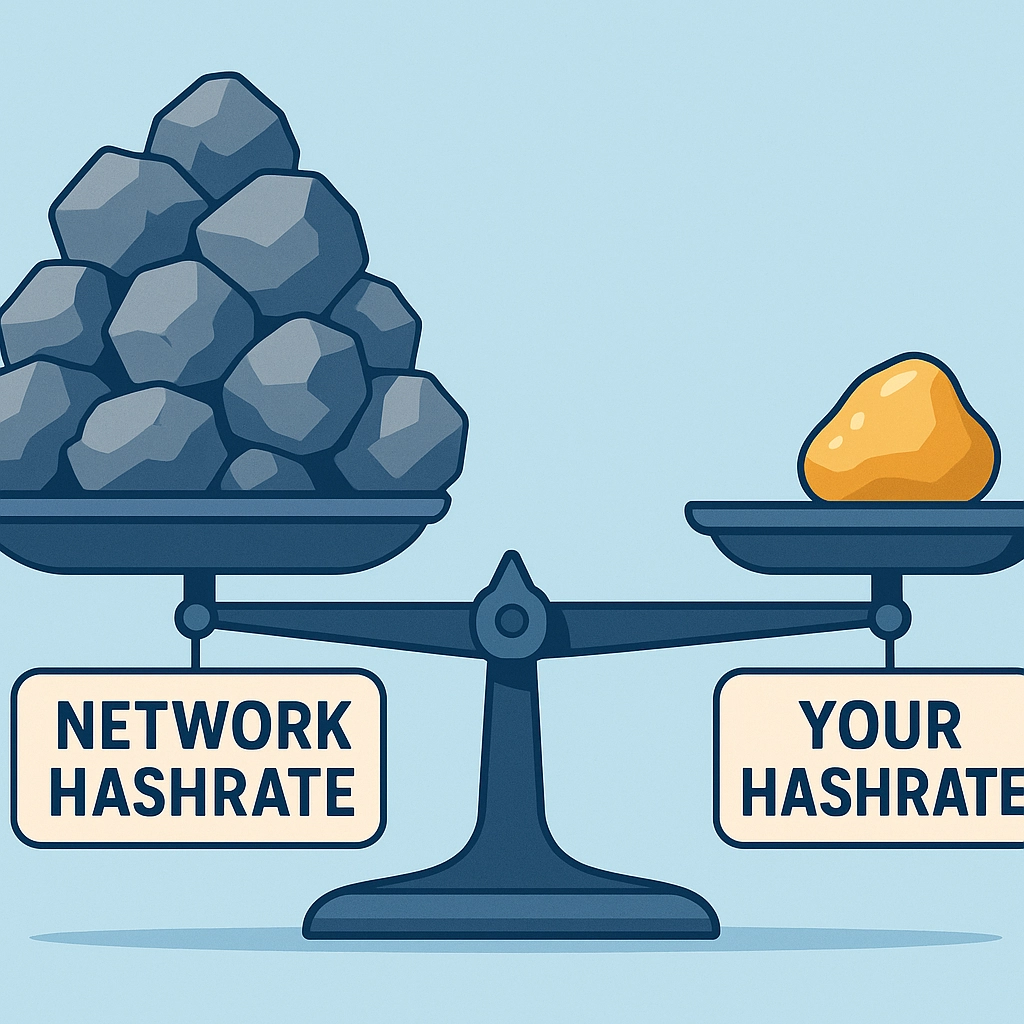

While the rewards are tempting, it’s crucial to understand the challenge. Your success depends on your hashrate relative to the entire network’s hashrate. As the network grows, your individual probability of finding a block decreases significantly.

What Hashrate and Difficulty Mean for You

Hashrate is your miner’s processing power. Network difficulty is a measure of how hard it is to find a new block. As more miners join, the difficulty rises to maintain a consistent block time, making it harder for any single miner to succeed.

Calculating Your Probability of Success

With a powerful ASIC providing 200 TH/s against a network hashrate of 700 EH/s, your chance of finding a block is minuscule. It’s a game of probability where you need immense patience, powerful hardware, and a touch of luck on your side.

The Critical Decision: Solo Mining vs. Joining a Pool

Every serious miner faces this choice. Do you aim for the jackpot with solo mining, or secure a steady, predictable income by joining a mining pool? The right path depends entirely on your capital, risk tolerance, and long-term goals.

The Case for Solo Mining: Full Autonomy, Full Reward

The allure of solo mining is clear: you keep 100% of the rewards. There are no pool fees, and you have complete control over your hardware and operations. For those who can afford the risk, the potential payoff is unparalleled.

The Case for Pool Mining: Stable Income, Lower Risk

Pool mining offers stability. By combining your hashrate with others, you earn small, consistent payouts based on your contribution. This approach eliminates the extreme volatility of solo mining and provides a reliable income stream.

| Feature | Solo Mining | Pool Mining |

|---|---|---|

| Reward Structure | All or nothing; full block reward + fees. | Proportional share based on hashrate. |

| Payout Frequency | Extremely low and unpredictable. | High and consistent (daily/hourly). |

| Potential Reward | Very high (e.g., 3.125+ BTC). | Very small, fractional amounts. |

| Risk & Volatility | Extremely high risk, high variance. | Low risk, low variance. |

| Autonomy | Full control over your operation. | Follow pool operator’s rules and fees. |

The Modern Solo Miner’s Playbook: Strategy & Tools

Success in solo mining today isn’t just about luck; it’s about strategy. This involves selecting top-tier hardware, using specialized services that cater to solo miners, and diligently managing operational costs to maximize your chances of profitability.

Choosing Hardware: Why ASICs are Non-Negotiable

For Bitcoin, the only viable tools are Application-Specific Integrated Circuit (ASIC) miners. You can explore a range of modern Bitcoin Miners to see what fits your budget and goals. Anything less powerful simply can’t compete.

Power and Profit: Managing Your Operational Costs

Your largest ongoing expense will be electricity. Before buying, always use a Miner Profitability Calculator to estimate returns based on your electricity cost, the miner’s efficiency, and current market conditions.

Gearing Up: Top ASIC Miners for Your Solo Venture

To have any chance at solo mining, you need the best equipment. High-performance ASICs give you the necessary hashrate to compete on the global stage. Sourcing this hardware from a reliable vendor is the first step toward building your operation.

Key Metrics for Choosing a Miner

When selecting an ASIC, focus on three key metrics: hashrate (TH/s), power consumption (W), and efficiency (J/TH). A more efficient miner costs less to run, increasing your long-term profitability and viability as a solo operator.

Where to Source Reliable Hardware

The market is filled with unreliable sellers. Partnering with a trusted vendor is key to avoid scams and secure quality hardware. Explore our full range of products or contact us for a bulk order to ensure you’re getting authentic, high-performance equipment.

| Model | Algorithm | Max Hashrate | Power Consumption | View on Miners1688 |

|---|---|---|---|---|

| Bitmain Antminer S21 | SHA-256 (BTC) | 200 TH/s | 3500W | View Product |

| Canaan Avalon Q | SHA-256 (BTC) | 90 TH/s | 1674W | View Product |

| Bitmain Antminer L9 | Scrypt (LTC/DOGE) | 16 GH/s | 3360W | View Product |

Frequently Asked Questions

- Is solo Bitcoin mining still possible for an individual?

Yes, it’s statistically improbable but demonstrably possible, as shown by several miners in 2025. Success requires powerful, efficient ASIC hardware and a great deal of luck.

- What is the main advantage of solo mining over pool mining?

The primary advantage is the reward. If you successfully mine a block, you keep the entire block reward (currently 3.125 BTC) and all associated transaction fees, which can total hundreds of thousands of dollars.

- What is the minimum hardware l need to attempt solo mining Bitcoin?

A modern, high-efficiency ASIC miner is essential. Models like the Bitmain Antminer S21 series are designed for the current network difficulty. GPU or CPU mining for Bitcoin is no longer feasible.

- How much can l make from solo mining?

It’s all or nothing. You could earn nothing for years, or you could earn the full block reward (over $350,000 at current prices) in a single day. Your income is extremely volatile, unlike the steady returns from pool mining.